Home Loan Tips for the Self-Employed

Are you self-employed? In Singapore? Congratulations; you either have brass genitalia, or the opportunistic instincts of a starved vulture. Self-employment isn’t the easiest route in this city, and if you can make it, you deserve a nice house. But before you take out your loan, I suggest you weigh the state of your finances: Cash-flow and security have to come first, especially in our little den of financial predators:

Just keep saying it: At least I’m no longer a wage slave. At least I’m no longer…

Extra Concerns for the Self-Employed

You could have been a corporate drone or government bureaucrat, with a nice steady job. You could have been paid for typing pointless reports, or approving bicycle purchases with zero investigative effort. But no, you had to go and use your brain.

Now you’ll pay the price. When you’re self-employed, there are other factors you need to consider for your home loan:

Be Extra Cautious with Cash Out Refinancing

Choose a Fixed Rate

Consider Mortgage Insurance

Meet in Person, Not On the Phone

1. Be Extra Cautious with Cash-Out Refinancing

Cash-out refinancing is a way to get money out of your house without selling it. This is basically going up to a bank and saying:

“I borrowed $1 million for my house. It’s grown in value now. Can we say I borrowed $1.2 million for it instead, and then you hand me the difference?”

Then the bank hands you the difference in cash, with a complimentary shovel so you can dig yourself further into that hole.

“And please accept this $10 voucher for reaching your 10,000th loan repayment.”

Cash-out refinancing is appealing to self-employed businessmen, who often think that, hey, this cash-out thing sounds way easier than looking for funding. Why look for investors when I can just cash-out my home?

Because by cashing out, you’re staking your house on the outcome of the business. That’s why. It can also mean higher loan repayments, as your loan quantum has grown.

Property investor Charlie Sng says:

“Your house should not be treated as if it is a credit card. Every time you extend your home loan, you are losing money. The capital appreciation of your property is being squandered on the interest payments.

Never forget that money from the cash-out is borrowed money. Investing borrowed money is one of the fastest ways to go broke; especially if you are cashing-out to support a failing business.”

2. Choose a Fixed Rate

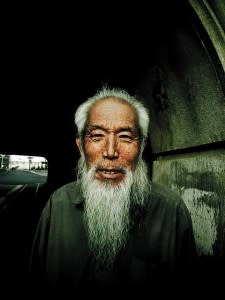

I do a lot of strategic wealth allocation.

If you’re running a start-up, or your business is less than five years old, consider a fixed rate.

In case you haven’t noticed, banks aren’t paragons of patience. They’re really not interested in how bad the market was this month, how your business is having shipment issues, or how you’re being held hostage in a container ship in Somalia and can’t get to an ATM. They don’t care.

Home loan due, money in. That’s all they’ll accept.

Problem is, most self-run businesses don’t have predictable performances. And I can think of any number of things more regular than a start-up’s revenue; like the toilet schedule of an elderly incontinent cat.

By getting a fixed rate package, you’re eliminating a variable. A fixed rate allows you to plan and set aside several months of repayments. This will help to weather dry spells, and buy you time if the business heads south.

To get the better fixed rate packages, check the free loan comparison sites, like SmartLoans.sg. Or you can follow us on Facebook; we talk about loans a lot.

3. Consider Mortgage Insurance

“I’m a musician, I’ll never be able to work again. Yes, I’m lead singer, but that’s irrelevant.”

Private insurers usually have policies that cover loss of income. If you have one of these policies, you might give mortgage insurance a miss. But such policies are expensive, and not available to everyone.

Mortgage insurance is fairly cheap, and easy to qualify for. It’s a form of reducing term insurance; should you lose your income and be unable to work, it will pay the remainder of your home loan. Most mortgage insurances are fully paid before the end of the end of the loan tenure.

For example, if your home loan tenure is 30 years, your mortgage insurance might be paid by the 26th year. After that, you’re covered for free in the last four years.

Mortgage insurance is a priority for the self-employed, because you folks haven’t got company insurance have you? And if you want standard life insurance to cover loss of income, you’d best be swimming in money. Premiums for life insurance are already extortionate, without adding extras.

4. Meet in Person, Not on the Phone

“Hi, I’ve just got 3 minutes left on this phone card. Could you loan me $1.5 million real quick?”

When stating your income, try to give it more time than a three minute phone conversation. Likewise, don’t assume a banker or broker can figure out your complex accounts.

Bankers aren’t allowed to give advice without clearing corporate communications. And I can’t name the person who told me:

“We also want to help you to get your loan. But a lot of self-employed people resort to a lot of shenanigans. The most common one in Singapore is that they don’t declare their full income. Because they are scared of alerting the tax department.

But if you don’t want to tell us how much you really make, how to give you a loan? Probably you will end being able to borrow a lot less. Sometimes we cannot disburse the loan at all, because something doesn’t tally.

For anyone who is self-employed, I would encourage them to meet their bankers privately and explain things. It might be more inconvenient, but on our side, at least we can understand what’s going on. We can explain to credit officers or our higher-ups.”

Image Credits:

tachyondecay, bureau36, Inha Leex Hale, etagwerker, believekevin

Are you self-employed? Comment and tell us how you handle your home loan!

Get more Personal Finance tips and tricks on www.MoneySmart.sg

Click to Compare Singapore Home Loans, Car Insurance and Credit Cards on our other sites.

More From MoneySmart

Yahoo Finance

Yahoo Finance