HSBC Q3 Pre-Tax Earnings Jump, $2B Buyback Program Announced

HSBC Holdings HSBC reported third-quarter 2021 pre-tax profit of $5.4 billion, up 75.8% from $3.1 billion recorded in the prior-year quarter.

The company’s shares on the NYSE gained almost 1% in the pre-market trading on an upbeat outlook and $2 billion share repurchase plan, which indicates a solid capital base. These factors led to bullish investor sentiments. A full day’s trading session will provide a better picture.

Results benefited from net reserve releases and a slight fall in expenses. However, lower adjusted revenues were the undermining factor.

Adjusted Revenues & Expenses Fall

Adjusted total revenues of $12.2 billion decreased 1.4% year over year. Reported revenues were up almost 1% to $12 billion.

Adjusted operating expenses declined marginally to $7.6 billion. The company’s continued investment in technology was majorly offset by the effects of its cost-saving initiatives.

The company’s cost-reduction program continues to progress well. Cumulatively, since the start of the plan in 2020, the company has delivered savings of $2.6 billion, with costs to achieve being $3.1 billion.

Adjusted change in expected credit losses (ECL) and other credit impairment charges was a net release of $659 million against a charge of $823 million recorded in the year-ago quarter.

Common equity Tier 1 (CET1) ratio as of Sep 30, 2021, was 15.9%, in line with the prior year-quarter level. Leverage ratio was 5.2%, down from 5.5% at the end of September 2020.

Solid Performance by Business Lines

Wealth and Personal Banking: The segment reported $1.9 billion in pre-tax profit, jumping 53.9% from the year-ago period. The improvement was driven by a rise in revenues, ECL release, and lower costs.

Commercial Banking: The segment reported a pre-tax profit of $1.9 billion, surging 60.7%. It recorded a rise in revenues along with higher expenses.

Global Banking and Markets: Pre-tax profit was $1.3 billion, rising 27.9% from the prior-year quarter end. Lower expenses, as well as a modest rise in revenues, supported the segment’s performance.

Corporate Centre: The segment reported a pre-tax profit of $323 million against a pre-tax loss of $336 million in the year-ago quarter.

Share Repurchase Update

Concurrently, HSBC announced a $2 billion share repurchase plan for 2021, which will commence soon.

Upbeat Guidance

Management believes that revenue growth outlook is “becoming more positive” mainly driven by fee growth across businesses and a stabilizing net interest income (NII). Further, NII is projected to grow in the quarters ahead on the back of improving lending scenario and expectation of earlier-than-anticipated policy rate rise.

Given the inflationary pressures, continued investment, and the impact and timing of announced acquisitions and divestitures, management now expects adjusted costs to be roughly $32 billion for both 2021 and 2022. This excludes the estimated U.K. bank levy charge of $0.3 billion. Earlier, the company had expected expenses for 2021 to be stable year over year and $31 billion for 2022.

The company continues to anticipate total cost-saving program’s cost to achieve to be $7 billion by 2022.

Given the current consensus economics and default experience, a net release of ECL is expected for 2021, with an anticipated further small net release of ECL in the fourth quarter. Further, ECL charges are expected to normalize in the second half of 2022, with medium-term ECL guided range being 30-40 basis points.

With an improved revenue outlook and the prospect of rising policy rates, management remains committed to achieving a return on tangible equity of 10% or more for the medium term.

The company expects to move within its target payout ratio of 40-55% of reported earnings per share in 2021.

CET1 ratio is expected to be between 14% and 14.5% by 2022-end.

HSBC remains on track to achieve $110 billion gross risk-weighted asset (RWAs) reduction target by the end of 2022. The company projects RWAs to rise $20-$35 billion for 2022 due to regulatory developments.

Our View

The low interest rate environment across the globe is expected to continue hurting HSBC’s revenue growth to some extent. However, the company’s initiatives to improve market share in the U.K. and China are likely to support financials. The planned acquisition of AXA Insurance in Singapore for $575 million will further strengthen its wealth management business in Asia.

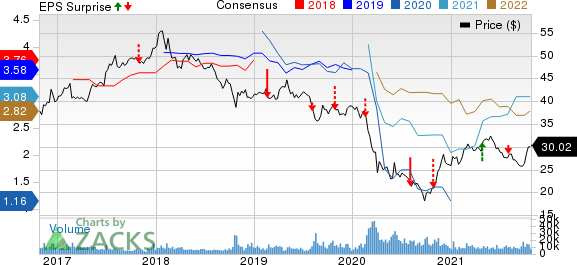

HSBC Holdings plc Price, Consensus and EPS Surprise

HSBC Holdings plc price-consensus-eps-surprise-chart | HSBC Holdings plc Quote

Currently, HSBC carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance & Earnings Release Dates of Other Foreign Banks

Barclays BCS reported third-quarter 2021 net income attributable to ordinary equity holders of £1.45 billion ($2 billion), up significantly from the prior-year quarter. Results were aided by a rise in revenues, partly offset by higher operating expenses. The company recorded a decline in credit impairment charges in the quarter.

Among other major foreign banks, UBS Group AG UBS and Deutsche Bank DB are scheduled to announce quarterly numbers of Oct 26 and Oct 27, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Barclays PLC (BCS) : Free Stock Analysis Report

Deutsche Bank Aktiengesellschaft (DB) : Free Stock Analysis Report

UBS Group AG (UBS) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance