Can Harley-Davidson's Dividend Survive Another Year of Falling Sales?

We can expect Harley-Davidson (NYSE: HOG) to post its fourth-quarter and full-year 2018 earnings sometime in late January, but there's no reason to believe the motorcycle leader is going to be able to stop its sales slide.

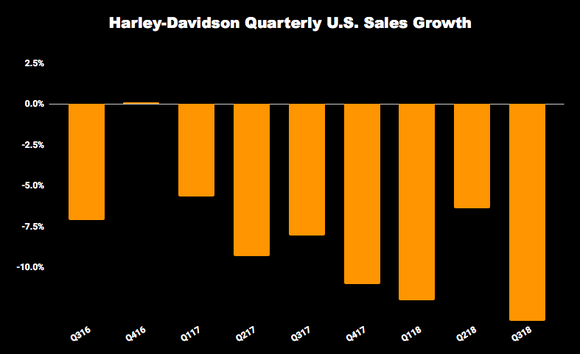

Every quarter, save one for the past four years, Harley has reported falling sales. Furthermore, with the fourth quarter one of its historically weakest periods, it's a good bet sales will be down again. It's not all the company's fault because the entire motorcycle industry is contracting. As the industry leader with a 50% share of the market, though, it's been hit the hardest.

Yet the protracted decline raises the question of whether Harley's dividend is safe. Can the big bike maker afford to keep paying investors to wait until it is able to ride out of its current skid?

Data source: Harley-Davidson quarterly SEC filings. Chart by author.

A fractured dividend history

Harley-Davidson began paying a quarterly dividend in 1993 and has done so every quarter. Yet in 2009, as Harley hit its nadir in the depths of the Great Recession, the bike maker slashed its dividend, from $0.33 per share per quarter down to just $0.10 in a bid to conserve cash. U.S. retail sales had plunged 13% the year before to 219,000 motorcycles, and they were down 7% worldwide.

Free cash flow also turned negative, as the bike maker was unable to securitize motorcycle loans, resulting in cash proceeds from their sale plunging from $2.5 billion in 2007 to just $467 million in 2008, an indication of the sort of financial free fall Harley-Davidson and the economy were in at the time.

However, Harley has since increased the dividend for eight consecutive years and the annual payout today of $1.48 per share yields 3.8%. But Harley-Davidson's U.S. sales are in a downward spiral similar to the one a decade ago, falling over 10% in 2018, and the only hope for a revival on the horizon is a new electric motorcycle due out sometime next year. It's a completely untested market, as there are currently no sales of a high-performance machine like the one Harley will be building, meaning it's unlikely the LiveWire will be able to turn the company around on its own.

Harley-Davidson's future is riding on the LiveWire electric motorcycle. Image source: Harley-Davidson.

Better financial standing

As bleak as the sales picture is for Harley, the financial situation is much better. Unlike its rivals, the bike maker doesn't engage in the sort of wholesale discounting that would eat away at its margins. Despite falling sales, revenue was actually 17% higher in the third quarter due to higher prices, and operating margin widened to 5.8% from 1.8% a year ago (it is down 280 basis points to 12% year to date, however).

Even better, trailing free cash flow stands at $970 million, significantly ahead of the $800 million it produced in 2017, and Harley has changed the way it handles the securitization of its motorcycles from the way it did in 2008. Last year, it had no asset-backed securitization transactions, nor has it had any so far this year. Asset-backed debt fell to $543 million as of the end of September, down from $832 million a year ago and $807 million last December.

A strong support system

To measure the sustainability of Harley's dividend payment stream, the payout ratio is calculated by dividing its dividends of $1.48 per share by its trailing earnings of $3.53 per share, giving us a ratio of 41%, a fairly safe level.

EPS isn't necessarily the best measure, though, because it incorporates several non-cash items like depreciation and doesn't include capital spending. That's why it's important to look at free cash flow (FCF) per share, which for Harley totals $5.77, giving us an FCF-based payout ratio of under 26%. Lower is better when it comes to the payout ratio because it means a company can continue to pay its dividends even if earnings drop, or it could increase the dividend further with little risk.

Seen from that perspective, Harley-Davidson's dividend appears intact and safe. Its high profit margins provide ample cash to cover its new investments and its payout to investors. You could argue that it ought to lower the prices of its motorcycles and boost sales, but Harley is intent on not diluting its margins or its brand.

There are many issues investors will confront when deciding whether to invest in Harley-Davidson as the motorcycle industry evolves, but its dividend is probably one they don't have to worry about.

More From The Motley Fool

Rich Duprey has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance