Here's Why You Should Invest in Yum! Brands (YUM) Stock Now

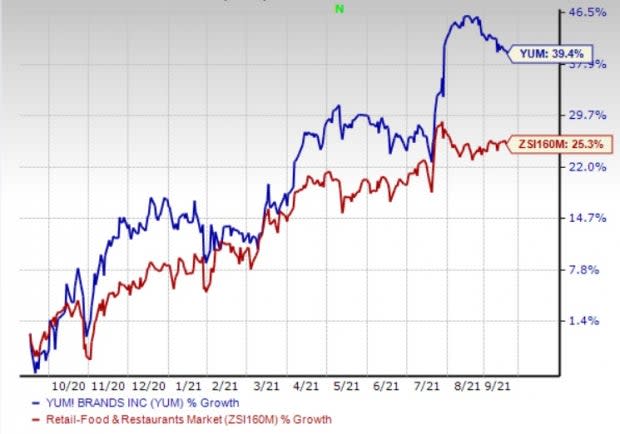

The restaurant industry has been grappling with traffic and sales woes due to the coronavirus pandemic for nearly two years now. However, Yum! Brands, Inc. YUM has shown great resilience despite prevailing uncertain conditions. Case in point, the company’s shares have surged 39.4% in the past year, compared with the industry’s rally of 25.3%.

This Zacks Rank #2 (Buy) company’s continued focus on off-premise channels, strategic investments in digital technology and partnership with Beyond Meat, Inc. BYND are anticipated to drive its performance over the long run. These factors make it an alluring investment pick at the moment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

What’s Driving the Stock?

Strong digital sales, record unit development, robust same-store sales, and the company’s ability to adjust operations, menu options and marketing worldwide helped it counter the challenging scenario. The company continues to benefit from robust sales momentum in North America, the U.K., and Australia, and improved performance in Europe. In 2020, digital sales increased to $17 billion, reflecting an improvement of 45% from the prior year. In the second quarter, the company reported digital sales of more than $5 billion. During the second-quarter 2021 conference call, the company announced that it delivered digital sales of more than $20 billion on a trailing 12-month basis for the first time.

The company is benefiting from expansion efforts. During the first, second, third and fourth quarter of 2020, it opened 515, 328, 556 and 1,024 gross new restaurants, respectively. In first and second-quarter 2021, the company inaugurated 435 and 603 net new units, respectively. KFC opened 428 net new units in second-quarter 2021. During fourth-quarter 2020, the company opened restaurants in China, Russia, Thailand and Eastern Europe. Further, master franchise agreements in Brazil (Taco Bell), Spain (Taco Bell), and Russia (Pizza Hut), and the international growth alliance with Telepizza to accelerate the development of Pizza Hut in key European markets and consolidate franchisees in Latin America and the Caribbean are likely to drive growth.

Yum! Brands is gaining from its partnership with Beyond Meat. The company is focusing on a plant-based menu. In May 2021, Yum! Brands’ Pizza Hut in collaboration with Beyond Meat, announced the launch of new plant-based protein menu items — The Great Beyond, Beyond Creamy Alfredo and Alfredo Loaded Flatbread — in Canada. The announcement comes as part of a broader collaboration between the two brands, after the company unveiled Beyond Meat’s meat-free options in the United States and the U.K. in November 2020. Moreover, in August 2021, Yum! Brands’ Pizza Hut in collaboration with Beyond Meat announced the launch of Beyond Pepperoni, a delicious plant-based form of pizza. Yum! Brands’ Taco Bell has also partnered with Beyond Meat for a new plant-based product.

Image Source: Zacks Investment Research

Growth Projections

The Zacks Consensus Estimate for 2021 earnings per share has moved up by 7% in the past 60 days to $4.43.

The consensus mark for 2022 earnings has moved up 4.8% in the past 60 days to $4.82 per share. The company has an impressive long-term earnings growth rate of 12%.

Other Solid Restaurant Bets

Some other top-ranked stocks in the same Zacks Retail - Restaurants industry include Jack in the Box Inc. JACK and The Wendy's Company WEN, each carrying a Zacks Rank #2.

Jack in the Box has a trailing four-quarter earnings surprise of 26.4%, on average.

Wendy's earnings for 2021 are expected to rise 42.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jack In The Box Inc. (JACK) : Free Stock Analysis Report

Yum Brands, Inc. (YUM) : Free Stock Analysis Report

The Wendys Company (WEN) : Free Stock Analysis Report

Beyond Meat, Inc. (BYND) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance