Greek debt crisis: LIVE REPORT

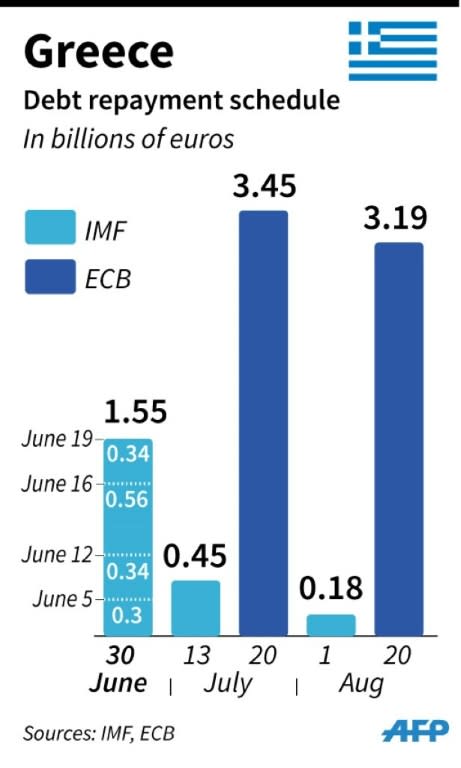

15:23 GMT - AFP IS NOW CLOSING THIS LIVE REPORT with the Greek debt crisis set to roll on at least until next Sunday's referendum on the proposals the European Union, International Monetary Fund and European Central Bank want Greece to accept before they release fresh funds. 15:22 GMT - Key points - - Greece has shut its banks for a week after the ECB refused to raise the ceiling for emergency loans to the nation's commercial lenders. Greeks can only withdraw 60 euros at a time, though tourists are unaffected - Prime Minister Alexis Tsipras has called a referendum for next Sunday on whether the government should accept proposals by the European Union, International Monetary Fund and European Central Bank for a new deal on the cash-strapped country's debt - The next key date is tomorrow, the deadline date set by the IMF for Greece to make a loan repayment of more than $1.5 billion euros. The ECB has capped its emergency lending ceiling to Greek banks at close to 89 billion euros, a source says - The key sticking points are pension system reforms, increases in sales tax (VAT) and privatisation, all meant to boost government coffers - Without agreement, the creditors will not release the last bailout tranche worth 7.2 billion euros Athens needs to cover the June 30 IMF payment 15:22 GMT - Obama 'backs new talks' - French President Francois Hollande and his American counterpart Barack Obama have agreed in a telephone call to work together to encourage a return to the negotiating table with Greece to solve its debt crisis. "They agreed to combine their efforts to favour a return to talks, allowing a swift resolution of the crisis and insuring Greece's financial stability," reads a statement from the French presidency. - IMF deadline - 15:21 GMT - 'Death' - "I feel like I'm voting for sudden death or slow death," says Athens office manager Maria, 38, who wants Greece to stay in the European Union but fails to see how she will pay her taxes if they are raised any further. She said today's heated exchange -- in which Jean-Claude Juncker insisted a "No" would be a no to Europe, and Athens cast doubt on the EU chief's "sincerity" -- suggests "someone is lying, or rather, they probably both are". 15:21 GMT - Greek payday - Not only could tomorrow be the day that Athens defaults -- it is not expected to make a more than 1.5 billion euro payment to the International Monetary Fund -- but it is also supposed to be payday for many. "I'm afraid I'm going to lose my job, to be broke," says Sofia Chronopoulos, who works in a fabric shop. "The banks are closed, the boss has no money, there are bills to pay," she tells AFP. 15:16 GMT - 100 percent - Angela Merkel describes the last proposals to Athens by creditors, which Greece has rejected, as generous, adding "the will on the Greek side for such a compromise was not there". While she tells reporters Europe must be capable of compromise, she also warns that "nobody can however get 100 percent". 15:07 GMT - Puerto Rico - Alejandro Garcia Padilla, the governor of Puerto Rico -- the American territory now being call the "US's Greece" -- has told the New York Times the American territory cannot make payments on its $72 billion in debt, AFP's Paul Handley reports. Puerto Rico has been trying to tighten spending while negotiating with bond holders -- many of them hedge funds -- to restructure the debt. A report released by the government today has parallels with the Greek situation, Handley says. "For its part, the administration has worked hard to stave off a financing crisis with important measures since 2013, including higher taxes, pension reforms and spending cuts. … The debt cannot be made sustainable without growth, nor can growth occur in the face of structural obstacles and doubts about debt sustainability," the report states. 15:04 GMT - Bundestag debate - Germany's Bundestag lower house of parliament will hold a debate on the Greek crisis Wednesday, the day after Greece's bailout programme expires, Angela Merkel says. 14:45 GMT - 'Blow to eurozone' - "I think this is definitely a big blow for the eurozone project, even if they manage to keep Greece," Pieter Cleppe of the Open Europe think-tank, tells AFP's Danny Kemp. There has not been permanent damage to the EU yet as core principles such as the single market are not affected, but "there is a danger that this could be undermined", Cleppe says. 14:45 GMT - 'Distrust' - Europe's failure to solve the Greek debt crisis risks lasting damage to the post-war dream of "ever-closer union", analysts have told AFP's Danny Kemp. The chaos in Greece comes with European leaders already at each others' throats over a wave of Mediterranean migrants, while the Ukraine conflict has plunged relations with Russia to their worst level since the Cold War, they note. Experts say even if Brussels can keep Athens in the euro, the crisis will sow deep seeds of distrust. "It will leave scars," Janis Emmanouilidis of the European Policy Centre think-tank in Brussels tells Kemp. "There is a lot of distrust." 14:07 GMT - 'Euro vs drachma' - Italian Prime Minister Matteo Renzi says the Greek debt battle is about the euro versus the drachma, rather than a "derby" fight between the European Commission and Greek PM Alexis Tsipras. "The point is: Greek referendum won't be a derby EU Commission vs Tsipras, but euro vs drachma. This is the choice," Renzi tweets. 14:07 GMT - EU shares trim losses - European stock markets trimmed their losses in afternoon trade, after the Frankfurt, Paris, Milan and Madrid bourses all plunged more than 4 percent at the opening as Greece closed its banks. During mid-afternoon trading in Frankfurt, the DAX 30 was showing a loss of 2.47 percent to 11,208.26 points. In Paris the CAC 40 fell 2.73 percent to 4,921.23 points, Milan slumped by 3.79 percent in value and Madrid shed 3.60 percent. 14:07 GMT - 'No black swan' - Despite the high drama in the unfolding Greek debt crisis, Berenberg Bank chief economist Holger Schmieding says it does not constitute an unexpected, uncontrollable and history-altering "black swan moment" for Europe and the euro. "The eurozone has spent the last four years strengthening its defences against contagion risks, and has had ample reason over the last few weeks to ponder 'what if' scenarios," says Schmieding. - Talks 'next week' - 14:07 GMT - Talks 'after vote' - Angela Merkel says any new negotiations with Greece on its crippling debt crisis should come after next Sunday's referendum on EU bailout proposals. "Should the Greek government ask for negotiations, for example after the referendum (next Sunday), we would of course not refuse," she tells reporters after meeting with parliamentary and party leaders. 14:07 GMT - Celtic Tiger - More from Irish Deputy finance minister Simon Harris. "Ireland and Greece are very different but Ireland has shown that you can actually negotiate and you can grow your way out of your problems," he says. "Ireland wants Greece to remain in Europe, Ireland wants to help Greece find a solution but you can't have a solution when people are refusing to engage," he adds. Ireland's booming "Celtic Tiger" economy collapsed during the financial crisis and was forced to accept a bailout from the European Union and International Monetary Fund. But after deep spending cuts, tax rises, structural reforms and the sale of state assets, the eurozone country is now growing faster than any other EU economy. 14:05 GMT - Ireland says 'copy us' - The Irish government urges Greece to follow its example and keep working with its international creditors on averting a default and possible exit from the euro. Deputy finance minister Simon Harris says he is "frustrated" by the hard-left Greek government's refusal to accept proposed reforms because it was elected earlier this year on an anti-austerity ticket. "I get a bit frustrated when I hear about the democratic mandate of the Greek government. We all accept that but they also need to accept the democratic mandate of the other governments in the euro group," he tells RTE radio. Urging Athens to "come back into the room", he says: "We need the Greeks to come back and do what Ireland did." 13:44 GMT - Serbian controls - In Serbia, the central bank has put into place temporary measures on banks with Greek owners. The measures include "additional controls and transaction limits between branches in Serbia and their parent banks in Greece," a statement says. "The goal of these measures is to prevent negative effects on the Serbian banking sector" from the crisis in Greece, the National Bank of Serbia said. 13:43 GMT - MERKEL SAYS NEW DEBT TALKS WITH GREECE ONLY AFTER REFERENDUM 13:42 GMT - US stocks - Five minutes into trade, the Dow Jones Industrial Average was at 17,807.25, down 139.43 points (0.78 percent). The broad-based S&P 500 fell 16.20 (0.77 percent) to 2,085.29, while the tech-rich Nasdaq Composite Index dropped 53.12 (1.05 percent) to 5,027.38. 12:38 GMT - US STOCKS OPEN LOWER ON GREECE FEARS - Tsipras hotline - 12:37 GMT - Tsipras talks - Greek PM Alexis Tsipras has spoken on the telephone today to European Commission President Jean-Claude Juncker and answered a call from European Parliament head Martin Schulz, a Greek government source says. An outburst by Juncker, saying he feels "betrayed", came after speaking with Tsipras by telephone, the source says. Tsipras asked Juncker and Schulz once more for a "few days' extension" to the country's current bailout deal, set to expire tomorrow, to give the Greek people time to vote on it at a referendum set for next Sunday. Schulz said he would immediately call a meeting of European parliamentary groups to see whether an extension might be possible, the source says. 12:37 GMT - Sarkozy - Former French President Nicolas Sarkozy urges the European Union not to "yield" to Greece following the break-up of talks between Athens and its international creditors. "If Europe, the euro give the impression of yielding, it's the credibility of the entire European system that will be swept away," he says during a visit to Madrid. "Due to the irresponsibly of its prime minister, Greece has suspended itself from the eurozone," Sarkozy adds. 12:16 GMT - ATHENS CASTS DOUBT ON JUNCKER'S SINCERITY 12:16 GMT - The Greek government has cast doubt on EU commission head Jean-Claude Juncker's "sincerity", as a bitter war of words erupts over who is to blame for the breakdown in bailout negotiations. "An essential element in indicating good faith and reliability in negotiations is sincerity," government spokesman Gabriel Sakellaridis says, after Juncker complained he felt betrayed by Athens and urged Prime Minister Alexis Tspiras to tell the Greek people "what is really at stake". 12:15 GMT - Macedonian cash out - Macedonia has ordered its banks to withdraw their deposits from Greek banks in a move to ringfence the country from its neighbour's escalating financial crisis. The Macedonian central bank has also imposed restrictions limiting the outflow of capital to Greece, after Athens announced capital controls following a collapse in bailout negotiations with its creditors. "Macedonian banks are required to withdraw all loans and deposits from banks based in the Republic of Greece and their branches and subsidiaries in the Republic of Greece or abroad," a Macedonian central bank (NBRM) statement says. 11:58 GMT - 'Others have done it' - Juncker says turning around the ravaged Greek economy remains a huge challenge. "It will not be easy, but it's necessary," he says. "Others have done it, just ask the Irish, Portuguese, Spanish and Latvians," he adds, referring to EU countries that have previously implemented harsh austerity measures to get through economic crises. 11:41 GMT - 'No to EU' - More from Juncker's news conference... He says Greek voters will be rejecting the European Union if they oppose creditors' reform proposals in Sunday's referendum. "A 'No' would mean, regardless of the question posed, that Greece had said no to Europe," Juncker says. 11:39 GMT - 'EU could be tarnished' - More from Merkel's speech to the CDU conference: she stresses that Europe's principles "need to be fought for", otherwise it could see its image diminished. "Perhaps we could give them up in the short term, maybe we could say 'let's just give in for once'," she said. "But I say: in the medium and long term, this would damage us. It would damage us in that we (Europe) would cease to be relevant in the world, that our unity disappears." Merkel was speaking ahead of an emergency meeting with German party leaders and heads of parliamentary groups to discuss the Greek crisis. - Juncker urges 'Yes' - 11:32 GMT - JUNCKER SAYS 'NO' IN GREEK REFERENDUM WOULD BE 'NO' TO EUROPE 11:27 GMT - 'Moment of truth' - Juncker urges voters in Greece to support the package of creditors' reform proposals which they will vote on in a referendum on Sunday. "I will ask the Greek people to vote 'Yes,'" he says, adding that one "should not commit suicide because one is afraid of death". Juncker says the vote is a "moment of truth" for their country. 11:22 GMT - EU'S JUNCKER: 'I ASK THE GREEK PEOPLE TO VOTE YES' IN REFERENDUM 11:09 GMT - Juncker 'betrayed' - European Commission president Jean-Clause Juncker says he feels "betrayed" by the failure of Athens to agree on a bailout deal with EU ministers, despite the huge efforts made. "After all the efforts I deployed from the commission, I feel betrayed because these efforts were insufficiently taken into account," Juncker says at a news briefing. 10:57 GMT - EU'S JUNCKER: 'THIS IS NOT A STUPID AUSTERITY PACKAGE' 10:56 GMT - EU'S JUNCKER FEELS 'BETRAYED' BY GREECE SITUATION 10:51 GMT - Merkel urges compromise - Merkel tells representatives of her Christian Democratic Union party that if the "euro fails, Europe fails" and calls for compromise on the Greek debt crisis. "If this capability to find compromises is lost, then Europe is lost," Merkel says, addressing an event in Berlin to mark 70 years since the party's founding. 10:46 GMT - Delay or default? - Greece would be unable to meet its commitments in the long term if the vote is 'No' in Sunday's referendum, after currently only having a short-term problem, economist Nicolas Veron tells AFP. "That's the difference between late payment and default," he says. If Greece fails to make its payment to the IMF tomorrow, the global institution won't have any cashflow problem, Veron says. "It will tell its board Greece is behind. There is a formula for doing this in internal jargon. The markets have completely built in this possibility and Wednesday's deadline is just one more" date, the economist believes. For that reason, Greece's European creditors will wait to see what happens in the referendum, he says. 10:42 GMT - MERKEL WARNS: 'IF EURO FAILS, EUROPE FAILS'. SHE CALLS FOR 'COMPROMISE' 10:40 GMT - Markets off lows - European stock markets have recovered slightly in late morning trade, as fears eased of contagion from the Greek debt crisis. Indices in Frankfurt and Paris trimmed their losses after plunging more than 4 percent in opening trade, Around midday in Frankfurt, the DAX 30 was showing a loss of 3.33 percent. In Paris the CAC 40 slid 3.40 percent. Milan shrunk by 3.72 percent in value and Madrid shed 3.66 percent. 10:24 GMT - Merkel willing - Merkel's spokesman tells reporters the Chancellor is still prepared to hold talks with Alexis Tsipras despite the breakdown in debt negotiations at the weekend. "Of course she is still willing to speak to Prime Minister Tsipras if he would like to," Steffen Seibert says. German Finance Minister Schaeuble is also still open to talks with his Greek counterpart, Yanis Varoufakis, a finance ministry spokesman adds at the same news conference. 10:19 GMT - Nose-scratching - In Berlin, Angela Merkel is busy tapping text messages on her phone as she prepares to address representatives of her Christian Democratic Union party, AFP's Angela Richter reports. Finance Minister Wolfgang Schaeuble lightly scratches his nose. 10:14 GMT - IMF deadline - The next key moment in the rapidly unfolding debt crisis will come tomorrow, deadline day for Greece to make a repayment of more than 1.5 billion euros ($1.7 billion) to the International Monetary Fund. Greece is expected to default unless the IMF, EU and ECB make a last-minute decision to heed Alexis Tsipras's request for a bailout extension. - Merkel - 10:12 GMT - MERKEL STILL READY TO TALK TO GREECE: SPOKESMAN 10:05 GMT - EU proposals - Jean-Claude Juncker, head of the European Commission, will make a fresh effort to set out its proposals later today to try to solve the crisis in Greece, EU commissioner of economic affairs Pierre Moscovici tells French radio Athens was "centimetres" away from a deal when discussions broke down over the weekend, Moscovici says. Juncker "will indicate the route to follow. I hope everyone will commit themselves to a way of compromise," Moscovici says. 10:03 GMT - Free transport - Public transport will be free in Athens for a week to ease difficulties created by the closure of the banks and a rush on petrol stations, Transport Minister Christos Spirtzis announces. Residents and tourists will be able to ride buses, metro trains and trams for free in the country's capital and surrounding suburbs as soon as the decision is officially published, which is likely to be on Tuesday. The offer is set to last until July 7, when in principle the banks will re-open. 09:59 GMT - 'No Grexit plan' - "We will do everything in our power to keep Greece in the eurozone," Finnish Finance Minister Alexander Stubb tells a news conference in Helsinki. "Nobody has a plan for a Grexit. We don't want that. "We do everything in our power so that Greece remains a steadfast member of the eurozone, and we also do everything in our power to help the Greek people who are in a very difficult situation. And finally we will do everything in our power to avoid a containment risk and a domino effect," Stubb says. 09:54 GMT - '89 bn euro ceiling' - The closure of Greece's banks on Monday came after the European Central Bank refused to raise the ceiling on the value of its loans to Greek lenders under its ELA emergency facility. A source familiar with the matter tells AFP that the ceiling is "close to 89 bn euros". 09:48 GMT - 'Underpants sacrificed' - Michele Ammann from Switzerland avoided the ATM problem by bringing a lot of cash with him for his holiday in Athens. "We've been budgeting to make sure it doesn't run out. Our hotel is in the suburbs and people there seem very tired, very worried," he says. "I feel sorry for the Greeks, they've been asked to sacrifice everything, right down to their underpants." 09:47 GMT - 60 euro limit - While cash withdrawals are officially limited to 60 euros a day, many Greeks say they tried and failed to get any money out at all. A panicked-looking Chris Bakas, 28 and unemployed, sweats as he stares at the ATM screen. "No money, no hope, how did we get in this situation? This is Black Monday," he says. 09:46 GMT - Tension - On Athens' historic Syntagma Square, the scene of fierce riots in the past over biting austerity measures imposed by the country's international creditors, tourists snap photographs of the parliament buildings, but tell AFP's Pauline Froissart and Ella Ide that they feel the tension in the air. "There's a sort of eerie calm, perhaps the calm before the storm," says Jestin Marina from France, on holiday with her husband and son for three days. The family brought extra cash with them and have been warned about the possibility of being targeted by thieves, but say they are not afraid. - Price reductions - 09:42 GMT - 'Broke' - AFP's Pauline Froissart and Ella Ide have gathered more views from Greek workers in Athens: Athens clothes shop owner Panayotis Vergetis says he is slashing 30 percent off his wares this week in a bid to lure people in. 09:39 GMT - Cafe tables free - Cafe tables are laid out in the sun all over Athens, but cafe owner Nikos Gyallitsis says he expects a 50 percent drop in customers, with people keeping their money for essentials such as food and petrol. "To shop you have to be happy, be confident, and now you don't know what will happen the next day," he tells AFP. 09:34 GMT - Swiss intervention - Switzerland's central bank has been forced to intervene "in order to stabilise the markets," which have tumbled over Greece's escalating crisis, the bank's chief Thomas Jordan says. Jordan has not specified the amount spent on the intervention aimed at halting the rise in the Swiss franc -- a safe haven currency 09:29 GMT - 'Black Monday' - The crisis is dubbed "Black Monday" in Athens as jittery housewives, shoppers and business owners queue in vain at cash machines, after the country awakes to capital controls and shuttered banks. "I have a baby to feed, what am I supposed to do?" secretary Zoe Kallis, 32, tells AFP after failing to get money out of the third ATM she had tried in the wealthy Kolonaki district. 09:24 GMT - 'Reverse Corleone' - "The troika clearly did a reverse Corleone -- they made Tsipras an offer he can't accept, and presumably did this knowingly. So the ultimatum was, in effect, a move to replace the Greek government," Nobel prize winning economist Paul Krugman says on his New York Times blog, in a reference to The Godfather films. Krugman adds: "I would vote no, for two reasons. First, much as the prospect of euro exit frightens everyone -- me included -- the troika is now effectively demanding that the policy regime of the past five years be continued indefinitely. Where is the hope in that?" 09:21 GMT - 'Not about euro' - Greece's proposed referendum is only about creditors' proposals and not about the euro, Greek Finance Minister Yanis Varoufakis insists. "Anyone who says it's a referendum about the euro is imposing a very shaky interpretation. It's not about the euro and could never be… there is no provision for exit from the euro," he said on Saturday. 09:16 GMT - EU summit? - German TV network ZDF, quoting "reliable sources", says EU leaders will meet for a summit on Wednesday, adding that Chancellor Angela Merkel will address the Bundestag before then. 09:12 GMT - Greece 'lacks cash' for vote - Citing Brussels insiders, Germany's FAZ TV network says they don't think Greece has enough cash to organise Sunday's promised referendum - Sovereign choice - 09:08 GMT - Democracy - Hollande says the Greek referendum on the bailout proposals is a "sovereign choice" on whether or not to leave the eurozone. "It is democracy, it is the right of the Greek people to decide what they want for their future. What is at stake is whether or not Greeks want to stay in the eurozone (or) take the risk of leaving," the French president says. 09:05 GMT - France 'ready to talk' - President Francois Hollande says France is "always available" for negotiations with Greece and that a deal on its bailout remains possible. He says France's economy is robust and has nothing to fear as Greece prepares a referendum on bailout proposals from its creditors. 09:03 GMT - Italy 'doesn't fear fallout' - Italy's finance minister has played down the threat of Italy being hit by the fallout from market instability linked to the Greek crisis. "I would not be surprised but neither would I be that concerned if there was an increase in market volatility. The European Central Bank has all the instruments at its disposal to deal with it," Pier Carlo Padoan says in an interview with Corriere della Sera. 09:01 GMT - Markets 'calming' - A Natexis analyst says markets are calming, especially debt markets, after polls predict a victory for the "Yes" vote in Sunday's referendum 08:59 GMT - ATMs 'empty' - In the smart Kolonaki area of Athens, 32-year-old Anna tries in vain to find a working cash machine. "There is no more money," she tells AFP, adding that she hopes her compatriots will vote in the referendum "to stay in the eurozone and the European Union" and that "the nightmare will finally end". 08:58 GMT - HOLLANDE SAYS 'ROBUST' FRENCH ECONOMY HAS 'NOTHING TO FEAR' FROM GREEK CRISIS 08:58 GMT - Salary withdrawn - In Athens, teacher Yiannis Grivas tells AFP he has withdrawn his entire 940-euro salary on Friday so "I have enough to live on for a few weeks". "I am not afraid of capital controls, I never take out more than 50 euros a day anyway," he says. 08:52 GMT - HOLLANDE SAYS FRANCE 'AVAILABLE' FOR TALKS WITH GREECE, DEAL 'STILL POSSIBLE' - Shares plunge - 08:46 GMT - Deal 'still possible' - "Time has almost run out to keep Greece in the eurozone, but even now it is perhaps unwise to discount the possibility of an emergency package that will avert disaster," says Chris Beauchamp, senior market analyst at London traders IG. 08:45 GMT - 1.3 bn euros withdrawn - Since Friday night alone, 1.3 billion euros ($1.45 billion) have been withdrawn from the Greek banking system, according to the head of the bank workers' union Stavros Koukos. 08:45 GMT - ECB veto - The drastic measures to protect Greece's banking system came after the European Central Bank said it would not increase its financial support to Greek lenders, despite early signs of a chaotic bank run. - Weekend drama - 08:40 GMT - Referendum - A weekend of high drama began with Tsipras's unexpected call for a July 5 referendum on creditors' latest reform proposals after bailout talks in Brussels collapsed. In response, angry EU and IMF creditors rejected a request to extend the nation's bailout beyond its June 30 expiry date, sparking fears Greece would default on a key debt payment to the IMF due the same day, and possibly crash out of the eurozone. 08:37 GMT - FRANCE SAYS GREEK REFERENDUM 'SOVEREIGN CHOICE' 08:35 GMT - Safe havens - "The euro experienced heavy selling... as traders sought the safety of the yen, Swiss franc and gold to protect against the negative fallout from events in Greece," says Craig Erlam, senior market analyst at Oanda trading group 08:34 GMT - Frankfurt down 4% - Shortly after the start of trading, Frankfurt's DAX 30 was showing a loss of 4.26 percent to 11,003.17 points compared with Friday's closing level. In Paris the CAC 40 dived 4.23 percent to 4,845.31 points. Shares in Milan and Madrid also fell sharply. Outside the eurozone, London's benchmark FTSE 100 lost 2.14 percent to 6,609.69 points. 08:32 GMT - Shares dive - European stocks dived in early trading Monday as investors fear Greece could be heading for a eurozone exit, with a number of indices shedding more than four percent. The European single currency earlier dropped below $1.1 with Greece ever closer to defaulting on its debt. 08:24 GMT - WELCOME TO AFP'S LIVE REPORT on the Greek debt crisis after the government of Prime Minister Alexis Tsipras announced it will shut banks for a week and impose capital controls until a referendum next Sunday on creditors' proposals.

Yahoo Finance

Yahoo Finance