Great Real Estate Dividend Stocks For Every Portfolio

The real estate sector performs relatively in-line with the wider economy. Prosperous periods bring about high growth and inflation, leading to strong returns in real estate investments. These factors drive the profitability and cash flows of real estate companies, which in turn steer the dividend payout and yield for investors. During economic growth, these companies provide an opportune time to increase your portfolio income through dividends. As a long term investor, I favour these real estate stocks with great dividend payments that continues to add value to my portfolio.

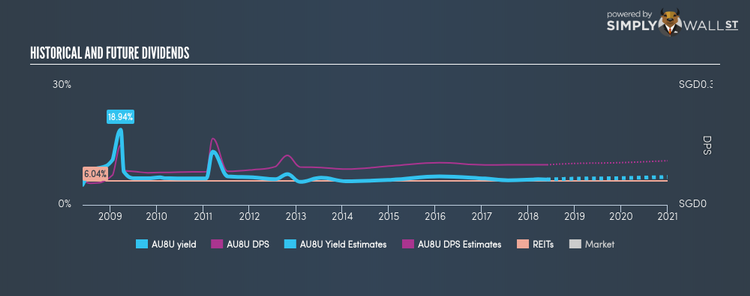

CapitaLand Retail China Trust (SGX:AU8U)

AU8U has a enticing dividend yield of 6.39% and distributes 64.68% of its earnings to shareholders as dividends , with an expected payout of 105.44% in three years. Dividends per share have increased during the past 10 years, but there have been a couple hiccups. However, they have historically always picked up again. CapitaLand Retail China Trust also reported a strong earnings growth of 25.64% over the past 12 months, More detail on CapitaLand Retail China Trust here.

Bukit Sembawang Estates Limited (SGX:B61)

B61 has a large dividend yield of 5.38% and the company currently pays out 18.72% of its profits as dividends , with analysts expecting a 46.95% payout in the next three years. Although investors would have seen a few years of reduced payments, it has so far always picked up again, with dividends increasing from S$0.12 to S$0.33 over the past 10 years. Analysts are expecting an impressive triple digit earnings growth over the next three years. Interested in Bukit Sembawang Estates? Find out more here.

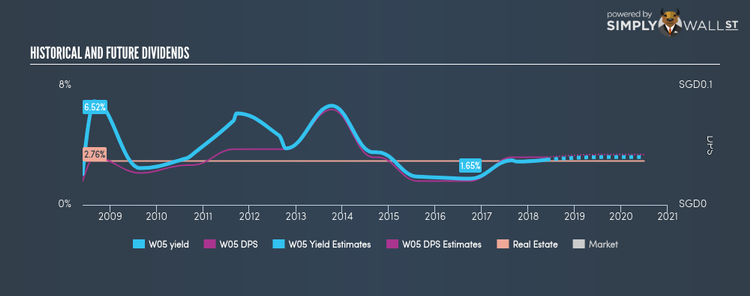

Wing Tai Holdings Limited (SGX:W05)

W05 has a good dividend yield of 2.84% and pays out 24.51% of its profit as dividends , with the expected payout in three years hitting 78.44%. While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from S$0.03 to S$0.06. The company outperformed the sg real estate industry’s earnings growth of 3.72%, reporting an EPS growth of 687.49% over the past 12 months. More on Wing Tai Holdings here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance