Here's Why You Should Retain Insulet (PODD) Stock for Now

Insulet Corporation PODD is well-poised for growth in the coming quarters, backed by strength in Omnipod 5 and global manufacturing capabilities. The company’s recently released 2023 first-quarter results also generate investors’ optimism. However, escalating expenses and a substantial fall in drug delivery sales are discouraging.

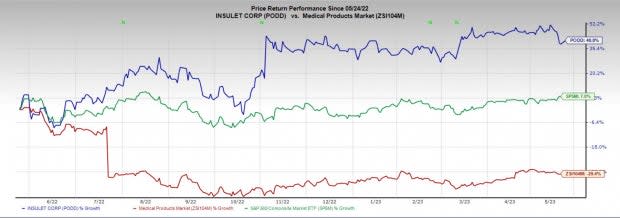

In the past year, this Zacks Rank #3 (Hold) stock has increased 40.8% compared to the 29.4% fall of the industry and a 7% rise of the S&P 500 composite.

The developer, manufacturer and distributor of insulin delivery systems has a market capitalization of $20.98 billion. Insulet projects a long-term estimated earnings growth rate of 35.1% compared with 13.6% of the industry. PODD’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, delivering an average surprise of 80.2%.

Let’s delve deeper.

Upsides

Impressive Q1 Results: Insulet delivered better-than-expected earnings and revenues in the first quarter of 2023. The company exceeded the high end of revenue guidance in the first quarter, led by solid 35% growth across the Omnipod portfolio of products. Internationally, high Omnipod revenues were supported by ongoing Omnipod DASH adoption.

Image Source: Zacks Investment Research

Robust new customer starts in both the United States and worldwide buoy optimism. Omnipod 5 continued to be a driving force of Insulet’s strong U.S. growth, representing almost 95% of the company’s U.S. new customer starts.

On the first-quarter earnings call, Insulet updated its full-year 2023 revenue guidance range of 18-22% (from the earlier band of 14-19%). Across the Omnipod portfolio of products, Insulet anticipates 2023 revenues in the range of 21-25% (from the previous 17-22%).

Omnipod 5 – a Key Growth Driver: In the first quarter, Omnipod achieved 49% revenue growth in the United States, driven by the company’s annuity-based model with cumulative record new customer starts and growing U.S. pharmacy volumes. These include increasing contributions from Omnipod 5 and a premium for the Omnipod 5 and Omnipod DASH pods in the U.S. pharmacy, where PODD provides a personal diabetes manager without any charge.

Insulet is set to begin its international rollout of Omnipod 5 — in the United Kingdom in the middle of 2023 and Germany during the fall. The company also plans to launch Omnipod 5 more broadly across international markets during 2024.

Solid Manufacturing Capabilities: Insulet considers its global manufacturing capabilities critical to the long-term growth plan. The company is building a new manufacturing facility in Malaysia, expected to start functioning in 2024.

Despite challenging macro-related headwinds, Insulet is securing components and producing pods ahead of forecasted demand levels. This ensures global supply for the company’s expanding customer base.

Downsides

Mounting Expenses: Insulet reported a 383-basis points contraction in the gross margin in the first quarter of 2023. A volume increase in the U.S. pharmacy channel, including the associated premium positively contributed to gross margin. However, it was more than offset by an expected higher mix of costs due to the ramping of Omnipod 5 and domestic manufacturing operations as well as an unfavorable mix from lower drug delivery revenues.

The quarter’s adjusted operating margin was affected by a 26.4% year-over-year increase in SG&A expenses and a 16.2% increase in Research and Development expenses compared to the prior year’s quarter.

Lumpy Drug Delivery Business: In the first quarter, Insulet’s Drug Delivery Business was down 98.1% year over year. The company expects full-year revenues to decline 55%-45% from this segment, similar to the 2022 reported figures.

With several investment opportunities to grow the diabetes side of the business, Insulet is currently not focusing on the drug delivery side.

Estimate Trend

Insulet has been witnessing a positive estimate revision trend for 2023. The Zacks Consensus Estimate for 2023 earnings per share (EPS) has moved up 2.4% to $1.27 in the past 30 days and 5.5% to $1.34 in the past seven days.

The Zacks Consensus Estimate for the company’s 2023 revenues is pegged at $1.57 billion. This suggests a 20.5% rise from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Zimmer Biomet ZBH, Penumbra PEN and Hologic, Inc. HOLX.

Zimmer Biomet, sporting a Zacks Rank #1 (Strong Buy) at present, has an earnings yield of 5.52% compared to the industry’s -2.30%. Zimmer Biomet’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 7.38%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Zimmer Biomet shares have increased 11.9% compared to the industry’s 29.6% decline in the past year.

Penumbra, sporting a Zacks Rank #1 at present, has an estimated growth rate of 64.1% for 2024. Penumbra shares have risen 123.7% compared with the industry’s 2.3% increase over the past year.

PEN’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 109.4%.

Hologic, carrying a Zacks Rank #2 (Buy) at present, has an earnings yield of 4.68% compared to the industry’s -7.16%. Shares of HOLX have risen 3.6% compared with the industry’s 2.4% growth over the past year.

Hologic’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 27.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report

Penumbra, Inc. (PEN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance