Huntington Ingalls' (HII) Q3 Earnings Beat, Revenues Up Y/Y

Huntington Ingalls Industries, Inc.’s HII third-quarter 2019 earnings of $3.74 per share surpassed the Zacks Consensus Estimate of $3.63 by 3%. However, the bottom line decreased 29.3% from the $5.29 registered in the prior-year quarter.

This year-over-year decline resulted from lower operating income, an unfavorable change in the non-operating retirement benefit and a lower non-operating retirement benefit compared with the prior year.

Total Revenues

Total revenues came in at $2,219 million, outpacing the Zacks Consensus Estimate of $2,197 million by 1%. The top line also increased 6.5% from the year-ago quarter’s $2,083 million. Higher volume in the Newport News Shipbuilding division and growth in the Technical Solutions division, on account of the recent acquisitions, led to the upside.

Segment Details

Newport News Shipbuilding: Revenues totaled $1,264 million in this segment, up 7.2% year over year, backed by higher revenues from aircraft carriers and submarines.

Meanwhile, operating income declined 8.4% to $109 million due to a workers’ compensation benefit of $43 million recorded in the year-ago quarter.

Ingalls Shipbuilding: This segment’s top-line figure slipped 6.8% to $647 million on account of lower revenues from the Legend-class National Security Cutter (NSC) program and amphibious assault ships.

Also, operating income declined 25.6% to $61 million, primarily due to lower risk retirement on the LPD program.

Technical Solutions: Revenues in this segment summed $347 million, up 41.6% year over year. The upswing was driven by the acquisitions of G2, Inc. and Fulcrum IT Services, as well as organic growth in fleet support, and oil and gas service revenues.

This segment recorded an operating income of $21 million compared with the operating income of $16 million reported in the year-ago quarter.

Backlog

Huntington Ingalls received new orders worth $2.1 billion in the third quarter. As a result, the company’s total backlog reached $39.2 billion as of Sep 30, 2019, compared with $41 billion as of Mar 31, 2019.

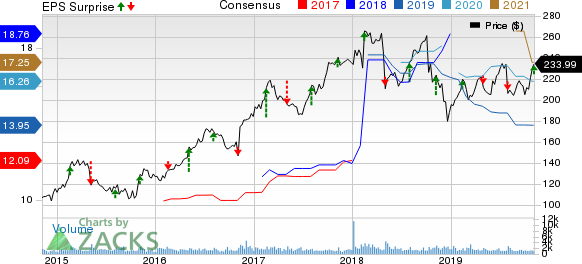

Huntington Ingalls Industries, Inc. Price, Consensus and EPS Surprise

Huntington Ingalls Industries, Inc. price-consensus-eps-surprise-chart | Huntington Ingalls Industries, Inc. Quote

Financial Update

Cash and cash equivalents as of Sep 30, 2019, were $32 million, significantly down from $240 million as of Dec 31, 2018.

Long-term debt, as of Sep 30, 2019, was $1,549 million compared with the 2018-end level of $1,283 million.

Cash inflow from operating activities, at the end of third-quarter 2019, grossed $330 million compared with the cash inflow of $266 million recorded at the end of third-quarter 2018.

Zacks Rank

Huntington Ingalls carries a Zacks Rank #3 (Hold), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

Lockheed Martin Corp LMT delivered third-quarter 2019 earnings of $5.66 per share, which surpassed the Zacks Consensus Estimate of $5.03 by 12.5%. The bottom line also improved 10.1% from $5.14 in the year-ago quarter.

Textron Inc TXT reported third-quarter 2019 earnings from continuing operations of 95 cents per share, outpacing the Zacks Consensus Estimate of 85 cents by 11.8%. In addition, the bottom-line figure surged 55.7% from the year-ago quarter.

General Dynamics Corporation GD recorded third-quarter 2019 earnings from continuing operations of $3.14 per share, which beat the Zacks Consensus Estimate of $3.06 by 2.6%. The reported figure also improved 10.2% from the prior-year quarter’s $2.85.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Huntington Ingalls Industries, Inc. (HII) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance