This Month’s Singapore Savings Bond (SSB): Interest Rates And How To Buy

Singapore Savings Bond (SSB) is one of the more common options for Singaporeans to invest their money in as it usually offers a higher return as compared to bank fixed deposits.

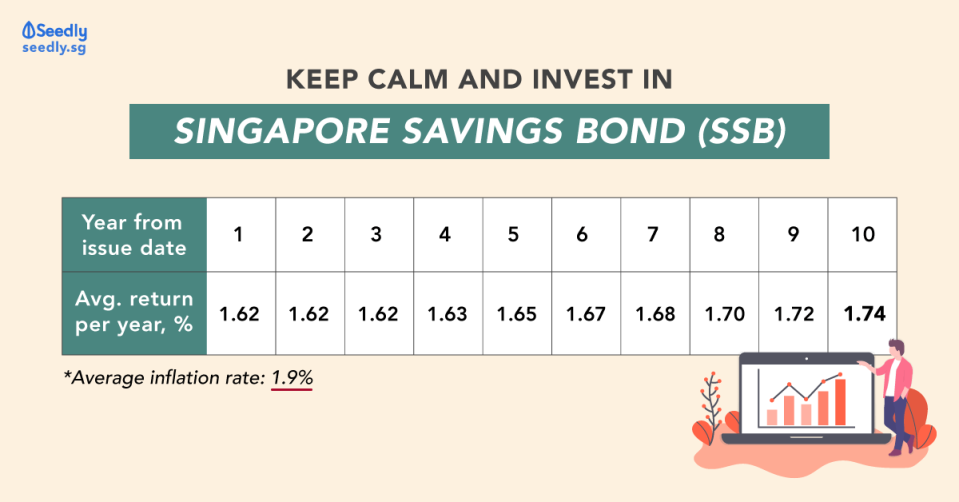

It is one of the easier ways to combat the prevailing inflation rate (1.9%) with little risks involved.

Side note: we’ve noticed that this month’s SSB rates barely beats inflation and it’s only if you hold it till maturity…

Here’s a quick comparison that can help you with your decision, should you be looking to invest in the SSB:

| Singapore Savings Bond (SSB) | Savings Account in Banks | Fixed Deposits |

|---|---|---|---|

Liquidity | YES | YES | NO |

Low Barriers to Invest | YES | YES | NO |

Returns >1% Per Annum | YES | NO | DEPENDS |

In this article, we’ll guide you through EVERYTHING you need to know about SSB:

This Month’s Singapore Savings Bond (SSB) Interest Rates

The interest rate for SSB changes every month. Here are the details for this month’s Singapore Savings Bond:

Details Of This Month's Bond | |

|---|---|

Bond ID | GX19110F |

Issue Date | 1 November 2019 |

Maturity Date | 1 November 2029 |

Application Period | Opens: 6.00pm, 1 October 2019 |

The interest rate for this month’s bond is:

Year From Issue Date | Interest (%) | Average Return Per Year (%) |

|---|---|---|

1 Year | 1.62 | 1.62 |

2 Years | 1.62 | 1.62 |

3 Years | 1.62 | 1.62 |

4 Years | 1.68 | 1.63 |

5 Years | 1.73 | 1.65 |

6 Years | 1.73 | 1.67 |

7 Years | 1.78 | 1.68 |

8 Years | 1.83 | 1.70 |

9 Years | 1.88 | 1.72 |

10 Years | 1.91 | 1.74 |

This means that if you invest $1,000 in this Singapore Savings Bond and held it for the full 10 years, the effective interest rate per year will be 1.74% and you’ll earn a total interest of $174.

What Is A Singapore Savings Bond?

Singapore Savings Bonds are issued by the Singapore Government, to provide Singaporeans with a safe and flexible option for long-term saving.

What Are The Benefits Of Parking My Savings With SSB?

Before we jump into investing in the SSB, let’s take a closer look at the risks and benefits.

1. No Penalty For Early Redemption

The longer you hold on to the bond, the higher the interest rate you enjoy.

There is also no penalty for individuals who wish to exit their investment early.

Once you submit your redemption request, you will get your principal back (along with any accrued interest) by the 2nd business day of the following month.

What does this mean?

Assuming you choose to redeem $1,000 anytime during September 2019

You will receive $1,000 and any accrued interest by the end of the 2nd business day of October 2019

So if you hate the feeling of having your money locked up for extended periods of time, the SSB is the perfect solution.

2. Fully Backed By The Singapore Government

The amount you invest in the SSB is completely backed by the Singapore Government.

Whatever your political views might be, it IS a fact that the Singapore Government received a “AAA” credit rating. This reduces the risks of investing in the SSB to the bare minimum (read: still got risks though).

The only other countries who enjoy the same “AAA” credit rating are countries such as Switzerland and Hong Kong.

Having such a strong rating arguably makes the SSB one of the safest products in the market.

3. $500 Is All It Takes

You don’t need to starve or scrimp like crazy in order to invest in the SSB.

The minimum amount to invest is $500. Which makes it suitable for almost everybody.

Also, the Individual Limit for SSB is currently set to $200,000 (this includes bonds bought with cash and your SRS monies)

Step-By-Step Guide To Investing In Your First Singapore Savings Bond (SSB)

Here’s how you go about applying for the Singapore Savings Bond.

1. What Do You Need?

Before applying, make sure you have the following:

A bank account with any local banks in Singapore (DBS/POSB, OCBC or UOB)

CDP securities account that is linked to the bank account you intend to invest with

2. How To Invest In Singapore Savings Bonds

You can apply for a Singapore Savings Bond through two methods:

Apply at an ATM (only DBS/POSB, OCBC, or UOB) near you, OR

Apply through Internet Banking under Singapore Government Securities

Note: If you are using OCBC, the OCBC mobile app works too!

Remember to have your CDP account number on hand when applying.

Take note that a minimum investment of $500 is required, and if you wish to invest more, increase in multiple of $500. Each application is capped at $50,000. There will be a $2 transaction fee involved for each application.

What To Do After Application?

Once you have applied for your SSB, all you have to do is sit back and relax. The results will be announced after the “last day to apply date”.

You can find out important dates like the “last day to apply date” here.

Do note that if there is an event of over-subscription, meaning more demand than the amount available, you might find yourself only investing a portion of the amount you applied for.

The rest of the amount will be returned back to your bank account.

Other Important Dates

The successful allocated Savings Bonds will be issued on the first business day of the following month.

You can expect your first interest 6 months after the bonds are issued.

Interests are payable every 6 months. All these will be reflected in your statement, and interests are automatically credited to your bank account.

Singapore Savings Bond (SSB) vs Fixed Deposits

We’ve established in other articles that SSBs are a better investment as compared to fixed deposits given their:

higher interest

higher flexibility, and

lower barrier to invest

HOWEVER, with the recent drop in average return per year for SSBs, this claim is highly contestable if we compared Singapore Savings Bond vs. Fixed Deposits.

A quick search online reveals that the fixed deposit plan with the highest interest rate is 2.22% per annum, with a minimum deposit of $20,000 for 12 months.

And if we compared it with the average return per year for this month’s SSB:

1.65% for 1 year

1.95% for 10 years (till maturity)

it would seem that a fixed deposit is a better investment if you’re only focused on getting the most interest with an investment horizon of 1 year.

Note: You should also note that most fixed deposit plans require a huge sum of money to be parked with the respective banks, usually more than $10,000 just to qualify. On top of that, investors are required to lock in their savings for an amount of time – the longer the lock-in period, the higher the interest rate.

Conclusion?

If you don’t have $20,000 to spare and would prefer more flexibility, and an interest rate that is higher than leaving it in a regular bank savings account, then SSBs are still your best bet.

What If I Have Questions About SSBs?

Do you have a question about Singapore Savings Bonds (SSBs)? Check out what our community members are discussing on the Seedly QnA platform:

Can’t find the answer to the question you’re looking for? Why not ask your question? Better still, you can even ask anonymously!

The post This Month’s Singapore Savings Bond (SSB): Interest Rates And How To Buy appeared first on Seedly - Get Rich Or Die Tryin'

Yahoo Finance

Yahoo Finance