Happy New Year with Rising Home Loan Rates?

Happy New Year with Rising Home Loan Rates?

Paul HO (iCompareLoan.com)

Happy Chinese New Year 2017 to the year of the Rooster, Rise and Shine.

We wish you 步步高升 which stands for “step by step going higher”, generally refers to career progression. Perhaps this wish of “step by step going higher” may also apply to your Home Loan rates if you do not take action before the Chinese New Year.

Our First Warning of Rate Hike in Early Dec 2016

Rates snapshot in Early Dec 2016: -

· 2 years fixed rates at 1.4%.

· 3 years fixed rates at 1.68%.

· 2 years fixed rates at 1.5%, 1.65% (limited tranche)

· Pegged to Fixed Deposit Rate

o Year 1 = 1%

o Year 2 = 1.4%

o Year 3 = 1.4%

· Board Rates at 1.25% (Year 1 to 3)

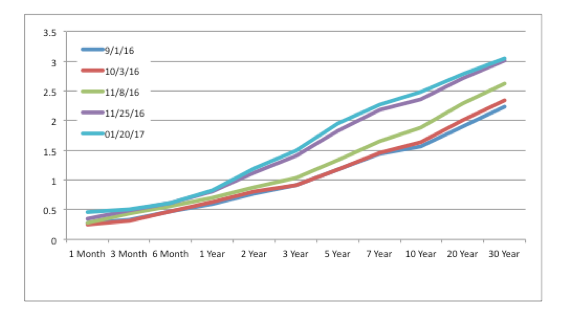

Since early Dec 2016, after Trump has been elected as the 45th US president, we have noted that Bond Yield Curve has risen and have warned about rate hikes.

Making a guess and voicing an opinion is free of charge hence there are many conflicting reports and news you read out there are very confusing.

However when the bond yield curve move, this means that people in the financial industry generally believe that there will be higher interest rates going forward. And for them to collectively put their own money on the table betting on higher interest rates, this means something to us. Of course they could all be collectively wrong, but these people are in the “know” with first hand information and walks along the corridors of power, hence when they put their money on the table, they bet to win.

Our Second Warning came in Mid Dec 2016

Rates snapshot in mid Dec 2016: -

· 3 years fixed rate – 1.68% withdrawn and launched at 1.88%.

· This 0.2% increase will cost an estimated $5000 over dollars in interest cost over 3 years for a $1 million dollar loan.

· 2 years fixed rate - 1.75%.

· 2 years fixed rate - 1.4% withdrawn.

· 2 years fixed rate - 1.5%, 1.65% and 1.8% 3 years fixed rates (stopped taking orders)

· Board rate - 1.25% was withdrawn and launched at 1.38%, 1.48%, 1.58%.

Our warning came in this article, “Singapore banks raise fixed rate home loan” and on Yahoo, “Singapore Banks hurry to raise mortgage rates”.

Our Third warning came in Early January 2017

Rates snapshot in Early Jan 2017: -

· 2 years fixed rates 1.8% withdrawn and replaced with 1.88%.

· 2 years fixed rates – 1.5%, 1.65% stopped taking orders. No new rates announced.

· Pegged to Fixed Deposit Rates

o 1.5% Pegged to Fixed Deposit Rates withdrawn, replaced with 1.6%.

o 1.48% (year 1 to 3) - processing extended to 3 weeks.

· 3 years fixed rates 1.5%, 1.65% and 1.8% processing time extended to 3 weeks.

Screenshot 1: iCompareLoan Facebook Page warning about Rate Hike, iCompareLoan.com

Join us at iCompareLoan FACEBOOK page to stay in touch with Updates and News.

This would be our 4th Warning about Rate hike

Rates snapshot: -

· 3 years fixed rates at 1.88% withdrawn and replaced with 2.18%.

· 2 years fixed rates at 1.8% expiring on 27th Jan 2017.

· Pegged to Fixed Deposit Rate

o 1.4% year 1, 1.5% year 2 onwards. (will end soon)

Many offers now will only last till 27th Jan 2017, the Chinese New Year eve.

This means that when you enter into the Chinese New Year in welcoming the year of the rooster, you will also likely welcome a spate of new home loan rates in February.

The latest US treasury bond yield curve further increased, intensifying the potential of US Federal Reserve interest rate hikes and hence our Sibor and SOR rates and trickling down to our home loan rates.

Chart 1: US Government Treasury (Nominal) Bond Yield Curve, US Treasury, iCompareLoan.com

Note that the Green line (11/8/16) is the date that Donald Trump was elected.

Business owners may think that this home loan rates do not concern them, but they will be surprised that soon the banks will be raising their business term loan rates. For those who have equity in their private property, they may wish to refinance their private property for Equity-term-loan, it is way cheaper to borrow from your residential property than from your SME business loan.

And if you believe what the charts and the trend indicate, after the new year, you will see Higher Home Loan Rates as well as borrowing cost, unless you take action with your home loan now. It will only take 1 hour of your time to collate documents and potentially tens of thousands of dollars or savings.

So before you go on your Chinese New Year celebration, we wish you prosperity, progress and rising fortunes but hopefully not Rising Home Loan rates. So instead of Gong Xi Fatt Cai we are going to wish you, Gong Xi Saving Interest.

Yahoo Finance

Yahoo Finance