Here's Why Hold Strategy is Apt for Colgate (CL) Right Now

Colgate-Palmolive Company CL has been displaying resilience amid a tough environment, backed by efforts to increase its leadership in key product categories through innovation in core businesses, tracking adjacent categories growth and expansion into new markets and channels. The company has been expanding its Naturals range, including Naturals toothpaste. Its robust surprise trend has been bolstering investors’ sentiments.

The company has a trailing four-quarter earnings surprise of 0.6%, on average. This beat streak instills further investor confidence in the stock. In third-quarter 2021, net sales increased 6.5% from the year-ago quarter’s levels, with organic sales growth of 4.5%. This marked the 11th successive quarter of organic sales growth within or beyond its target of 3-5%. The bottom line improved 3% year over year.

In the past seven days, estimates for the company’s 2021 and 2022 earnings per share remained unchanged. For 2021, its earnings estimates stand at $3.21 per share, suggesting growth of 4.9% from the year-ago reported figure.

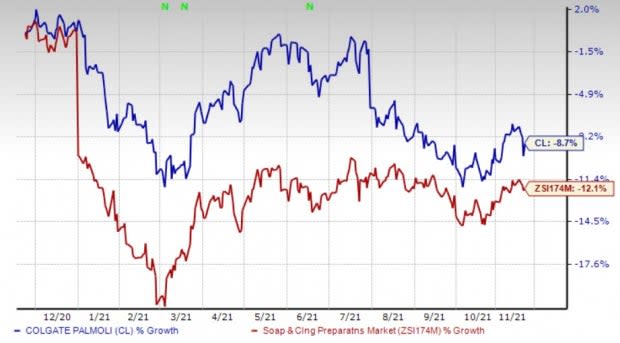

Although shares of Procter & Gamble have fallen 8.7% in the past year, it fared better than the industry’s decline of 12.1%. The Zacks Rank #3 (Hold) company’s long term earnings growth rate of 5.5% also buoys optimism.

Image Source: Zacks Investment Research

Factors Supporting Growth

Innovation and in-store implementation have been the guiding principles for Colgate’s growth strategy over the years. The company’s innovation strategy is focused on growing in adjacent categories and product segments. It is focused on the premiumization of its Oral Care portfolio through major innovations. Its premium innovation products including CO. by Colgate, Colgate Elixir toothpaste, and Colgate enzyme whitening toothpaste have been performing well. This led to organic sales growth of mid-single digits in its oral care business in the third quarter.

Some other notable innovation efforts include Colgate Renewal in the United States, Colgate Enzyme Whitening toothpaste in China, and the natural extracts line and Colgate Total Anti-Tartar Line in Latin America.

Continued expansion of the Naturals and Therapeutics divisions, and the Hello Products LLC buyout highlight Colgate’s focus on innovation. The company has partnered with Philips to introduce electric toothbrushes in Latin America, where the usage of electric toothbrush is low. This long-term deal will bring together the world’s number one oral care brand and number one manufacturer of sonic toothbrushes under a co-brand, namely Philips Colgate. This product line will come with a variety of electric toothbrushes at different prices. The new brand will be available in limited countries in the said region.

Expanding the availability of products, through enhanced distribution to newer markets and channels, is one of Colgate’s priorities to improve organic sales. The company is aggressively expanding into faster growth channels while extending the geographic footprint of its brands. In 2019, the company expanded its portfolio by introducing pharmacy brands like elmex and meridol to newer markets. It remains impressed with the performance of professional skincare businesses — Elta MD and PCA Skin — in spas and dermatologists. The company expanded its premium skincare portfolio with the buyout of Filorga skincare business.

Colgate’s Hill's business continued to witness momentum with sales growth of 20% in the third quarter with 19% rise in organic sales, driven by strength in Hill's Prescription Diet Gastrointestinal Biome and Hill's Science Diet Perfect Digestion. The company’s newly launched Prescription Diet Derm Complete has been gaining market share and is likely to be rolled out internationally in the coming quarters. It remains focused on expanding the availability of its products through the e-commerce channel, as more and more consumers are utilizing online services for their essential needs.

Hurdles to Overcome

Colgate, like others in the industry, continues to witness headwinds related to commodity cost inflation and higher freight costs. These have been weighing on its gross margin. Raw material cost inflation had a 510-bps impact on the gross margin in the third quarter of 2021. The company has been encountering restricted mobility and supply-chain disruptions stemming from the pandemic along with a rise in raw material and logistics costs. Management anticipates cost-related headwinds to persist in the forthcoming quarters as well.

Higher advertising investments and logistics costs resulted in SG&A expenses deleverage in the third quarter. The company expects elevated logistics and advertising costs in the quarters ahead.

Stocks to Watch

We have highlighted some better-ranked stocks from the broader Consumer Staples space namely, Coty COTY, Inter Parfums IPAR and Helen of Troy HELE.

Coty sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 66.4%, on average. Shares of the company has surged 50.9% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for COTY’s current financial year sales suggests growth of 15.3% and earnings per share reflects growth of 20%, from the year-ago period.

Inter Parfums, a Zacks Rank #2 (Buy) stock, has a trailing four-quarter earnings surprise of 29.7%, on average. Shares of the company have gained 72.7% in the past year.

The Zacks Consensus Estimate for IPAR’s current financial year sales and earnings per share suggests growth of 51.4% and 95.9%, respectively, from the year-ago period.

Helen of Troy carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 19.8%, on average. Shares of the company have gained 22.2% in the past year.

The Zacks Consensus Estimate for the current financial year sales and earnings per share suggests a decline of 2.1% and 4%, respectively, from the year-ago period. However, HELE has an expected long-term earnings growth rate of 8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ColgatePalmolive Company (CL) : Free Stock Analysis Report

Helen of Troy Limited (HELE) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance