High-quality carbon credits can help attract private capital to fund clean energy tech: GenZero, IEA report

By the early 2030s, US$4.5 trillion will be needed annually to deploy clean energy tech, up from US$1.8 trillion in 2023.

High-quality carbon credits can have a role to play in accelerating the transition to clean energy and scaling up solutions like low-emissions hydrogen, sustainable aviation fuel (SAF) and direct air capture and storage (DACS), according to a new joint report by GenZero and the International Energy Agency (IEA).

Titled “The Role of Carbon Credits in Scaling Up Innovative Clean Energy Technologies”, the 71-page report estimates that by the early 2030s, annual investment of US$4.5 trillion will be needed to accelerate deployment across all clean energy technologies and infrastructure, up from US$1.8 trillion in 2023.

Published on April 16, the report’s authors say reaching net-zero emissions targets will require a “rapid transformation” of energy systems. This will include deploying “innovative technologies” that can address the most challenging sectors and tackle residual emissions, they add.

According to the latest update of the IEA’s Net Zero Emissions by 2050 (NZE) Scenario, further progress is essential to develop and deploy critical technologies. Among these, low-emissions hydrogen, SAF and DACS would need to grow substantially in the coming years, say GenZero and IEA.

But achieving the necessary scaling up depends on early deployment and investment. To mobilise the level of investment required, governments can deploy a range of complementary policies and innovative financing instruments, say the authors.

An integrated approach of public and private funds could help manage different risks and lower the overall cost of capital for certain technologies, they add. “Public funds could help to manage regulatory and country risks to help unlock private capital for early projects.”

In developing economies, an integrated approach involving grants or guarantees could support market entry and project feasibility, with governments bridging the investment gap by providing clear regulations and enabling policies, say the authors.

Frederick Teo, chief executive officer of GenZero, says accelerating the development and adoption of these critical technologies are crucial, in order to achieve fundamental decarbonisation at industrial scale and realise net-zero ambitions globally.

That said, the world faces challenges in technology readiness and high costs, he adds. “While costs will eventually come down and technology will mature, will it happen fast enough to avert a looming climate crisis? We need to accelerate adoption by catalysing more investments and financing into these areas.”

According to Teo, the carbon markets offer a scalable pathway to do so, via “high-quality tech-based carbon credits”. “Together with supportive regulatory policies, clearer guidance on the carbon accounting associated with such carbon credits, and strong corporate demand supported by high-integrity claims guidance, we believe that carbon credits can play an important role to scale up these critical low-carbon technology solutions.”

To enable this, the report recommends that the government and private sector develop strategies to create the right enabling environment to drive investments, as carbon credits cannot bridge the investment gap on its own.

In addition, carbon crediting programmes, project developers and experts can accelerate the development of methodologies. “The lack of crediting methodologies hinders the generation of carbon credits from low-emissions hydrogen, SAF and DACS,” say the authors.

Finally, a coalition of stakeholders should develop guidance on emissions accounting for low-emissions hydrogen and SAF carbon credits, as these sectors have complex supply chains that span several countries and markets. “To support the guidance, better data on emissions will be needed,” they note.

Tim Gould, chief energy economist at the IEA, says low-emissions hydrogen, SAF and DACS all have crucial roles to play in limiting global warming to 1.5°C. “But for the moment, the underlying economics are challenging.”

Gould adds: “To secure an early, massive scaling up of these technologies, governments need a range of complementary policies and innovative financing instruments. Carbon credits cannot bridge the investment gap on their own, but our new joint work with GenZero underscores how well-designed and credible crediting mechanisms can get projects moving by improving revenues and bankability.”

GenZero papers

The latest report builds on GenZero’s series of papers exploring the status of the carbon markets today.

Last week, the Temasek-owned investment firm launched a paper examining possible future pathways for carbon markets and the role of carbon finance in accelerating climate action.

Titled “GenZero Carbon Scenarios – An Exploration of the Future of Carbon Markets”, the 56-page paper offered three possible scenarios for the carbon markets, named Green New World, Sustainably Divided and Resilient Islands.

These scenarios are not predictions or forecasts, said Teo. Instead, they are narratives about possible futures to help stakeholders understand how key driving forces can impact outcomes differently.

In December 2023, GenZero launched its inaugural whitepaper on the topic, which addressed common “misconceptions” around carbon markets and highlighted ways to drive climate mitigation at scale.

Launched at the COP28 Singapore Pavilion in Dubai, the 30-page “Carbon Markets 2.0 — Addressing Pain Points, Scaling Impact” report explored the state of the carbon markets and the obstacles from both the demand and supply sides.

GenZero also offered eight recommendations to “unleash the full potential of carbon markets”, including refining carbon credit taxonomies and incentivising corporate participation.

GenZero also released in March a joint legal paper with local law firm Allen & Gledhill LLP examining the importance of clarifying the legal characterisation of voluntary carbon credits (VCCs).

Titled “The Legal Character of Voluntary Carbon Credits: A Way Forward”, the paper offered a possible characterisation of VCCs as intangible property in Singapore. It also calls for governments to articulate a position and provide market participants with a “sound commercial basis” to transact and manage risk when buying and selling VCCs, among other actions.

GenZero is currently hosting the second edition of its flagship sustainability event, the GenZero Climate Summit, which is running from April 15 to 17.

Hosted in conjunction with Temasek’s annual flagship sustainability event, Ecosperity Week, the GenZero Climate Summit focuses on the theme of “The Next Steps”, spotlighting the pivotal and concrete course of actions required to overcome challenges and accelerate decarbonisation globally.

Read the report on GenZero’s website here.

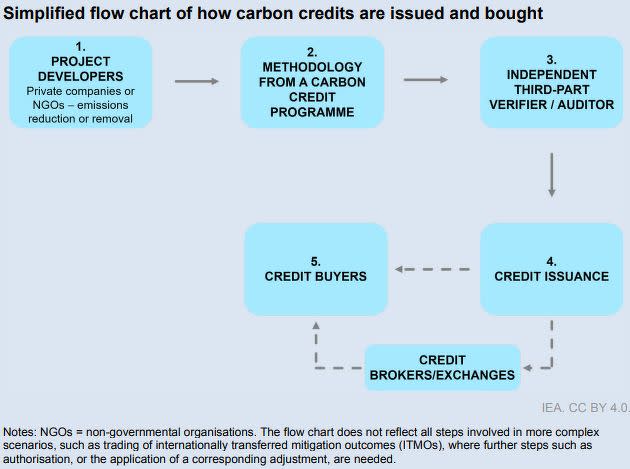

Infographic: GenZero, IEA

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Get in-depth insights from our expert contributors, and dive into financial and economic trends