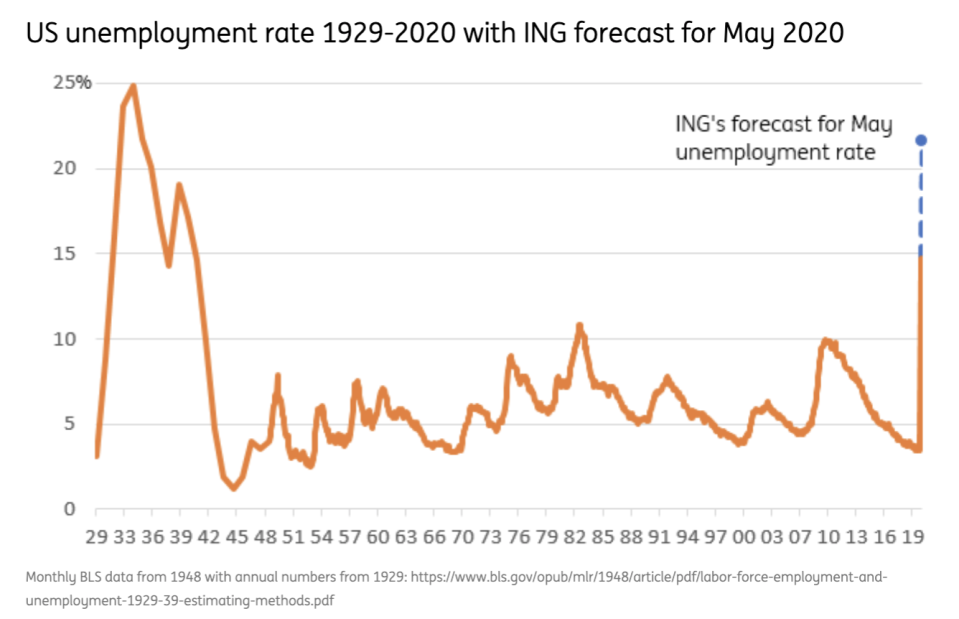

Get ready for the worst unemployment reading since the Great Depression: Morning Brief

Friday, June 5, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET.

And what measures outside unemployment economists will be watching this summer.

Later this morning, the world will receive more shocking data about the state of the U.S. labor market.

At 8:30 a.m. ET, the Bureau of Labor Statistics will publish the May jobs report.

This report is expected to show the economy lost 7.5 million jobs last month while the unemployment rate rose to 19.4%.

At this level, the unemployment rate would be the highest since the Great Depression.

And as we head into the summer months and the re-opening of state economies across the country continues, the headline unemployment rate will likely continue to draw the most interest from investors and the broader public as a sign of recovery — or continuing struggles — in the U.S. labor market.

But Wall Street economists are looking at other measures of the labor market for broader signs of where the job market stands as we progress through what financial markets are suggesting could be a solid economic rebound.

Ellen Zentner and the economics team at Morgan Stanley said in a note this week that today’s report will likely serve as the high water market for unemployment during this cycle. But Morgan Stanley thinks this unemployment rate actually understates the weakness we’re seeing in the U.S. labor market.

Zentner and her team, for instance, write that if workers absent from work for “other reasons” had been counted among the unemployed, the official rate could’ve been as high as 22% in April and 25% in May. And the firm is not alone on Wall Street in viewing the “true” unemployment rate as materially higher than what official data have said so far.

UBS economists led by Samuel Coffin forecast a rise in the unemployment rate to 17.2% in May from 14.7% in April, but writes that “even these [data] underestimate the damage.”

“Many are counted as employed who are not at work,” the firm adds. “Had they been classified differently, the unemployment rate could easily have been 20% in April. In addition, the participation rate plummeted from 63.4% before the pandemic in February to 60.2% in April and we forecast a slight further decline to 59.9% in May. The participation rate will be an important gauge, in coming months, of the extent of lasting damage to the labor market.” (Emphasis added.)

In addition to participation, economists also believe continuing claims for unemployment insurance bear close watching for understanding how well, or how poorly, the labor market’s recovery is really going.

“As states continue to ease stay-at-home requirements, we expect the economy will transition from a surge in layoffs to re-employment,” said Michael Gapen, an economist at Barclays in a note to clients on Thursday.

“If so, the signal from continuing claims could become more relevant since large-scale hiring would pull unemployment rapidly lower even in the event that initial claims remain elevated. In other words, the flow into employment could overwhelm the flow out of employment if the country is able to emerge successfully from economic lockdown.”

On Thursday, the latest data on initial jobless claims showed continuing claims for unemployment insurance rose to 21.49 million from 20.84 million in the previous week. This increase was seen by economists as driven by a backlog of data coming in from California and Florida, which have bi-weekly initial claims filings instead of weekly.

The team at Oxford Economics said in an email Thursday that, “when we exclude data from those two states, it appears continuing claims are moving down from their peaks, suggesting some rehiring is starting to take place.”

So while Friday might serve as a turning point of sorts for U.S. labor market data, a true recovery is tenuous at this point in the cycle. And as we noted last week, data no longer getting worse is a long way from things looking good in the labor market.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him at @MylesUdland

What to watch today

Economy

8:30 a.m. ET: Change in non-farm payrolls, May (-7.5 million expected, -20.537 million in April)

8:30 a.m. ET: Unemployment rate, May (19.1% expected, 14.7% in April)

8:30 a.m. ET: Average hourly earnings month on month, May (+1.0% expected, +4.7% in April)

8:30 a.m. ET: Average hourly earnings year on year, May (+8.5% expected, +7.9% in April)

Earnings

Pre-market

6:40 a.m. ET: Tiffany (TIF) is expected to report an adjusted loss of 27 cents per share on revenue of $611.9 million

Top News

AstraZeneca could supply two billion doses of potential vaccine [Yahoo Finance UK]

Slack earnings beat estimates, but Wall Street is not impressed [Yahoo Finance]

ZoomInfo shares close 62% higher after $935M US debut [Bloomberg]

Las Vegas reopens but won't return to full strength until 2023: analyst [Yahoo Finance]

YAHOO FINANCE HIGHLIGHTS

The stock market is off the rails

These 10 states are showing early signs of a job market recovery

U.S. needs 'cultural transformation' after George Floyd's death: Chase Koch

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay

Yahoo Finance

Yahoo Finance