HEICO (HEI) Q1 Earnings Surpass Estimates, Cost Increases

HEICO Corporation HEI reported first-quarter fiscal 2020 earnings of 89 cents per share, which surpassed the Zacks Consensus Estimate of 77 cents by 15%. The bottom line also rose 53.4% from the prior-year quarter’s figure of 58 cents.

The upside can be attributed to a discrete income tax benefit from stock option exercises.

Total Sales

Quarterly net sales of $506.3 million beat the Zacks Consensus Estimate of $505 million by 0.3%. The top line also increased 8.6% from the year-ago quarter’s figure of $466.1 million. The uptick can be primarily attributed to the company’s single-digit organic net sales growth within Flight Support Group and Electronic Technologies Group segments.

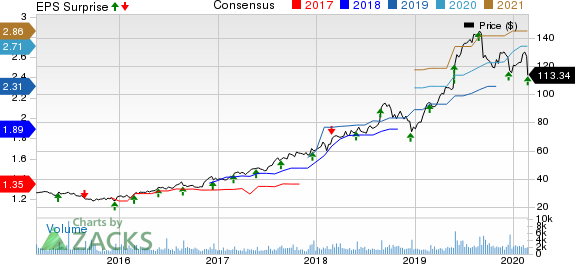

Heico Corporation Price, Consensus and EPS Surprise

Heico Corporation price-consensus-eps-surprise-chart | Heico Corporation Quote

Operational Update

HEICO’s total costs and expenses increased 7.4% year over year to $395.3 million in the quarter under review. The increase was due to higher cost of sales as well as increased selling, general and administrative expenses.

Segmental Performance

Flight Support Group: Net sales rose 5% year over year to $301.1 million driven by continued strong organic growth of 12% mainly due to increased demand and new offerings across all product lines.

Operating income improved 17% year over year to $62 million, courtesy of net sales growth, improved gross profit margin and a favorable impact from lower expenses related to changes in the estimated fair value of accrued contingent consideration.

Also, its operating margin expanded 220 basis points (bps) to 20.6% in the first quarter of fiscal 2020.

Electronic Technologies Group: Net sales increased 13% year over year to $208.4 million primarily owing to increased demand for its defense products. Also, a favorable impact from fiscal 2019 and 2020 acquisitions contributed to this segment’s top line.

Operating income increased 11% year over year to $57.5 million, primarily on account of quarterly net sales growth.

The company’s operating margin came down 40 bps to 27.6% in the first quarter of fiscal 2020.

Financial Details

As of Jan 31, 2020, cash and cash equivalents totaled $64 million compared with $57 million as of Oct 31, 2019.

Long-term debt (net of current maturities) totaled $567.9 million as of Jan 31, 2020, up from $561 million as of Oct 31, 2019.

As of Jan 31, 2020, cash provided by operating activities was $81.1 million compared with $49.6 million as of Jan 31, 2019.

Cash flow provided by operating activities grew 64% to $81.1 million in the first quarter of fiscal 2020.

Fiscal 2020 Guidance

HEICO Corp has partially raised its fiscal 2020 guidance. The company’s net income is currently expected to grow in the range of 14-15%, compared with the earlier range of 13-14%. However, net sales are still expected to rise in the band of 6-8% over fiscal 2019 levels.

The company also anticipates operating margin in the range of 21.5- 22.0%.

Zacks Rank

HEICO Corp currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Defense Releases

Aerojet Rocketdyne AJRD reported fourth-quarter 2019 adjusted earnings of 27 cents per share, which declined 18.2% from 33 cents reported in the year-ago quarter.

Huntington Ingalls Industries HII fourth-quarter 2019 earnings of $4.36 per share surpassed the Zacks Consensus Estimate of $4.24 by 2.83%. However, the reported figure declined 11.7% from $4.94 reported a year ago.

Teledyne Technologies TDY reported fourth-quarter 2019 adjusted earnings of $2.90 per share, which surpassed the Zacks Consensus Estimate of $2.76 by 5.1%. The bottom-line figure came above the guided range of $2.71-$2.76.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Teledyne Technologies Incorporated (TDY) : Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII) : Free Stock Analysis Report

Heico Corporation (HEI) : Free Stock Analysis Report

Aerojet Rocketdyne Holdings, Inc. (AJRD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance