Helios (HLIO) Stock Rises 14% in 3 Months: What's Driving It?

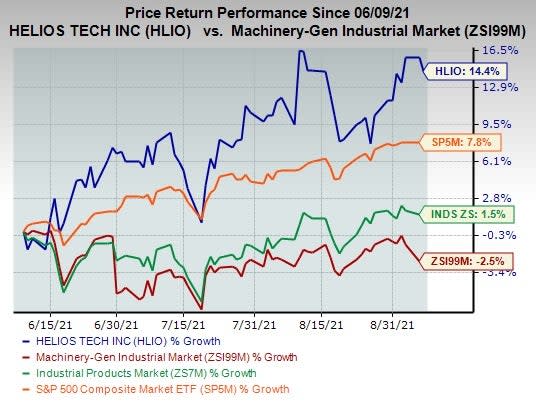

Shares of Helios Technologies, Inc. HLIO have jumped 14.4% in the past three months. Sound financial performances, earnings prospects and fundamentals support the price momentum for the company. It presently carries a Zacks Rank #2 (Buy).

The company engages in manufacturing and supplying solutions for use in the electronics and hydraulics markets. It has solid customer base in the Middle East, the Asia Pacific, the Americas, Africa and Europe. It belongs to the Zacks Manufacturing - General Industrial industry, which is in the top 23% (with a rank of 56) of more than 250 Zacks industries. It is based in Sarasota, FL, and has a market capitalization of $2.7 billion.

In the past three months, the industry has declined 2.5%. The S&P 500 has gained 7.8% in the same period and the Zacks Industrial Products sector has advanced 1.5%.

Image Source: Zacks Investment Research

Factors Influencing the Stock

In the past three months, Helios reported better-than-expected results for second-quarter 2021. Its earnings surpassed the Zacks Consensus Estimate by 39.53% and sales exceeded the same by 19.81%. The bottom line advanced 118% year over year on the back of 87% growth in revenues and an improvement in operating results.

In addition to sound financial performance, Helios’ is poised to benefit from a solid portfolio of products, innovation capabilities and strengthening end markets in the quarters ahead. Its operating and manufacturing strategies are added tailwinds, speaking highly of the company’s bright growth opportunities. Inflation in raw material costs and supply-chain issues are near-term hurdles.

Acquisitions also add to Helios’ attractiveness. In second-quarter 2021, buyouts contributed $60.2 million to the company’s revenues. In July, Helios acquired Italy-based NEM S.r.l. The buyout is anticipated to expand Helios’ manufacturing capabilities, presence in the OEM market and geographical reach. NEM will complement Helios’ Cartridge Valve Technology offerings, especially for customers in agriculture machinery, material handling, industrial and construction markets. It is integrated with Helios’ Hydraulics segment.

For 2021, Helios anticipates revenues of $800-$830 million, higher than the earlier mentioned $740-$750 million. Earnings are predicted to be $3.60-$3.80, higher than $3.30-$3.50 mentioned previously. Adjusted earnings before interest, tax, depreciation and amortization are expected to be $188-$203 million, higher than $170-$180 million mentioned earlier. Also, the company’s sound shareholder-friendly policies raise its appeal. In July, it paid out a quarterly dividend of 9 cents per share to its shareholders.

The Zacks Consensus Estimate for the company’s earnings per share is pegged at $3.82 for 2021 and $4.16 for 2022, marking increases of 12.4% and 8.6% from the respective 60-day-ago figures. The consensus estimate for third-quarter earnings has been unchanged at 83 cents. Such upward revisions in earnings estimates are reflective of healthy operating conditions for the company.

Helios Technologies, Inc Price and Consensus

Helios Technologies, Inc price-consensus-chart | Helios Technologies, Inc Quote

Helios’ Performance Versus Other Top-Ranked Industry Players

Helios’ performance in the past three months has been better than Nordson Corporation NDSN, DXP Enterprises, Inc. DXPE and Applied Industrial Technologies, Inc. AIT. The companies belong to the same industry as Helios. In the past three months, Nordson’s shares have gained 9.6%, while Applied Industrial has declined 9.6% and DXP Enterprises has lost 11%.

DXP Enterprises and Nordson presently sport a Zacks Rank #1 (Strong Buy), while Applied Industrial carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Nordson Corporation (NDSN) : Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE) : Free Stock Analysis Report

Helios Technologies, Inc (HLIO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance