Here comes a 20% stock market plunge if Trump and Democrats don't agree on more COVID-19 stimulus

Add the potential of not getting another massive new fiscal stimulus plan as beginning to weigh on the minds of otherwise exuberant investors.

“I think you are looking at a 10% to 15% range minimum [if there isn’t a new stimulus plan],” warned EvercoreISI senior managing director Dennis DeBusschere on Yahoo Finance’s The First Trade. “And then from there it’s going to be about your expectation for the policy response. So you probably go down 10% to 15%, and then we’ll all wait around to see if that 10% to 15% causes the political apparatus to get moving quickly. And if you ultimately get nothing, by the way, you know it’s a down 20%. And you know, we’ll reassess from there.”

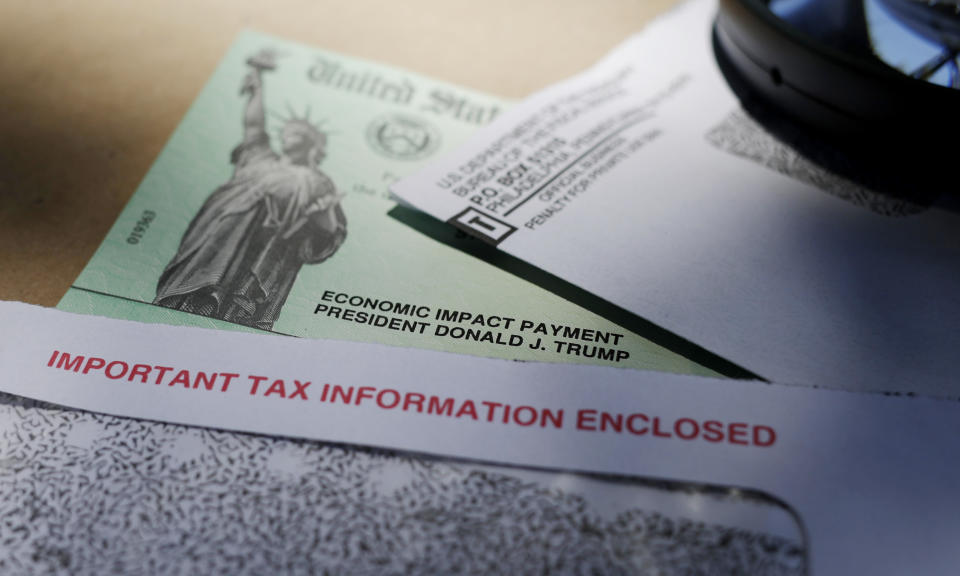

In March, lawmakers passed the $2 trillion Coronavirus Aid, Relief and Economic Security Act (CARES). It surpassed the $700 billion bailout package handed out to Wall Street during the Great Recession, underscoring the extent of the COVID-19 fueled economic downturn.

Under the plan, individuals were eligible for up to $1,200 (depending on income level) or $2,400 for married couples in stimulus checks. Children under 17 were granted $500. Those checks began hitting bank accounts in mid-April. Those unemployed were allowed to claim an extra $600 a week in benefits, known as a “top up” on Wall Street.

But with those checks largely being spent on everyday essentials and the unemployment “top up” set to expire at the end of July, households could take a big hit soon...one that the rallying stock market has overlooked.

Businesses could also take it on the chin again despite various sectors receiving loans under the CARES Act. If there isn’t more stimulus for businesses, then they may be at risk of a second wave of bad financials as states lock down again amid rising COVID-19 infections and deaths. Many simply may not survive fresh state lockdowns.

All of this puts pressure on lawmakers to act. While the Trump administration has floated a potential $2 trillion infrastructure plan, the Republican party is being viewed as lukewarm on another big fiscal stimulus plan. Meanwhile, a Democratic proposal for a $3 trillion stimulus plan would be all but dead on arrival in the Republican controlled Senate.

Brian Sozzi is an editor-at-large and co-anchor of The First Trade at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

Coca-Cola CEO: here’s what our business looks like right now

Dropbox co-founder: the future of work will be all about this

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance