Here's Why Investors Should Retain Pool (POOL) Stock Now

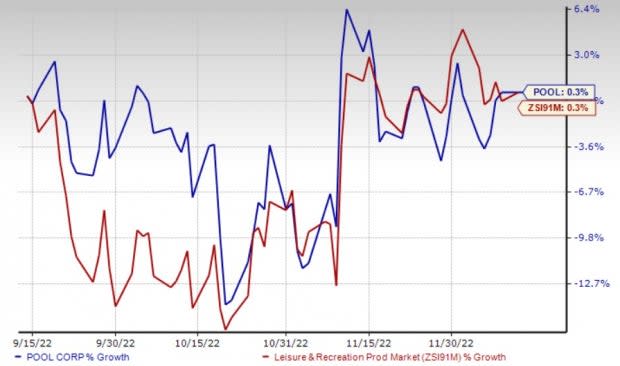

Pool Corporation POOL is benefiting from solid demand for non-discretionary maintenance and repair products, continued pool construction activity, and strong renovation and remodel activity. However, supply-chain disruptions and inflationary pressures continue to impact the company negatively. In the past three months, the company’s shares have gained 0.3% in line with the industry’s growth.

Growth Drivers

POOL benefits from the market-leading position that offers cost advantage and allows it to generate a higher return on investment than smaller companies. Further, the housing market continues to boost the demand for POOL’s products despite numerous competitors and low barriers to entry. Moreover, solid demand for swimming pool maintenance supplies, above-ground pools, spas, automatic pool cleaners, heaters, pumps, lights, chemicals and filters continues to drive the company’s results.

POOL is focused on expansion to drive revenues. It is foraying into newer geographic locations, expanding in existing markets and launching innovative product categories that will boost its market share.

The company generates a large portion of its earnings from existing pools. More than half of its gross profits are generated from products related to maintenance and repair of pools, while the remainder is derived from construction and installation of pools, and landscaping. Over the past five years, the pool industry has been showing signs of recovery, mostly supported by the gradual improvement in remodeling and replacement activities.

This Zacks Rank #3 (Hold) company generates the majority of its revenues from Base Business segment, which excludes sales centers that are acquired, closed or opened in new markets for 15 months. In third-quarter 2022, the company’s Base Business contributed 96.1% to the total revenues. During the quarter, Base Business’ revenues increased 10.1% year over year to $1,552.2 million.

In the previous five quarters, Base Business’ revenues increased 10.2% (as of second-quarter 2022), 25.6% (as of first-quarter 2022), 22.3% (as of fourth-quarter 2021), 18.6% (as of third-quarter 2021) and 31.9% (as of second-quarter 2021) on a year-over-year basis.

Image Source: Zacks Investment Research

Concerns

The company has been witnessing increased expenses lately. Inflationary cost increases in the areas of labor, compensation, healthcare, freight and rent are leading to higher expenses. In the third quarter, the cost of sales was $1,111.7 million, up 14.7% from the prior-year quarter. Selling and administrative expenses increased 17.2% year over year to $239.8 million.

We believe that the company has to work hard toward cutting expenses to achieve high margins. For 2022, the company anticipates inflationary pressures of 10%. For 2022, our projections for the cost of sales, and selling and administrative expenses indicate growth of 15.5% and 18.4%, respectively, on a year-over-year basis.

Key Picks

Some better-ranked stocks in the Zacks Consumer Discretionary sector are Monarch Casino & Resort, Inc. MCRI, Hyatt Hotels Corporation H and Crocs, Inc. CROX.

Monarch Casino currently has a Zacks Rank #2 (Buy). MCRI has a trailing four-quarter earnings surprise of 9.1%, on average. The stock has gained 21.2% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for MCRI’s 2022 sales and earnings per share (EPS) indicates growth of 21.1% and 29.2%, respectively, from the year-ago period’s reported levels.

Hyatt currently has a Zacks Rank #2. H has a trailing four-quarter earnings surprise of 652.3%, on average. The stock has gained 19.4% in the past year.

The Zacks Consensus Estimate for H’s current financial year's sales and EPS indicates surges of 92.2% and 121%, respectively, from the year-ago period’s reported levels.

Crocs currently has a Zacks Rank #2. CROX has a long-term earnings growth rate of 15%. Shares of Crocs have plunged 39.6% in the past year.

The Zacks Consensus Estimate for CROX’s 2022 sales and EPS indicates rises of 51.5% and 23.7%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Pool Corporation (POOL) : Free Stock Analysis Report

Monarch Casino & Resort, Inc. (MCRI) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance