Hill-Rom (HRC) Q4 Earnings Surpass Estimates, Margins Up

Hill-Rom Holdings, Inc. HRC reported fourth-quarter fiscal 2021 adjusted earnings per share (EPS) of $1.67, excluding the impact of certain one-time expenses. The figure rose 42.7% from the year-ago quarter. The metric also surpassed the Zacks Consensus Estimate by 13.6%.

The adjustments include acquisition-related intangible asset amortization expenses, debt-refinancing costs and others.

On a GAAP basis, earnings were 80 cents per share, registering a 26.9% improvement from the year-ago reported figure.

Full-year adjusted EPS was $6.31 compared with the year-ago EPS of $5.53, reflecting a rise of 14.1%.

Revenues

Revenues in the fiscal fourth quarter came in at $797.7 million, up 13.1% from the year-ago quarter (up 13% at constant exchange rate or CER). The top line beat the Zacks Consensus Estimate by 5.9%. The year-over-year rise in earnings and revenues can be attributed to the strong underlying performance and continued recovery across all three business segments.

Full-year revenues were $2.67 billion compared with the year-ago $2.57 billion, reflecting an improvement of 3.8%.

Quarter in Details

Geographically, in the reported quarter, U.S. revenues rose 26.2% on a reported basis and international revenues recorded a 15% decline on a constant-currency basis.

Segmental Update

Patient Support Systems revenues of $417 million increased 14% year over year on a reported basis and on a constant-currency basis. Excluding last year's one-time COVID-related revenues, the segment’s revenues increased 16% at CER, reflecting robust double-digit growth across med-surg and ICU bed systems, and the company's care communications platforms.

Revenues at the Front Line Care segment improved 14% year over year to $296 million (up 13% at CER). This performance was driven by strong demand and double-digit growth for Welch Allyn patient vital signs and cardiac monitoring devices, physical assessment tools including new digital solutions, and vision screening products. Revenues also include a one-time retrospective reimbursement benefit of $12 million for certain respiratory health devices.

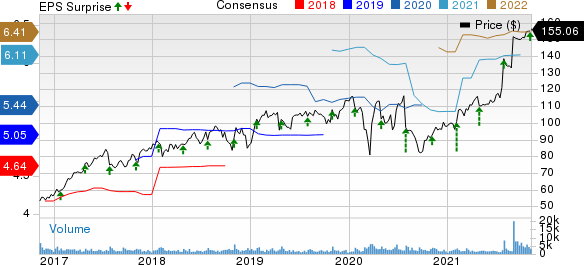

HillRom Holdings, Inc. Price, Consensus and EPS Surprise

HillRom Holdings, Inc. price-consensus-eps-surprise-chart | HillRom Holdings, Inc. Quote

The Surgical Solutions segment’s revenues improved 6% year over year (up 5% at CER) to $85 million. Growth in this segment reflects improved demand for patient positioning equipment and operating room tables, including record placements of Integrated Table Motion, as surgical procedures continued to rebound.

Margin

In the reported quarter, gross profit totaled $427 million, up 19.6% year over year. Gross margin expanded 291 basis points (bps) to 53.5%.

Selling, general and administrative expenses rose 12.7% to $238.4 million in the quarter under review, while research and development expenses increased 8.6% to $39.3 million.

Overall adjusted operating profit was $149.3 million, up 36.7% year over year. Adjusted operating margin expanded 323 bps year over year to 18.7%.

Cash Position

Hill-Rom exited fiscal 2021 with cash and cash equivalents of $271.8 million compared with $296.5 million at the end of fiscal 2020. Long-term debt for the company at the end of fiscal 2021 was $1.83 billion compared with $1.66 billion at the end of fiscal 2020.

The company returned $202 million to shareholders through dividends and share repurchases during fiscal 2021.

The company has a five-year annualized dividend growth rate of 7%.

At the end of fiscal 2021, cumulative net cash provided by operating activities was $476.1 million compared with $481.7 million at the end of the year-ago period.

Sell-Off Update

In September 2021, Hill-Rom entered into a definitive merger agreement under which Baxter has agreed to acquire Hill-Rom for $156.00 per share in cash. The transaction is subject to Hill-Rom’s shareholders' approval and the satisfaction of customary closing conditions, including regulatory approvals. The waiting period under the Hart Scott Rodino Act has expired and the parties have submitted their initial filings for all required regulatory approvals, including in the European Union. However, Hill-Rom continues to expect the transaction to close by early 2022.

Guidance

As a result of the proposed transaction with Baxter, the company has not provided any financial guidance for fiscal 2022.

Our Take

Hill-Rom exited fourth-quarter fiscal 2021 with better-than-expected earnings and revenues. The year-over-year growth in Front Line Care led by strong demand and double-digit growth for Welch Allyn patient vital signs and cardiac monitoring devices, physical assessment tools including new digital solutions, and vision screening products contributed to the top-line growth. The company witnessed improved demand for patient positioning equipment and operating room tables, including record placements of Integrated Table Motion, as surgical procedures continued to rebound. The company is working on the enhancement of patient access to annual diabetic retinal examinations with a new commercial partnership with one of the leading retail pharmacy chains in the United States, which is encouraging. Expansion of both margins is an added plus. However, escalating costs are building pressure on the bottom line. The company’s inability to provide any guidance for fiscal 2022 raises apprehension.

Zacks Rank and Key Picks

Hill-Rom currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical space that have announced quarterly results are Medpace Holdings, Inc. MEDP, Thermo Fisher Scientific Inc. TMO and West Pharmaceutical Services, Inc. WST.

Medpace, currently carrying a Zacks Rank #1 (Strong Buy), reported third-quarter 2021 adjusted EPS of $1.29, surpassing the Zacks Consensus Estimate by 20.6%. Revenues of $295.57 million beat the Zacks Consensus Estimate by 1.2%. You can see the complete list of today’s Zacks #1 Rank stocks here

Thermo Fisher Scientific reported third-quarter 2021 adjusted EPS of $5.76, which surpassed the Zacks Consensus Estimate by 23.3%. Revenues of $9.33 billion outpaced the Zacks Consensus Estimate by 12%. It currently carries a Zacks Rank #2 (Buy).

West Pharmaceutical Services, carrying a Zacks Rank #2, reported third-quarter 2021 adjusted EPS of $2.06, which beat the Zacks Consensus Estimate by 13.2%. Revenues of $706.5 million outpaced the consensus mark by 3.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

HillRom Holdings, Inc. (HRC) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance