Here's Why Callon Petroleum (CPE) is an Attractive Investment Bet

Callon Petroleum Company CPE witnessed upward estimate revisions for 2022 and 2023 earnings in the past 30 days. The leading upstream energy firm, flaunting a Zacks Rank #1 (Strong Buy), is likely to record earnings growth of 84.5% in 2022.

What’s Favoring the Stock?

West Texas Intermediate crude price, trading at more than $110 per barrel, has risen drastically in the past year. The sharp rise in oil price can be hitched to the assumptions by many analysts that the Ukraine war may be prolonged.

Being a leading exploration and production company, Callon Petroleum is well-positioned to capitalize on the rally in crude price. The company has a strong footprint in Permian, the most prolific basin in the United States, brightening its production outlook. Callon Petroleum is planning to allocate more capital in the most prolific basin this year than the last year. Compared with 75% of capital budget allocation for Permian in 2021, the upstream player has decided to increase the proportion to 85% in 2022.

Callon Petroleum is also focused on greenhouse gas emissions and lowering routine flaring. The new targets of Callon Petroleum also comprise strengthening its financials while deleveraging the balance sheet.

Banking on these developments, the company is expected to generate significant free cash flows.

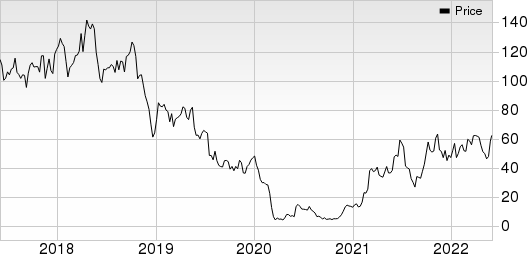

Callon Petroleum Company Price

Callon Petroleum Company price | Callon Petroleum Company Quote

Other Stocks to Consider

Some other top-ranked players in the energy space are ConocoPhillips COP, Marathon Oil MRO and Occidental Petroleum OXY. While ConocoPhillips and Marathon Oil carry a Zacks Rank #2 (Buy), Occidental Petroleum sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Considering production and reserves, ConocoPhillips is one of the leading exploration and production players in the global market. COP witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days.

In 2022, ConocoPhillips is likely to see an earnings growth of 141.6%.

Marathon Oil is a leading oil and natural gas exploration and production company. MRO witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days.

In 2022, Marathon Oil is likely to see an earnings growth of 201.3%.

In the United States, Occidental Petroleum is among the largest oil producers. OXY witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days.

In 2022, Occidental Petroleum is likely to see an earnings growth of 278.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ConocoPhillips (COP) : Free Stock Analysis Report

Marathon Oil Corporation (MRO) : Free Stock Analysis Report

Occidental Petroleum Corporation (OXY) : Free Stock Analysis Report

Callon Petroleum Company (CPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance