Greek stocks take a beating as bourse reopens

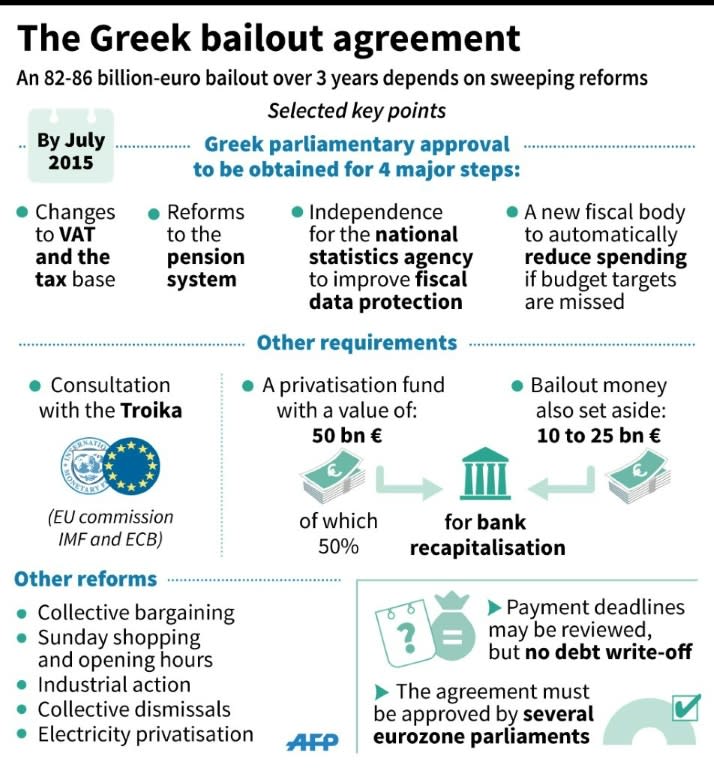

Greece's stock exchange took a beating Monday as trading resumed after a five-week shutdown forced by capital controls, with the main index losing around a fifth of its value and bank shares particularly hit. The ATHEX plunged nearly 23 percent at the opening before clawing back to losses of around 17 percent in midday trade, with analysts noting that the situation could deteriorate before the market aligns itself. The state agency ANA reported that 10 billion euros had been wiped out on the stock exchange. "The situation in Greek equity markets will have to get a lot worse before it gets better," said Luca Paolini, Pictet Asset Management’s chief strategist in London. "There are still critical risks to be resolved." The country's main banks took a heavy blow at the opening with drops of around 30 percent. But investors offloaded unreservedly on all the top Greek companies, including gaming giant OPAP, main electricity provider PPC, top telecoms operator OTE and leading refiners HELPE, which were also shedding between 14 and 23 percent. "Pressure by sellers was high. It is logical and anticipated by everyone," stock market chairman Socrates Lazaridis told Bloomberg TV, noting that he expected the market to stabilise in a month's time. "After five weeks of non-transacting ability, it was important to incorporate the changes that have taken place in the international environment of capital markets, and also on the local environment where there was a number of important changes," Lazaridis said. - 'Insecurity pervades market' - "We were not expecting something different today," said analyst Manos Hatzidakis of Beta Securities. "The stock exchange has not been closed for a month since 1974... This is a risk factor especially for major investors." "This is reflected today with great intensity... It is a sign of the insecurity that pervades the market," he said. The stock exchange operates as normal for foreign investors but local traders face limits on their transactions as part of the capital controls imposed by the government last month. As a result of the restrictions, Greek investors cannot buy securities with money from their bank accounts in Greece. They will, however, be able to use foreign bank accounts or make cash transactions. Lazaridis, the stock market chairman, noted that up to 65 percent of investors present on the Athens bourse are foreign. The volatility cap has been reduced from 30 percent to 20 percent during the first three days of trading. The country's lenders are in a vulnerable position because of outflows of billions of euros from deposits over the past six months. Some 40 billion euros ($44 billion) has been withdrawn from Greek banks since December, according to the country's banks association, amid fears over the fate of the Greek economy. The reopening of the stock market comes after senior EU and IMF auditors held their first meetings with Greek ministers to finalise a new three-year bailout for the country that could be worth up to 86 billion euros ($94 billion). - Auditors - The last trading session on the Athens stock exchange was on June 26, ending a few hours before Prime Minister Alexis Tsipras announced a referendum on the stringent bailout conditions demanded by Greece's international creditors. In response, worried Greeks rushed to withdraw cash from ATMs, prompting the government to impose capital controls from June 29 and announce the closure of the country's banks and the stock exchange. The banks reopened on July 20, but withdrawals and money transfers abroad remain restricted. The capital controls have also forced many companies to send staff on mandatory vacation and disrupted the import of a wide array of goods, raising the prospect of shortages in the autumn according to market insiders. Some 60,000 companies have requested to relocate to neighbouring Bulgaria, the association of Greek traders said last month. The Greek economy is already forecast to contract by around 3.0 percent this year.

Yahoo Finance

Yahoo Finance