This High-Growth Biotech Industry Is as Competitive as Ever Heading Into 2019

Things move fast in biotech. That's been the lesson for Myriad Genetics (NASDAQ: MYGN) in the past three years or so, although third-quarter 2018 results from around the genetic testing industry prove that school is still in session.

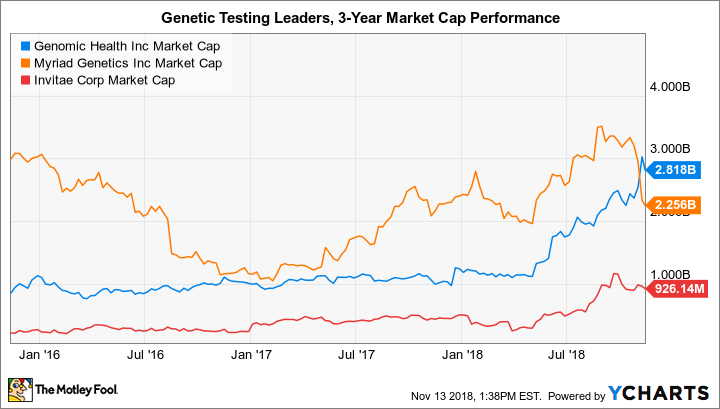

Genomic Health (NASDAQ: GHDX) reported its second straight quarter of operating profits, increased its full-year 2018 earnings guidance by a factor of 11, and zoomed past Myriad Genetics in market valuation. That's not the only thorn in the pioneer's side. Investors are increasingly confident in up-and-comer Invitae (NYSE: NVTA), which has delivered triple-digit revenue growth throughout 2018 and earned a $1 billion market cap.

In other words, it just got a lot more crowded at the top. But strengthening financial positions within the group promise to make 2019 the most action-packed year yet.

Image source: Getty Images.

Competitive, growing, and finally profitable

The genetic testing industry is taking off thanks to a combination of lower-cost DNA sequencing technologies, increased availability of tests, and heightened awareness of the genetic associations to various health conditions. Simply put, it's easier than ever for physicians to test patients for mutations of a single gene (or hundreds) during routine office visits -- and that's been great for business.

That's helped Myriad Genetics to earn back the trust of investors after falling to a $1 billion market cap in 2016. Since then, it has delivered growth with its most important products, pulled the trigger on a great acquisition with Counsyl, and clawed its way to a $3 billion market cap. Then it promptly tripped out of the gate at the start of its 2019 fiscal year.

The business managed to grow its revenue in the fiscal first quarter of 2019 (the three-month period that ended in September 2018) 13% from the year-ago period. It still expects sales to increase 20% for the full year compared to last year. But late in the quarter it "identified two issues" that forced it to reduce full-year fiscal 2019 revenue guidance 3% from initial expectations.

That may not be a big deal in the grand scheme of things, but Wall Street analysts appeared to interpret the revision within the context of the business's historical struggles to respond to a more competitive landscape. More worrisome for individual investors is that Myriad Genetics is pouring tons of cash into efforts to grow revenue. Fiscal first-quarter 2019 operating income came in at a paltry $1.2 million as a result.

Image source: Getty Images.

That figure looks much worse considering the increasing financial strength of competitors. The third quarter of 2018 was a record one for Genomic Health: The company surpassed $100 million in revenue for the first time and had an operating income for the second straight quarter. The business's trajectory serves as important validation for the industry -- including Invitae (discussed below) -- as it proves that new entrants really can outgrow operating losses if they attain sufficient scale.

Genomic Health performed so well in the third quarter that management increased full-year 2018 revenue and earnings guidance. A lot. The company previously expected total revenue for the year to settle somewhere around $374 million and net income to come in at around $2.5 million. Now, it's preparing investors to expect revenue near $390 million and net income of approximately $27 million.

That was enough to send shares soaring over 30%. And because of the sour news from Myriad Genetics on the same day, investors witnessed an industry first: Genomic Health earned a higher market cap than the pioneer.

GHDX Market Cap data by YCharts.

Investors are hopeful that Genomic Health's trajectory is a harbinger of things to come for Invitae. The business is still focused on scaling, but doing so at a remarkable pace. In the third quarter of 2018, Invitae delivered revenue growth of 106% and test volume growth of 92% compared to the year-ago period. Triple-digit year-over-year growth has been the norm for the genetic testing leader in 2018, which has helped push the company's market cap to all-time highs in recent months.

More important for investors, Invitae reached a crucial milestone in the third quarter of 2018. The business reported a year-over-year decrease in operating losses. It wasn't large, but it's a testament to management's ability to keep operating expenses in check while still realizing impressive growth in test volumes sold. In fact, operating expenses have flatlined at $47 million per quarter since the start of the year -- a huge improvement from sequential double-digit increases in previous years.

That's leading to growing gross profits quarter after quarter, although the business is still too small to deliver operating profits. As the table below shows, there's a long way to go before it catches its two larger peers.

Metric | Myriad Genetics, Fiscal Q1 2019 | Genomic Health, Q3 2018 | Invitae, Q3 2018 |

|---|---|---|---|

Total revenue | $202.3 million | $101.3 million | $37.4 million |

Year-over-year revenue growth | 13% | 21% | 106% |

Gross profit | $152.6 million | $85.7 million | $16.9 million |

Gross profit margin | 75.4% | 84.7% | 45.3% |

Operating expenses excluding cost of revenue | $151.4 million | $74.0 million | $47.0 million |

Operating income | $1.2 million | $11.7 million | ($30.1 million) |

Operating margin | 0.6% | 11.5% | N/A |

Data source: SEC filings.

Nonetheless, investors will be fixated on Invitae's operating income when fourth-quarter and full-year 2018 operating results -- and full-year 2019 guidance -- are announced early next year. While it wouldn't be surprising for Invitae's growth to slow as the business scales, improving profitability may be the more important metric in the quarters ahead. The same playbook worked for Genomic Health, which is still growing at a handsome clip and is now the healthiest business in the industry.

This biotech industry is just getting started

The growing financial strength among these three genetic testing leaders could make for a very interesting 2019. How so? The genetic testing industry is highly fragmented. There are dozens of small companies offering thousands of tests for applications as diverse as prenatal and pediatric diagnostics, cancer sequencing, and proactive health screenings.

Investors already witnessed Myriad Genetics and Invitae combine to make three acquisitions in the prenatal space since 2017. Including Genomic Health, the trio is eager to expand into biopharma with partnerships and new product offerings. And while it's not the lowest-hanging fruit in the industry, proactive screening is a massive opportunity for the company that figures out how to crack it open.

There is no shortage of prime acquisition targets in any of these areas, and with swiftly improving profit margins and cash flows, this competitive biotech industry is sure to light up investing radars in the near future. Individual investors with a long-term mindset may find it wise to get a head start while they still can.

More From The Motley Fool

Maxx Chatsko has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Genomic Health. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance