In a high interest rate environment homeowners should finance their loans using mortgage brokers

There are many reasons why homeowners should finance their home loans using mortgage brokers, especially in a high interest environment.

Singapore, being one of the world’s most expensive cities to live in, makes purchasing a home a significant financial investment. Thus, the mortgage industry is an essential aspect of the housing market, allowing homeowners to finance their homes over an extended period, which would have otherwise been unaffordable.

However, homeowners in Singapore may face a challenge when the interest rates on their mortgages increase to 3.5% – 4% due to market forces such as inflation, government policies, and global economic trends.

So, we need to examine how homeowners in Singapore can cope in a high-interest environment and how mortgage brokers can assist them in navigating the challenging conditions.

Homeowners should finance and refinance using mortgage brokers to enjoy many advantages in a high environment area.

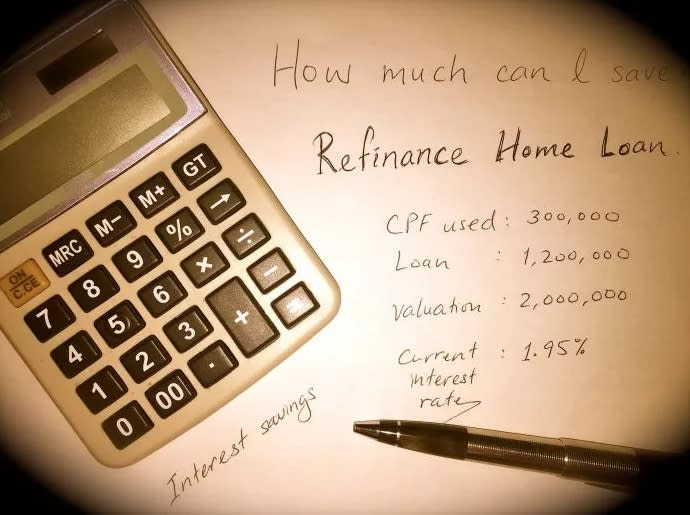

The first step that homeowners can take to cope with high-interest rates is to refinance their mortgage. Refinancing is the process of taking out a new mortgage to replace the existing one. This method allows homeowners to take advantage of lower interest rates or change their mortgage terms to meet their financial needs.

In a high-interest environment, refinancing can be an attractive option, as it can lower the homeowner’s monthly mortgage payments and overall interest costs. A mortgage broker can help homeowners identify suitable refinancing options that offer favorable interest rates and terms, thereby making the process easier and more efficient.

Homeowners should finance by paying down principal faster

Another option that homeowners can consider when interest rates are high is to pay down their mortgage principal faster. By paying more than the minimum required monthly payments, homeowners can reduce their overall interest costs and shorten their mortgage terms.

Additionally, paying down the mortgage principal faster can build equity in the home, which can be used for future financing options or in emergencies. Mortgage brokers can provide homeowners with guidance on how much extra to pay each month to achieve their goals and identify any penalties or fees associated with paying off the mortgage early.

Fixed-rate or variable rate? Homeowners should finance using what’s best for them.

Homeowners can also consider changing the type of mortgage they have. In a high-interest environment, it may be advantageous to switch from a variable rate mortgage to a fixed-rate mortgage. A variable rate mortgage is one in which the interest rate fluctuates according to market conditions, while a fixed-rate mortgage offers a stable interest rate for the entire mortgage term.

A fixed-rate mortgage can provide homeowners with greater certainty about their monthly payments and overall interest costs, making it easier to budget and plan for the future. However, fixed-rate mortgages may come with higher interest rates than variable rate mortgages, and mortgage brokers can assist homeowners in determining which option is best for their financial situation.

Homeowners should reduce their overall debt

In addition to the options mentioned above, homeowners can take several steps to reduce their overall debt and improve their financial position. For example, homeowners can consider consolidating their high-interest debt into a single, lower interest rate loan. This method can lower their overall debt payments and reduce the interest costs associated with multiple loans or credit cards.

Additionally, homeowners can take steps to reduce their expenses, such as cutting back on unnecessary spending or negotiating lower interest rates on their credit cards. By reducing their overall debt and expenses, homeowners can free up more cash to pay down their mortgage principal or meet other financial obligations.

Homeowners should finance using mortgage brokers

Mortgage brokers can play a vital role in helping homeowners cope in a high-interest environment. As experts in the mortgage industry, mortgage brokers can provide homeowners with access to a wide range of mortgage products and options, thereby increasing the likelihood of finding a suitable solution for their financial needs.

Additionally, mortgage brokers can offer guidance on the various mortgage terms, interest rates, and fees associated with each product, making it easier for homeowners to make informed decisions. Mortgage brokers can also help homeowners navigate the complex mortgage application process, from pre-approval to closing, which can save time and reduce stress.

Moreover, mortgage brokers can provide ongoing support to homeowners throughout the mortgage term. This support can include advice on refinancing options, strategies for paying down the mortgage faster, and guidance on other financial matters that may impact the homeowner’s ability to stay buoyant financially.

The post In a high interest rate environment homeowners should finance their loans using mortgage brokers appeared first on iCompareLoan.

Yahoo Finance

Yahoo Finance