Honda (HMC) Beats on Q2 Earnings & Sales, Announces Buyback

Honda Motor HMC reported fiscal second-quarter 2020 results on Nov 8. During the quarter, it topped earnings and revenue estimates on the back of cost-cut efforts and stronger-than-expected sales, primarily in Japan and China. Meanwhile, on Nov 7, Japan’s #1 automaker Toyota TM released fiscal second-quarter 2020 results, wherein it missed earnings estimates.

Bringing in further good news for investors, Honda announced a $915-million buyback. However, the company cut its annual profit guidance amid sluggish global vehicle demand and supply. Let’s delve deeper.

The Japanese auto biggie posted earnings of $1.04 per ADR, surpassing the Zacks Consensus Estimate of 91 cents. However, the bottom line declined from the year-ago earnings per ADR of $1.07.

The firm reported revenues of $34,763 million, surpassing the Zacks Consensus Estimate of $34,286 million and increasing from the prior-year sales of $34,464 million.

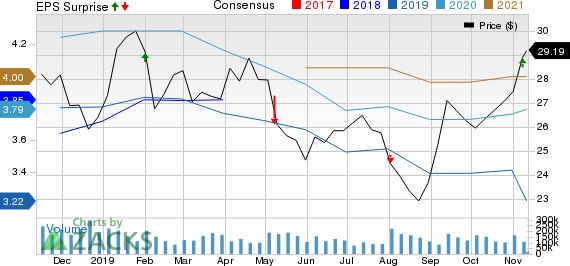

Honda Motor Co., Ltd. Price, Consensus and EPS Surprise

Honda Motor Co., Ltd. price-consensus-eps-surprise-chart | Honda Motor Co., Ltd. Quote

Segmental Highlights

For the three months ended Sep 30, 2019, revenues from the Automobile segment declined 5.2% year over year to ¥2.53 trillion ($23.6 billion) amid lower sales in India and Pakistan. Nonetheless, the unit’s operating profit increased 7.3% from the corresponding period of 2018 to ¥74.9 billion ($698 million) on the back of cost containment efforts, and increased sales in China and Japan.

Revenues from the Motorcycle segment came in at ¥522.5 billion ($4.8 billion), down 3.1% year over year. The unit’s operating profit decreased 8.5% from the comparable year-ago period to ¥77.8 billion ($725 million). Lower sales volumes in India primarily resulted in soft contribution, partially offset by increased unit sales in China and Brazil.

Revenues from the Financial Services segment totaled ¥660 billion ($6.2 billion), up 10% year over year. The unit’s operating profit also increased 12.1% year over year to ¥66.4 billion ($618.7 million). Higher lease revenues in Japan, China and the United States led to stronger contribution.

Revenues from Life Creation and Other Business came in at ¥81.8 million (762.5 million), down 6% year over year. Despite lower revenues, operating profit from the segment rose a whopping 155% from the prior-year period to ¥1,056 million ($0.009 million) on the back of reduced costs and improved results from North America.

Dividend & Financial Position

The company announced a quarterly dividend of ¥28 per share for its shareholders. For fiscal 2020, total annual dividend payment per share is expected to be ¥112.

Consolidated cash and cash equivalents were ¥2.33 trillion ($21.6 billion) as of Sep 30, 2019. Long-term debt was ¥4.1 trillion ($38.3 billion), representing a debt-to-capital ratio of 32.6%. At the end of the first half of fiscal 2020, operating cash flow was ¥409.9 billion, up 3% year over year.

Guidance Cut

Amid the expectation of stronger yen and contracting sales in India and North America, Honda has narrowed its sales and operating profit view for fiscal 2020 (ending Mar 31, 2020).

At the end of fiscal 2020, this Japanese automaker expects revenues to be ¥15 trillion, indicating a 5.3% year-over-year decline. This compares unfavorably with the prior guidance of ¥15.7 trillion. Further, operating income is projected at ¥690 million compared with the previous forecast of ¥770 billion. The estimated figure suggests 5% year-over-year fall. Operating margin is now anticipated to be 4.6%, down from the prior projection of 4.9%. Earnings per share at the end of fiscal 2020 are expected to be ¥ 329.64, down from the prior view of ¥366.57.

Zacks Rank and Key Picks

Honda currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the Auto-Tires-Trucks sector are Spartan Motors, Inc. SPAR and BRP Inc. DOOO, each holding a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Spartan Motors has an estimated earnings growth rate of 85.4% for the current year.

BRP has a projected earnings growth rate of 18.5% for the current year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Spartan Motors, Inc. (SPAR) : Free Stock Analysis Report

BRP Inc. (DOOO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance