Can HSA Member Growth Drive HealthEquity's (HQY) Q2 Earnings?

HealthEquity, Inc.’s HQY second-quarter fiscal 2019 results are expected to release on September 4. Solid Health Savings Account (HSA) member growth is likely to boost the top line.

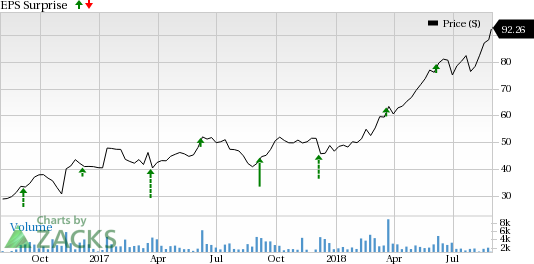

Earnings Surprise History

HealthEquity has an average earnings surprise of 33.6% in the trailing four quarters.

In the last reported quarter, HealthEquity reported earnings of 31 cents per share, surpassing the Zacks Consensus Estimate of 28 cents. The figure was higher than the year-ago quarter’s earnings of 19 cents on revenues and margin expansion. Revenues during the said quarter amounted to $69.9 million, up 26.1% year over year and marginally missing the Zacks Consensus Estimate of $70 million.

Which Way Are the Estimates Treading?

For the quarter to be reported, the Zacks Consensus Estimate for revenues is pegged at $69.9 million, reflecting growth of 22.9% on a year-over-year basis. The same for earnings per share (EPS) is pinned at 28 cents, reflecting year-over-year decline of 3.7%.

Let’s discuss how are things shaping up before the earnings release.

HealthEquity, Inc. Price and EPS Surprise

HealthEquity, Inc. Price and EPS Surprise | HealthEquity, Inc. Quote

Factors at Play

HSA Growth

HealthEquity is an Internal Revenue Service approved non-bank custodian of HSA, which is a medical savings account available to taxpayers in the United States who are enrolled in a high-deductible health plan (HDHP).

The funds contributed to an account are not subject to federal income tax at the time of deposit. Along with HSA, HealthEquity now offers FSA and HRA administration to regional employers.

In the first quarter of fiscal 2019, HealthEquity registered solid HSA member growth. HSA members in the first quarter reached $3.5 million, up 24% year over year. Custodial assets at the end of the quarter grew to $6.9 billion, up 31% from the year-ago quarter’s figure. HealthEquity opened 98,000 new HSAs in the quarter, up 27% year over year. Custodial assets grew by $84 million.

Unique Suite of Advisory Services

HealthEquity’s automated investment advisory service are delivered through a web-based tool, AdvisorTM, which is offered and managed by HealthEquity Advisors, LLC. Notably, it is the company’s SEC registered investment advisor subsidiary.

Apart from this, HealthEquity offers 401(K) solution that can reduce the cost, risk and work of managing a retirement plan. By the end of the first quarter of fiscal 2019, management is confident regarding the launch of HealthEquity retirement services.

Stiff Treasury Regulations

As a non-bank custodian, HealthEquity is required to comply with Treasury Regulations Section 1.408-2(e) formulated by the IRS. The stiff regulatory environment has been a major dampener for HealthEquity. Notably, any failure to comply with the regulations adversely affect HealthEquity’s ability to maintain current custodial accounts.

What Does Our Model Predict?

Our quantitative model does not show a beat for HealthEquity this earnings season. This is because a stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to be able to beat estimates.

Earnings ESP: The Earnings ESP for HealthEquity is 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: HealthEquity carries a Zacks Rank #3.

Stocks That Warrant a Look

Caseys General Stores, Inc. CASY has a Zacks Rank #3 and an Earnings ESP of +7.35%. You can see the complete list of today’s Zacks #1 Rank stocks here.

lululemon athletica inc. LULU has a Zacks Rank #3 and an Earnings ESP of +1.53%.

Dollar General Corporation DG has a Zacks Rank #3 and an Earnings ESP of +0.56%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Caseys General Stores, Inc. (CASY) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance