Here's Why Investors Should Hold on to Lear (LEA) Stock Now

Lear Corporation's LEA top line is likely to benefit from buyouts and acquisitions. Its E-Systems unit is gaining from robust consumer demand for vehicle content and notable business wins. However, supply-chain bottlenecks, rising commodity costs and intensive capital spending are likely to add to woes.

Let’s delve deeper as to why LEA — currently carrying a Zacks Rank #3 (Hold) — warrants a cautious stance right now.

Growth Drivers

Strategic acquisitions are aiding Lear’s prospects. The buyout of M&N Plastics has increased the vertical integration in the E-Systems unit, and that of Kongsberg has strengthened Lear’s Seating business. The acquisition of Xevo has enhanced LEA’s capabilities in software, services and data analytics, bolstering its market position in connectivity. The buyouts provide the company with differentiated offerings and enhance both top- and bottom-line growth. Also Lear’s significant sales backlog has been adding to its growth. A backlog of around $2 billion through 2023-2024 is likely to buoy the top line of the firm. Encouragingly, full-year net sales are expected within $20.55-$21.05 billion, up from $19.2 billion in 2021.

Lear’s E-Systems unit is gaining from rising consumer demand for vehicle content and focused electrification efforts. Frequent business wins because of innovative product launches like Battery Disconnect Units (BDU) and Intercell Connect Boards (ICB) are likely to boost the unit’s revenues. Lear’s upcoming facility in Michigan, which will manufacture BDU and other electrification components, is expected to generate $500 million in annual electrification sales when it reaches full production. Also, the firm’s Connection Systems business is on track to grow to around $500 million in 2022 and approximately $900 million to $1 billion by 2025. Moreover, Lear has captured a noticeable position in the Seating segment. Its ConfigurE+ product offering and thermal comfort system expertise pave the way for long-term gains.

Further, Lear has improved its debt maturity profile and has no outstanding debt maturities till 2027. The company’s debt-to-capitalization of 37% is also manageable. Its investor-friendly moves of returning excess cash to shareholders via dividends and share repurchases preserve shareholder value and instill confidence. Lear has raised its quarterly dividend to the pre-pandemic level of 77 cents a share. During 2021, the company returned $207 million of cash to shareholders via buyback and dividends. It returned $71 million to investors during the third quarter of 2022.

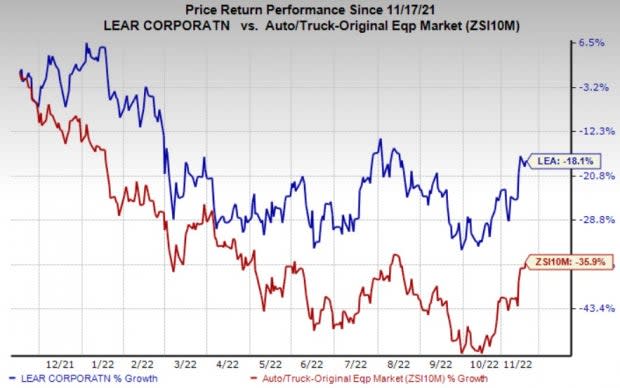

Shares of LEA have lost 18.1% in a year compared with the industry’s 35.9% decline.

Image Source: Zacks Investment Research

Headwinds

Lear’s investments in research and development (R&D) and technology and increased spending on advanced engineering lead to intensive capital spending. This is expected to dent the company’s near-term cash flows. Capital spending is estimated at $675-$700 million for 2022, up from $585 million recorded in 2021, to support upcoming launches and a growing backlog.

Moreover, rising commodity prices, especially steel and copper, are concerning. Additionally, an increase in the prices of foams, chemicals and leather hides will also play spoilsport. An increase in commodity, component, freight and logistics costs are expected to negatively impact margins in 2022. The company expects a net commodity headwind of around $155 million in 2022. Also, wage inflation, labor shortages and other inflationary pressures in the supply chain will impact both material costs and labor and overhead costs in manufacturing facilities. The company’s reduced projection of vehicle production in North America and Europe will lead to lost sales.

Lear anticipates incurring restructuring costs of around $150 million in 2022. Unfavorable foreign currency translations might mar the overall results. It expects adverse forex transactions to hurt 2022 revenues.

Key Picks

Here are some better-ranked players in the auto space –CarParts.com PRTS, sporting a Zacks Rank #1 (Strong Buy), and Allison Transmission Holdings ALSN and Genuine Parts Company GPC, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

CarParts has an expected earnings growth rate of 85% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised 72.7% upward over the past 30 days.

Allison has an expected earnings growth rate of 26.1% for the current year. The Zacks Consensus Estimate for ALSN’s current-year earnings has been revised 3.8% upward in the past 30 days.

Genuine Parts has an expected earnings growth rate of 18.1% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised 2.5% upward over the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Genuine Parts Company (GPC) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

CarParts.com, Inc. (PRTS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance