Here's Why You Should Retain PENN Entertainment (PENN) Stock

PENN Entertainment, Inc. PENN is likely to benefit from Barstool Sports expansion, 3C’s initiatives and iCasino business. Also, the emphasis on new loyalty program bodes well. However, a rise in labor and non-gaming costs is a concern.

Let us discuss the factors that highlight why investors should retain the stock for the time being.

Growth Catalysts

PENN Entertainment focuses on Barstool Sports expansion to drive growth. During the first quarter of 2023, the company reported solid revenue and engagement results, courtesy of a compelling content and an exceptional product experience. During the quarter, the company stated progress with respect to the integration of the Barstool Sportsbook (in the United States) to theScore player account management and trading platform. During the quarter, the initiative paved a path for improved metrics, including a rise in six-month retention rates. On the media front, the company’s cross-platform views were up 40% year over year.

The company is optimistic about the inclusion of the remaining Barstool Sports to the Penn Entertainment family. PENN is of the opinion that the combination of Barstool’s audience with theScore’s fully-integrated media and betting platform will pave the path for new customer acquisition and organic cross-selling opportunities. The company anticipates completing the migration in July 2023.

PENN Entertainment continues to progress toward the new generation of cordless, cashless and contactless technology, collectively known as 3C’s, to drive growth. The technological solution removes friction from transactions and reduces wait times and bolsters its marketing capabilities. During the first-quarter 2023 conference call, the company announced that 3Cs technology is active in 21 properties. Owing to the continuous roll-out, the company witnessed a rise in mywallet customers (195,000) and deposits (worth $104 million), marking growth on a sequential basis.

The company emphasizes on new game additions, creative marketing and leveraging the casino database to boost the Barstool-branded iCasino business. During the first quarter of 2023, the company reported strong performance in Ontario, with iCasino GGR experiencing significant year-over-year growth. The upside was backed by the proprietary technology stack.

Increased focus on loyalty program bodes well. During the first quarter of 2023, the company announced the launch of an enhanced and rebranded customer loyalty program, PENN Play. The program connects the Company’s brands under one loyalty program and allows members a wide range of incentives including priority access, discounts, gifts, trips to PENN destinations, partner experiences and PENN Cash. Given the rising adoption of digital wallet and its supporting role in increasing visitation and time on device, the company anticipates the program to drive growth in the upcoming periods.

Concerns

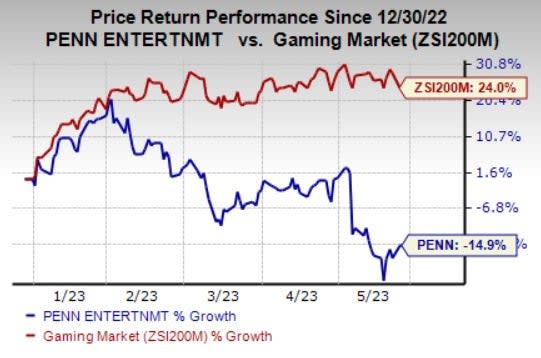

Image Source: Zacks Investment Research

So far this year, shares of PENN Entertainment have declined 14.9% against the industry’s 24% growth. The company’s performance was impacted by a rise in labor and non-gaming costs. During the first quarter of 2023, the company’s gaming expenses came in at $729.5 million compared with $686.6 million reported in the prior-year quarter. The upside was primarily driven by a rise in third-party service provider fees, higher payroll expenses and an increase in gaming taxes. Food, beverage, hotel and other expenses during the quarter came in at $244.3 million compared with $171.9 million reported in the prior-year quarter. The company is cautious about the ongoing uncertain macroeconomic environment. For 2023, our model predicts gaming expenses and Food, beverage, hotel and other expenses to rise 2.2% and 16.1%, respectively, on a year-over-year basis.

Zacks Rank & Key Picks

PENN Entertainment currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Consumer Discretionary sector are MGM Resorts International MGM, Royal Caribbean Cruises Ltd. RCL and Crocs, Inc. CROX.

MGM Resorts sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 81%, on average. The stock has increased 25.9% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MGM’s 2024 sales and EPS indicates a rise of 1.4% and 22.3%, respectively, from the year-ago period’s estimated levels.

Royal Caribbean sports a Zacks Rank #1. RCL has a trailing four-quarter earnings surprise of 26.4%, on average. Shares of RCL have gained 45.1% in the past year.

The Zacks Consensus Estimate for RCL’s 2023 sales and EPS indicates a rise of 47.9% and 160.8%, respectively, from the year-ago period’s levels.

Crocs carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 19.6%, on average. Shares of Crocs have increased 100.2% in the past year.

The Zacks Consensus Estimate for CROX’s 2023 sales and EPS indicates a rise of 13.2% and 5.7%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

MGM Resorts International (MGM) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

PENN Entertainment, Inc. (PENN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance