Is This High-Yield Stock Finally a Buy?

There's a lot about industrial conglomerate ABB (NYSE: ABB) that will attract value investors. Start with its 4.3% dividend yield and end with a management concertedly restructuring the company so it can grow in line with industry peers like Rockwell Automation (NYSE: ROK) and Siemens, and you have a strong value investing candidate. On the other hand, there have been false dawns for the company before, and recent execution hasn't been great. Let's take a closer look at what you need to know before buying ABB stock.

Changing is simple as ABB

Investors can be forgiven for being a bit confused with ABB. Going back to 2017, management rejected the idea of divesting its underperforming power grids business, arguing that the business was better run within ABB. Fast forward to the end of 2018, and ABB announced it would sell power grids to Hitachi in an $11 billion deal and reshape the remaining company's focus toward digital industries.

Image source: Getty Images.

Indeed, in a sign of what's to come, during the fourth-quarter earnings presentations, CEO Ulrich Speisshofer announced a partnership with industrial software company Dassault Systemes (NASDAQOTH: DASTY) in order to add digital twin and product lifecycle management (PLM) solutions. Of course, Siemens has its own in-house PLM solutions, and Rockwell Automaton has invested in IoT platform provider and digital twin expert PTC (NASDAQ: PTC), so ABB's move is in line with its peers.

In case you are wondering, a "digital twin" is a digital replica of a physical asset that will help companies monitor and analyze asset performance while enabling them to run simulations on the digital twin in order to improve the performance of the physical twin. It's an integral part of industrial IoT, and partnering with Dassault Systemes is a key sign of ABB's digital ambition.

Goodbye to the matrix

In addition, management is discontinuing its so-called matrix business model. In a nutshell, the now out-of-fashion matrix business model is an organizational structure whereby an individual or business unit reports to a number of different leaders.

So for example, a marketing person would not report to one boss on an assigned project but could report to a few different project leaders working on different projects.

Speisshofer argued that ditching the matrix structure will lead to a "stronger customer focus, more agility and speed of decision making, and it also means significant efficiency gains. We expect about $500 million of efficiency gains medium term through this change." That's a significant figure given that full-year income from operations was $2.22 billion in 2018.

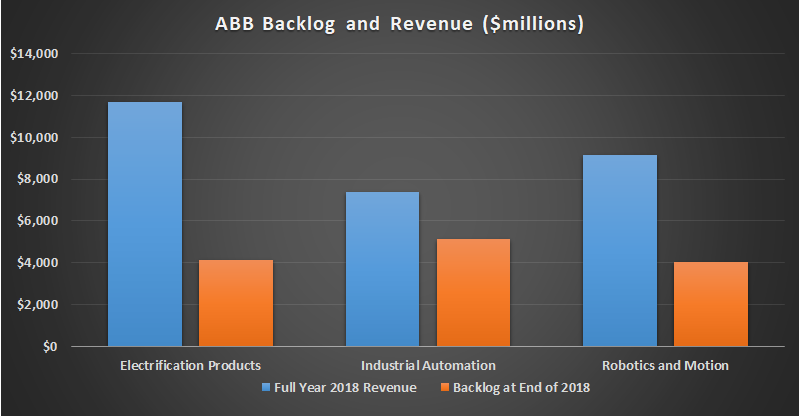

Putting it all together, there are plenty of signs to suggest that the new ABB (comprising electrification, industrial automation, and robotics and motion) is taking the appropriate measures to achieve its aim to grow revenue over the long term by management's targeted rate of 3.5% to 4%.

The glass half empty

The recent developments are good news, and investors should welcome the changes made by management. However, there are three areas of concern for investors.

First, the rate of global growth is set to slow in 2019. Moreover, U.S. industrial production growth is forecast to slow in the next couple of years, and Europe (ABB's core market) is seen as coming under pressure. All of this could affect ABB's orders growth in 2019, a particular concern given that the industrial automation business backlog only grew 2% in 2018.

In addition, ABB's relative lack of exposure to LNG (liquefied natural gas) means it could struggle to receive orders in the first half -- ABB's peer Emerson Electric (NYSE: EMR) believes the current cycle will be characterized by relatively stronger LNG activity compared to conventional upstream oil and gas -- ABB's strong point.

Data source: ABB presentations. Chart by author.

Second, ABB's administrative restructuring is a worthy pursuit, but it's far from clear that ditching its traditional matrix structure will be stress-free. Engineering a significant change in management style when end markets are slowing is often a problematic endeavor.

Third, dividends paid came to $1.72 billion in 2018, and cash flow from operating activities was $2.92 billion while capital expenditure was $772 million, meaning free cash flow of around $2.15 billion covered the dividend payout.

However, given that peer grids and other discontinued businesses contributed $572 million in cash flow from operations in 2018 (around 20% of the total figure), operating cash flow could be a lot lower in 2019. Moreover, management plans to increase capital expenditure to $850 million this year. Clearly, ABB needs to grow earnings and cash flow in order to make its dividend sustainable on an underlying basis.

Thinking of buying ABB stock?

If investors are purely looking for an income stream from dividends, then ABB's rival in electrification, Eaton Corp (NYSE: ETN), is probably a safer investment right now -- the stocks trade on similar valuations, but Eaton' looks like it can cover its dividend much better.

That's not to say that ABB doesn't have merit. It's a stock that will attract value investors hoping the restructuring plans will lead to growth, but you are going to have to believe in management's execution and favorable end markets in order to buy the stock right now. Otherwise, it makes sense to wait and watch developments.

More From The Motley Fool

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool recommends Dassault Systemes. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance