Hemp Is on the Verge of U.S. Legalization: Could MariMed Profit?

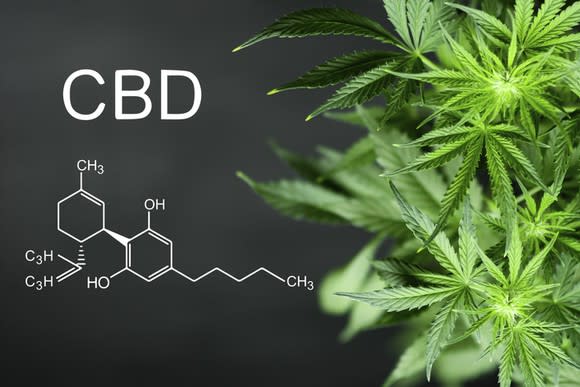

Hemp is anticipated to be legal to grow across the United States beginning on Jan. 1, 2019. This has huge implications for the cannabis industry because hemp can be used to extract cannabidiol (CBD), a chemical found in the cannabis plant that has been associated with a wide range of medical and wellness benefits.

Unlike its cannabis cousin marijuana, hemp contains negligible concentrations of tetrahydrocannabinol (THC), the chemical responsible for pot's psychotropic effects, including getting users high. By definition, hemp must contain less than 0.3% THC on a dry-weight basis.

(Image Source: Getty Images)

Given the massive growth projections for hemp, some forward-looking cannabis companies that have been focused on marijuana have recently been positioning themselves to profit from the U.S. hemp market.

One such company is MariMed (NASDAQOTH: MRMD). Let's explore whether it looks like a good investment.

The Farm Bill should ignite explosive growth in the hemp market

On Tuesday and Wednesday, the U.S. Senate and House of Representatives, respectively, overwhelmingly passed the latest version of the 2018 Farm Bill, which contains provisions that would make it legal on a federal level to grow industrial hemp. President Trump is widely expected to sign the bill by year's end, with the effective date likely Jan 1, 2019.

If the current Farm Bill becomes law, the U.S. market for hemp is projected to explode. Relevant to cannabis investors, the U.S. hemp-derived CBD market is expected to balloon by about 37 times in just four years, according to cannabis research firm Brightfield Group. That firm expects the market to grow from about $591 million in annual revenue this year to $22 billion by 2022.

MariMed in a nutshell

MariMed, based in the Boston area, is a multistate cannabis company that develops, owns, and manages cannabis cultivating and processing facilities as well as branded product lines.

In the third quarter, MariMed's revenue soared 98% year over year to $3.4 million. According to its earnings release, this growth was driven by increased rental income from its facilities in Maryland and Massachusetts, higher revenue from cannabis supply procurement services, and increased "management fees and additional rental revenue ... [from] its cannabis-licensed clients." Operating income rocketed 200% to $861,000, the net loss widened 2,500% to $10.2 million, and the loss per share came in at $0.05, versus $0.00 in the year-ago quarter.

The fact that MariMed generated a profit on an operating basis is more than nearly all other cannabis companies can say. (A notable exception is real estate investment trust Innovative Industrial Properties, which is also profitable on a bottom-line basis and pays a solid dividend.) MariMed's net loss widened because, like nearly all players in the cannabis space, it's investing heavily in growth initiatives. The company ended the quarter with $6 million in cash. Given its annual cash burn rate of $19.9 million through the end of the third quarter, its cash position is the first thing investors should be monitoring.

(Image Source: Getty Images)

MariMed recently invested in U.S. hemp player GenCanna

Last month, MariMed entered the hemp-derived CBD market via a $30 million investment in Kentucky-based GenCanna Global, which the press release announcing the deal described as a "global leader in the hemp CBD industry." (GenCanna can already grow hemp because it's licensed in Kentucky to do so. Some states allow licensed growers to farm hemp.) Moreover, the two companies formed a strategic partnership, including a long-term supply agreement.

MariMed says it plans to "create a product and branding business unit focused on the development and distribution" of products made from hemp-derived CBD. As one might expect, GenCanna plans to use the cash infusion to significantly ramp up production capacity.

In the press release, MariMed CEO Robert Fireman said, "MariMed's renowned product development expertise, combined with GenCanna's leadership position in premium Hemp CBD, will enable us to expand the Hemp CBD product category by creating compelling new consumer brands, and by developing powerful distribution channels."

Fireman added, "We believe many of the nation's leading retailers will soon provide Hemp CBD products to their customers, in response to popular demand." I couldn't agree more, and I believe that hemp-derived consumer products will be humongous sellers in the U.S.

Is MariMed worth investing in?

At this point, I wouldn't call MariMed a buy. That's largely because of its meager cash position relative to its recent spending. Moreover, larger players with deeper pockets could invade its turf.

That said, because management has proven capable of running a cannabis business that's already profitable from an operating standpoint, and has secured a long-term hemp supply, MariMed is worth watching.

More From The Motley Fool

Beth McKenna has no position in any of the stocks mentioned. The Motley Fool recommends Innovative Industrial Properties. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance