Here's Why Investors Should Steer Clear of Cracker Barrel (CBRL)

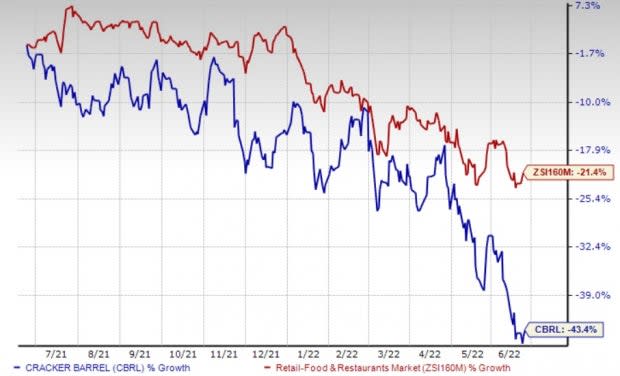

Shares of Cracker Barrel Old Country Store, Inc. CBRL have slumped 43.4% in the past year, compared with the industry’s decline of 21.4%. High costs and dismal traffic have been hurting its performance. Since the company reported third-quarter 2022 results on Jun 7, the company’s shares have lost 15.6%. Let’s delve deeper and find out why investors should offload this Zacks Rank #5 (Strong Sell) from their portfolio.

Primary Concerns

Despite cost-saving initiatives, higher labor costs due to increased wages are expected to persistently keep profits under pressure. The company is apprehensive regarding incurring inflationary costs. Meanwhile, management is making significant investments to support training, the launch of several initiatives and value testing. Although these moves are expected to drive Cracker Barrel’s top-line growth during fiscal 2022, initial investments might dent margins. Expenses for opening units are anticipated to weigh on the company’s margins.

During the fiscal third quarter, the total cost of goods sold (as a percentage of total revenues) came in at 31.6% compared with 28.8% reported in the prior-year quarter. The increase was primarily due to commodity and wage inflation, and elevated freight costs. Going forward, the company anticipates high inflation and lower consumer confidence to act as a headwind in fourth-quarter fiscal 2022. Operating margins in the fiscal fourth quarter are expected to bear the impact of significant commodity, wage and other operating expenses inflation. For the quarter under discussion, the company anticipates commodity inflation of approximately 16-18% and wage inflation of approximately 8-10%. For the fiscal fourth quarter of 2022, the company expects capital expenditures at approximately $30 million.

Although comps have increased over the past few quarters, the decline in traffic remains a major concern for the stocks in this space. In fiscal 2019, traffic declined 0.7%. The downtrend continued in the first and second quarter of fiscal 2020, with traffic declining 1.5% and 0.2%, respectively. During third-quarter fiscal 2020, comparable store restaurant traffic slumped 43.6%. Traffic woes have intensified due to the pandemic. In the first and the second quarter of fiscal 2021, comparable store restaurant sales comprised traffic declines of 18.3% and 24.2%, respectively.

Although traffic has improved since then, it still remains below pre-pandemic levels. In third-quarter fiscal 2022, the company witnessed a downfall in traffic recovery on account of deteriorating consumer sentiment and inflationary pressures. The company anticipates the traffic trends to continue for the remaining of fiscal 2022.

Image Source: Zacks Investment Research

Key Picks

Some better-ranked stocks in the Zacks Retail-Wholesale sector are MarineMax, Inc. HZO, BBQ Holdings, Inc. BBQ and Arcos Dorados Holdings Inc. ARCO.

MarineMax sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 32.8%, on average. Shares of the company have declined 24.5% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MarineMax’s 2022 sales and EPS suggests growth of 16% and 21.5%, respectively, from the year-ago period’s levels.

BBQ Holdings carries a Zacks Rank #2 (Buy). BBQ Holdings has a long-term earnings growth of 14%. Shares of the company have decreased 35.6% in the past year.

The Zacks Consensus Estimate for BBQ Holdings’ 2022 sales and EPS suggests growth of 46.1% and 67.6%, respectively, from the year-ago period’s levels.

Arcos Dorados carries a Zacks Rank #2. ARCO has a long-term earnings growth of 34.4%. Shares of the company have appreciated 14.5% in the past year.

The Zacks Consensus Estimate for Arcos Dorados’ 2022 sales and EPS suggests growth of 16.6% and 83.3%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance