Here's Why You Should Hold Avanos Medical (AVNS) Stock Now

Avanos Medical, Inc. AVNS is likely to gain from a solid fourth-quarter show, while sluggishness in the Acute Pain business is a concern.

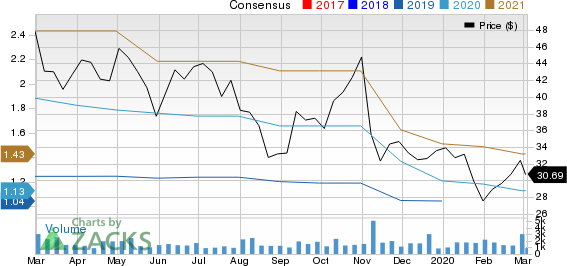

Shares of this company have declined 34.6% against the industry’s 0.9% rise in a year’s time. The current level also compares unfavorably with the S&P 500 index’s 9.6% rise over the same time frame.

This $1.56-billion medical technology company currently has a Zacks Rank #3 (Hold). Avanos’ earnings are expected to grow 13.3% in the first quarter of 2020. Also, the company has a trailing four-quarter positive earnings surprise of 0.1%, on average.

Let’s take a closer look at the factors that are working in favor of the company right now.

Q4 Earnings & Positive Developments

Avanos reported adjusted earnings per share (EPS) of 34 cents in fourth-quarter 2019, which rose by a penny year over year.

Revenues totaled $189.8 million, up 11.7% on a year-over-year basis.

AVANOS MEDICAL, INC. Price and Consensus

AVANOS MEDICAL, INC. price-consensus-chart | AVANOS MEDICAL, INC. Quote

Notably, the core Chronic Care segment recorded revenues of $113.4 million, up 15.5% year over year. Per management, the upside can be attributed to positive organic sales growth.

Additionally, the Pain Management arm reported net revenues of $76.4 million. The metric improved 6.6% on a year-over-year basis.

That’s not all. Management is optimistic about the FDA clearance of its new 80-Watt COOLIEF Radiofrequency System for neurological lesion procedures. Moreover, the upcoming launch of the company’s next-generation enteral feeding tube Mic-Key is likely to boost the Chronic Care unit.

Management at Avanos confirmed that the company expects lower foreign currency impact in 2020 in comparison to 2019.

Deterrents

Avanos continues to see pressure in its Acute Pain business, which saw a soft fourth quarter. Per management, ON-Q sales declined low-single-digits globally in the quarter. Also, in North America, sales declined low single digits.

Estimates Picture

For 2020, the Zacks Consensus Estimate for revenues is pegged at $739.1 million, indicating an improvement of 6% from the year-ago quarter’s reported figure. For adjusted EPS, the same stands at $1.13, suggesting growth of 5.6% from the year-ago reported figure.

Key Picks

Some better-ranked companies in the broader medical sector include Stryker Corporation SYK, Accuray Incorporated ARAY and IDEXX Laboratories, Inc. IDXX, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker’s long-term earnings growth is expected at 11.9%. The stock has a Zacks Rank #2.

Accuray’s fiscal fourth-quarter earnings is expected to skyrocket 200%.

IDEXX Laboratories’ first-quarter earnings growth is projected at 5.1%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

Accuray Incorporated (ARAY) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance