Gulfport Energy (GPOR) Down 16.6% Post-Q1 Earnings Release

Shares of Gulfport Energy Corporation GPOR have declined almost 17% since its first-quarter 2020 earnings announcement on May 7. While the top and the bottom line came ahead of the respective Zacks Consensus Estimate, investors are snubbed by the company’s 2020 guidance.

Let’s delve deeper.

Gulfportwitnessed better-than-expected results for first-quarter 2020 as both earnings and sales surpassed estimates.

This Oklahoma-based company delivered first-quarter adjusted net earnings per share (EPS) of 10 cents, attributable to lower lease operating and depreciation expenses. Meanwhile, the Zacks Consensus Estimate was of a loss of 12 cents. However, the bottom line fell from the year-ago earnings of 33 cents a share amid weaker year-over-year natural gas price realizations and weak production volumes.

Further, revenues of $246.88 million came ahead of the Zacks Consensus Estimate by 12.02%. However, the top line plunged from the year-ago figure of $320.58 million.

Production & Realized Prices

Gulfport’s total oil and gas production decreased to 95,896 million cubic feet equivalent (MMcfe) from 113,726 MMcfe in the corresponding period of last year. Of the total output, 89.7% comprised natural gas. Gas production from the Utica Shale dropped 17.7% year over year to 73,575 MMcfe. Nearly, 76.7% of the output came from the Utica acreage. Output from SCOOP came in at 22,274 MMcfe, down from the year-ago level of $23,394 MMcfe.

Average realized natural gas price (before the impact of derivatives) during the first quarter was $1.26 per thousand cubic feet, lower than the year-ago period’s $2.70. Average realized natural gas liquids price was 36 cents per gallon, down from the year-ago quarter’s 58 cents. Gulfport fetched $43.53 per barrel of oil during the quarter, down from the year-ago figure of $53.10. Overall, the company realized $1.55 per thousand cubic feet equivalent in the quarter compared with $3 a year ago.

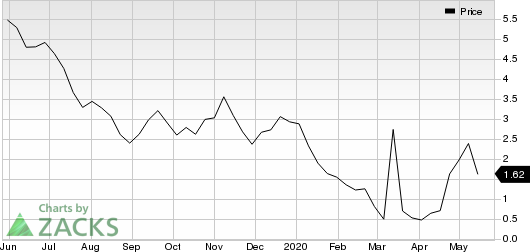

Gulfport Energy Corporation Price

Gulfport Energy Corporation price | Gulfport Energy Corporation Quote

Costs, Capex and Balance Sheet

Total expenses in the quarter under review amounted to $727 million, higher than $227.6 million in the prior-year period. This downside is mainly attributed to higher general and administrative costs and impairment charges incurred in the reported quarter. Depreciation costs plunged 34.1% from the prior-year quarter to $78 million.

In the first quarter, Gulfport spent $130.7 million on drilling and completion. As of Mar 31, this natural gas-weighted energy explorer had $1.63 million in cash and cash equivalents. Gulfport had a long-term debt of $1,898 million, representing total debt to total capital of 70.77%.

2020 Guidance

As a result of the coronavirus- induced economic downturn,this upstream player expects current-year capex at the lower end of or below the $285-$310 million band. Gulfport plans to close up a minimal amount production over the next few months together with a large number of vertical wells in the SCOOP. The company expects these shut-ins to affect its production by not more than 20 MMcfe per day.

Gulfport also expects some of its non-operated production units to be affected by voluntary shut-ins due to lower prices. The company expects natural gas price realizations (before the effects of hedges and including transportation) between 70 cents and 80 cents per thousand cubic feet in 2020.

Zacks Rank & Performance of Other Energy Players

Gulfport has a Zacks Rank #2 (Buy). Among other players in the energy sector that already reported first-quarter earnings, the bottom-line results of Cheniere Energy Inc. LNG, Murphy USA Inc. MUSA and Williams Companies Inc. WMB beat the respective Zacks Consensus Estimate by 204.3%, 4.3% and 4%. While Cheniere Energy and Williams Companies carry the same Zacks Rank as Gulfport, Murphy sports a Zacks Rank #1 (Strong Buy).You can see the complete list of today’s Zacks #1 Rank stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Williams Companies, Inc. The (WMB) : Free Stock Analysis Report

Cheniere Energy, Inc. (LNG) : Free Stock Analysis Report

Gulfport Energy Corporation (GPOR) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance