Here's Why You Should Hold Onto Air Products (APD) Stock for Now

Air Products and Chemicals, Inc. APD is expected to benefit from its investments in high-return industrial gas projects and productivity measures amid headwinds including higher energy costs.

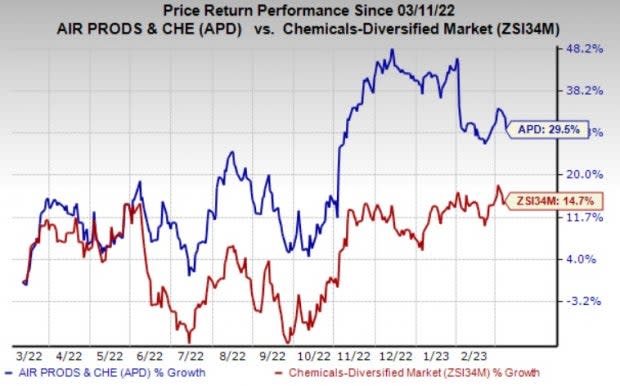

The company’s shares are up 29.5% over a year, compared with a 14.7% rise recorded by its industry.

Let’s find out why this Zacks Rank #3 (Hold) stock is worth retaining at the moment.

Image Source: Zacks Investment Research

What’s Aiding APD?

Air Products is gaining from higher pricing and higher volumes as witnessed in the last reported quarter. Its top line in first-quarter fiscal 2023 was driven primarily by higher pricing across its largest segments and higher volumes, notably in Asia and America.

The company, in its fiscal first quarter call, said that it expects full-year fiscal 2023 adjusted earnings per share of $11.20-$11.50, indicating a 9-12% year-over-year growth. For the second quarter of fiscal 2023, the company expects adjusted earnings per share in the range of $2.50-$2.70, suggesting a rise of 7-15% from the year-ago quarter.

Air Products is benefiting from investments in high-return projects, new business deals, acquisitions and productivity initiatives. It remains committed to its gasification strategy and is executing its growth projects. These projects are expected to be accretive to earnings and cash flows.

The company has a total available capacity to deploy (over fiscal 2018-2027) $36.3 billion in high-return investments aimed at creating significant shareholder value. It has already spent or committed 74% of the capacity.

Air Products is also driving productivity to improve its cost structure. It is seeing the positive impacts of its productivity actions. Benefits from additional productivity and cost improvement programs are likely to support its margins moving ahead.

The company also remains committed to maximize returns to shareholders leveraging strong balance sheet and cash flows. APD, earlier this year, increased its quarterly dividend by 8% to $1.75 per share from $1.62 per share. This marked the 41st straight year of dividend increase. The company paid more than 45% of its distributable cash flow as dividend in the fiscal first quarter.

A Few Headwinds

Air Products is exposed to challenges from cost inflation. It is witnessing higher power costs in its merchant business. The company is seeing significantly higher energy costs, especially in EMEA due to the considerably high natural gas and electricity costs. It is expected to continue to face headwinds from the power cost inflation moving ahead. Higher power costs are likely to weigh on margins over the near term.

The company also faces headwinds from unfavorable currency translation. It witnessed significant currency headwinds in the last reported quarter. Currency translation, stemming from a stronger U.S. dollar, reduced its sales by 6% in the quarter and lowered its earnings by 15 cents per share. The company is likely to face continued currency headwinds moving ahead.

Air Products and Chemicals, Inc. Price and Consensus

Air Products and Chemicals, Inc. price-consensus-chart | Air Products and Chemicals, Inc. Quote

Stocks to Consider

Better-ranked stocks worth considering in the basic materials space include Steel Dynamics, Inc. STLD, Olympic Steel, Inc. ZEUS and Nucor Corporation NUE.

Steel Dynamics currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for STLD's current-year earnings has been revised 20.1% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Steel Dynamics’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 11.3%, on average. STLD has rallied around 78% in a year.

Olympic Steel currently sports a Zacks Rank #1. The Zacks Consensus Estimate for ZEUS's current-year earnings has been revised 60.6% upward in the past 60 days.

Olympic Steel’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 26.2%, on average. ZEUS has rallied around 84% in a year.

Nucor currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for NUE’s current-year earnings has been revised 10.7% upward in the past 60 days.

Nucor beat Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 7.7% on average. NUE’s shares have gained roughly 24% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance