HDB resale prices up 0.4% in Q4 2019

As such, the HDB Resale Price Index (RPI), which measures overall price movements of resale HDB flats, is now 131.4.

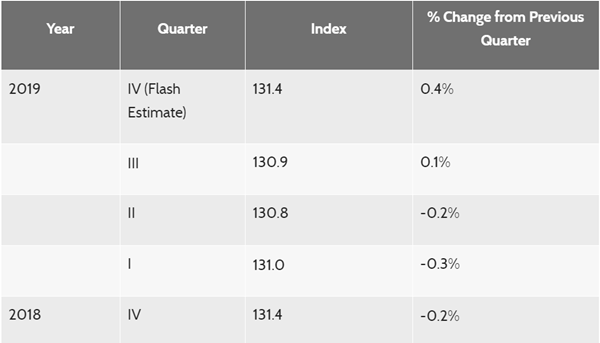

Resale prices of HDB flats have continued to climb in Q4 2019, raising by 0.4% from the 0.1% increase in Q3 2019, according to the latest HDB flash estimates.

As such, the HDB Resale Price Index (RPI), which measures overall price movements of resale HDB flats, is now 131.4.

Photo: HDB

“Based on the flash estimate, there was no change in the resale flat prices for the whole year of 2019,” said HDB.

Providing information on the general price movement within the resale public housing market, the RPI for the full quarter, along with more public housing data, will be rolled out on 23 January.

According to data from Data.gov.sg and OrangeTee, the number of resale transactions in the first 11 months of 2019 is higher when compared to the same period in 2018 and 2017:

Months | Number of resale transactions |

Jan-Nov 2017 | 18,776 |

Jan-Nov 2018 | 20,139 |

Jan-Nov 2019 | 20,353 |

“The various policies seemed to have achieved their goals in improving the demand of different flat types and mitigating further price falls that were mainly caused by the lease depreciation of older flats and an increasing supply of HDB flats,” says Christine Sun, Head of Reseach and Consultancy from OrangeTee & Tie.

“For instance, the policy change that allows buyers to use more Central Provident Fund monies to buy HDB flats and the ongoing HIP (Home Improvement Programme) seemed to have improved the attractiveness and demand for older flats. In the second and third quarters of last year, the sales volume of older flats increased islandwide while the prices of older flats rose in certain towns.

“Enhancing the housing grants for first-time buyers and raising the income ceiling for eligible buyers seemed to have expanded the pool of potential buyers in the market,” she added.

Meanwhile, HDB announced that it will offer around 16,000 to 17,000 Build-To-Order (BTO) flats this year.

For the first BTO sales exercise, it will launch around 3,000 BTO flats in Toa Payoh and Sembawang in February.

RECOMMENDED ARTICLES: HDB’s plans for flats in Bishan and Queenstown

Another 3,700 BTO flats in Choa Chu Kang, Tampines, Tengah and Pasir Ris will be offered in May. It revealed that the flats in Choa Chu Kang will have a shorter waiting time.

Looking for a property in Singapore? Visit PropertyGuru’s Listings, Project Reviews and Guides.

Victor Kang, Digital Content Specialist at PropertyGuru, edited this story. To contact him about this or other stories, email victorkang@propertyguru.com.sg

Yahoo Finance

Yahoo Finance