Hilltop Holdings (HTH) Q3 Earnings & Revenues Beat, Costs Up

Hilltop Holdings Inc.’s HTH third-quarter 2019 earnings per share of 86 cents easily outpaced the Zacks Consensus Estimate of 53 cents. Also, the figure compared favorably with the prior-year quarter’s earnings of 38 cents.

Results were primarily driven by an increase in revenues, and improvement in loan and deposit balances. However, higher expenses and provision for loan losses were the undermining factors.

Net income applicable to common stockholders was $79.4 million, up significantly from $35.8 million in the prior-year quarter.

Revenues Improve, Costs Rise

Net revenues were $454.6 million, increasing 19.6% year over year. The top line also beat the Zacks Consensus Estimate of $406.3 million.

Net interest income was $113.2 million, reflecting 2.6% rise. Net interest margin (taxable equivalent basis) was 3.45%, down 3 basis points (bps) from the prior-year quarter.

Non-interest income jumped 26.6% from the year-ago quarter to $341.4 million. This rise was largely driven by higher mortgage loan origination fees, investment and securities advisory fees and commissions, net gains from sale of loans and other mortgage production income, and other income.

Non-interest expenses increased 4.3% to $350.1 million. The increase was due to rise in employees' compensation and benefits costs.

Credit Quality Improves

In the reported quarter, provision for loan losses was nearly $0.1 million against recovery for loan losses of $0.4 million in the prior-year quarter.

Moreover, non-performing assets as a percentage of total assets was 0.37%, down 18 bps from the year-ago quarter. Furthermore, non-performing loans were $35.5 million as of Sep 30, 2019, down 16.5%.

Strong Balance Sheet

As of Sep 30, 2019, Hilltop Holdings’ cash and due from banks was $326.1 million, down 4.6% from the prior quarter. Total shareholders’ equity was $2.1 billion, up 1.5% sequentially.

As of Sep 30, 2019, net loans held for investment increased 1.7% to $7.3 billion. Further, total deposits were $8.7 billion, up 3.2% from the prior quarter.

Profitability Ratios Improve, Capital Ratios Deteriorate

Return on average assets at the end of the reported quarter was 2.26%, up from 1.07% in the prior-year quarter. Also, return on average equity was 15.55%, up from 7.41% in the year-earlier quarter.

Common equity tier 1 capital ratio was 16.15% as of Sep 30, 2019, down from 16.95% as of Sep 30, 2018. Moreover, total capital ratio was 16.95%, reflecting a decline from 17.87% in the prior-year quarter.

Share Repurchase Update

During the first nine months of 2019, Hilltop Holdings repurchased 3.4 million shares at an average price of $21.64 per share.

Our Take

Given the continued rise in loan balances, Hilltop Holdings’ top-line growth is expected to remain impressive. Also, its efforts to expand via acquisitions are likely to aid profitability through synergies. While higher costs, owing to continued investments in franchise and inorganic growth strategy, are likely to hurt bottom-line growth, its strong balance sheet is expected to keep supporting financials.

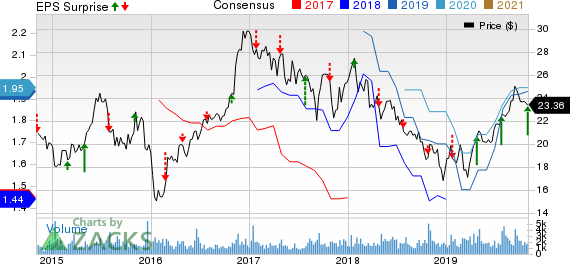

Hilltop Holdings Inc. Price, Consensus and EPS Surprise

Hilltop Holdings Inc. price-consensus-eps-surprise-chart | Hilltop Holdings Inc. Quote

Hilltop Holdings currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Performance of Other Banks

East West Bancorp EWBC third-quarter earnings per share of $1.17 lagged the Zacks Consensus Estimate of $1.20. Nonetheless, the figure was on par with the prior-year quarter level.

Bank OZK’s OZK third-quarter 2019 earnings per share of 81 cents lagged the Zacks Consensus Estimate of 83 cents. The bottom line was higher than the prior-year quarter figure of 58 cents.

Associated Banc-Corp’s ASB third-quarter 2019 adjusted earnings of 50 cents per share outpaced the Zacks Consensus Estimate of 46 cents. The figure compares favorably with 48 cents reported in the prior-year quarter.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.5% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Associated Banc-Corp (ASB) : Free Stock Analysis Report

East West Bancorp, Inc. (EWBC) : Free Stock Analysis Report

Hilltop Holdings Inc. (HTH) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance