Hornby execs handed golden goodbyes as losses mount

Hornby handed out almost £1m to two of its ousted executives amid mounting annual losses, it has emerged.

Former chief executive Steve Cooke quit following a review by Hornby’s majority shareholder last September after just 18 months in the role. David Mulligan, previously Hornby’s finance chief, stepped down in December 2017.

Mr Cooke took home £403,000 in salary and benefits for six months’ work, with a further £155,652 in severance compensation. Mr Mulligan, who was paid £244,000, was handed a £174,697 golden goodbye.

Hornby’s annual sales slumped from £47.4m to £35.7m in the year to March 2018. Losses before tax were £10.1m, up from £9.5m in 2017.

The Aim-quoted company last posted an annual profit in 2012. Several attempts have been made to get operations back on track. The latest was last summer when Barnes-based fund manager Phoenix replaced Mr Cooke with Lyndon Davies, the founder of hobby firm Oxford Diecast.

Hornby also warned sales for the 10 weeks subsequent to its financial year end had been “lower than expected”. The Airfix-owner blamed “insufficient investment in tooling in the past” and the late placing of purchase orders with suppliers.

Mr Davies said during his first seven months at Hornby that “tough decisions have now been taken”.

“We are currently laying down the foundations for our future success,” he added.

Earlier this month Hornby secured an £18m funding lifeline. Some £12m was provided by asset-backed lender PNC with Phoenix issuing £6m of shareholder loans. The refinancing allowed Barclays, which has waived covenant testing on numerous occasions, to exit its long-term relationship with Hornby.

“Over the last few years our competitors have gained strength in the marketplace,” Mr Davies wrote in his chairman’s report, before calling for a “culture of frugality” to be implemented.

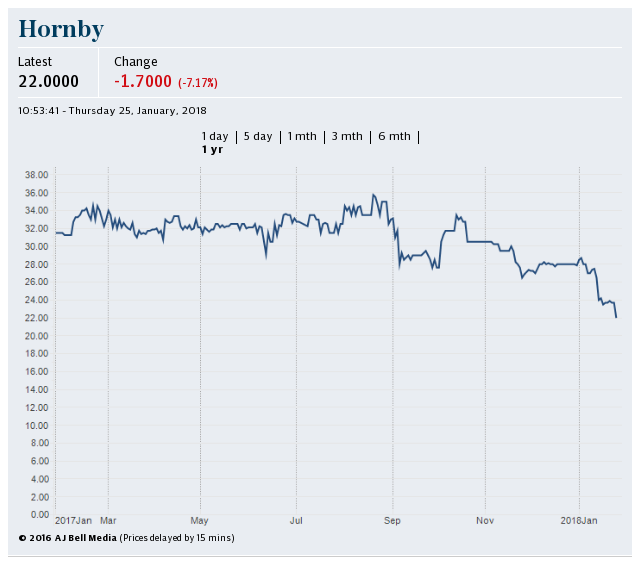

Hornby shares were down 9.6pc at 22.96p in afternoon trade.

Yahoo Finance

Yahoo Finance