Heres Why Hold Strategy is Apt for Hanover Insurance (THG)

The Hanover Insurance Group’s THG growth in the Core Commercial and Specialty segments, stable retention, better pricing, strong market presence and solid capital position make it a stock worth retaining in one’s portfolio.

Hanover Insurance has a stellar history of delivering positive surprises in the last 18 reported quarters.

This insurer has an impressive VGM Score of B. This helps to identify stocks with the most attractive value, growth and momentum. THG believes that it is well-positioned to deliver long-term return on equity target of 14% or higher by 2026 on better rates and prudent cost management.

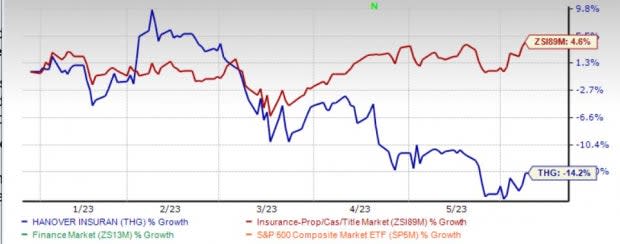

Zacks Rank & Price Performance

Hanover Insurance currently carries a Zacks Rank #3 (Hold). Year to date, the stock has lost 14.2% against the industry’s increase of 4.6%.

Image Source: Zacks Investment Research

Optimistic Growth Projections

The Zacks Consensus Estimate for 2023 earnings is pegged at $6.88 per share, implying an increase of 24.4% from the year-ago reported figure on 8.2% higher revenues of $6 billion. The consensus estimate for 2024 earnings is pegged at $12, implying an increase of 74.4% from the year-ago reported figure on 5.8% higher revenues of $6.4 billion.

The expected long-term earnings growth is pegged at 36.9%, better than the industry average of 13.7%.

Growth Drivers

Hanover Insurance is poised for gain, given its focus on pricing segmentation and mix management as well as an emphasis on growth in target states, product lines and industry classes in the middle market.

Ramping up organic growth, partnering with consolidators and new agency appointments should drive growth for THG. In its Specialty division, the insurer expects to deliver about 10% CAGR over the next five years.

Prudent underwriting, data, analytic tools and technology helped the company lower coastal exposures and enhance pricing for the catastrophe perils, eventually helping it build a diversified book of business.

Given the accelerated pace in digitalization across the insurance industry, THG continues to invest in technology to upgrade its front-end capabilities.

Banking on these positives, Hanover Insurance, which has evolved into a balanced, small/middle market-focused commercial and personal lines carrier, now looks to be the premier P&C franchise in the independent agency channel.

The insurer also expects to deliver 130 basis points of expense ratio improvement on the $2 billion in premium growth by 2026.

Impressive Dividend History

Hanover Insurance has been hiking dividends for the last 17 years, in addition to paying special dividends. Its yield of 2.8% is better than the industry average of 0.3%.

Stocks to Consider

Some better-ranked stocks from the insurance industry are Reinsurance Group of America RGA, RLI Corporation RLI and Kinsale Capital Group KNSL, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Reinsurance Group’s 2023 and 2024 earnings indicates a year-over-year increase of 23.3% and 1.7%, respectively. RGA delivered a four-quarter average earnings surprise of 56.92%.

The consensus estimate for 2023 and 2024 earnings has moved up 0.3% and 0.6%, respectively, in the past seven days. Shares of RGA have gained 3.1% year to date.

RLI delivered a four-quarter average earnings surprise of 43.50%. Year to date, the insurer has gained %.

The Zacks Consensus Estimate for RLI’s 2023 earnings indicates a year-over-year increase of 4.1%.

Kinsale Capital delivered a four-quarter average earnings surprise of 14.77%. Year to date, the insurer has gained 36.1%.

The Zacks Consensus Estimate for KNSL’s 2023 and 2024 earnings indicates a year-over-year increase of 32.9% and 19.7%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

The Hanover Insurance Group, Inc. (THG) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance