Government Land Sales (GLS) Programme Guide (Updated With GLS Sites for 1H2024 Singapore)

The Government Land Sales (GLA) programme is announced every six months. During this time, the Urban Redevelopment Authority (URA) releases a list of land sites for sale. When this happens, developers’ eyes widen, their breathing intensifies, and they stop whatever they’re doing to pay attention.

But it’s not just developers who should listen up. If you’re a potential private home buyer, you should also pay good attention whenever URA announces GLS sites. That’s because, like the URA Masterplan, the GLS programme provides great insight into upcoming real estate developments, which are likely to come in handy.

Here’s an overview of the latest GLS sites for the first half of 2024, as well as a beginner-friendly guide to the GLS programme and why it is meaningful for homebuyers in Singapore.

Government Land Sales (GLS) Programme: What Is It and How Does It Work?

As you probably already know, Singapore is a small country with limited land. Of the land we have, over three-quarters is owned by the Government (State Land).

To better utilise the land for urban planning, URA plans and designs land usage for purposes including residential land-dwelling, township designs, and zoning of land. Put simply, URA plans where new buildings go, be it for new condos, sports complexes, shopping malls, and even hotels.

For us, the most relevant are the GLS sites allocated for residential developments. Before private property developers (e.g. CapitaLand, Keppel Land, Oxley Holdings, etc.) can develop houses, they will first need to buy land from the Government.

That’s where the GLS programme comes in, where the Government sells usable land to private developers through a tendering process. Long story short, developers will purchase land from the Government in a land-bidding war.

GLS Sites Are Released Twice a Year

Before the start of each half of the year, the Government will release State Land for tender through the URA sites. Upcoming URA GLS sites can be viewed on URA’s website.

As mentioned, interested developers who wish to acquire the State Land for residential development (e.g. to build new condominiums) will then bid for the land through an open tender. The land will (usually) be awarded to the developer who puts in the highest bid in the open tender.

Upon closing of the tender, URA will release a media statement on the GLS sites and the developers who were awarded the site. Then, a separate media statement will be released to show the public the list of developers that have tendered for the site and the price quoted in their tender.

Here’s an example of how the media statement can look like, which includes the top bidders:

Now that we’ve explained the GLS in a nutshell, let’s take a look at the latest release of GLS sites.

GLS For 1H2024

Location | Site area (ha) | Estimated number of units | Gross plot ratio | Estimated launch date |

Holland Drive | 1.23 | 680 | 4.7 | February 2024 |

River Valley Green (Parcel A) | 0.93 | 380 | 3.5 | March 2024 |

Canberra Crescent | 2.05 | 375 | 1.6 | April 2024 |

De Souza Avenue | 1.92 | 355 | 1.6 | April 2024 |

Jalan Loyang Besar (EC) | 2.84 | 710 | 2.5 | May 2024 |

Margaret Drive | 0.95 | 460 | 4.2 | May 2024 |

Media Circle | 0.57 | 515 | 4.2 | May 2024 |

Dairy Farm Walk | 2.16 | 530 | 2.1 | June 2024 |

Tengah Garden Avenue | 2.55 | 860 | 3.0 | June 2024 |

Tampines Street 94 (Commercial & Residential Sites) | 2.35 | 585 | 2.6 | June 2024 |

On 6 December 2023, URA announced the largest housing supply on the Confirmed List in a single GLS programme since 2H2013. The 1H2024 GLS programme includes 10 Confirmed List sites and nine Reserve List sites. According to URA, these sites will be able to yield about 8,910 private residential homes, 107,750 sqm gross floor area (GFA) of commercial space, and 530 hotel rooms.

From the 2H2023 GLS programme, all the sites from the Confirmed List have been launched for tender: Clementi Avenue 1, Pine Grove (Parcel B), Lorong 1 Toa Payoh, Orchard Boulevard, Plantation Close (EC), Upper Thomson Road (Parcel A), Upper Thomson Road (Parcel B), and Zion Road (Parcel A). No sites will be carried over to the 1H2024 GLS programme.

GLS 1H2024: What Can You Expect?

Dr Lee Nai Jia, Head of Real Estate Intelligence, Data and Software Solutions, PropertyGuru Group commented, “The GLS 1H2024 is set to provide a variety of property options for potential buyers in 2025. The sites in the Confirmed List can be categorised into three main types.

Firstly, lifestyle homes. This category includes sites that enable developers to construct residences tailored to professionals. Notable locations include Holland Drive and River Valley Green, known for their proximity to MRT stations, major shopping districts, or the CBD. These areas feature a diverse range of retail options, from high-end branded stores to local shops offering traditional food and goods.

The estimated starting price for private residential homes in these areas is expected to be above $2,800 per sq ft (PSF). Developers are focusing on designing homes that appeal to affluent local buyers.

Secondly, sweet spots. Located in mature HDB estates and near MRT stations, these sites are designed to cater to upgraders from the public housing sector. Examples include the mixed-use site at Tampines Street 94 and the Margaret Drive site. These locations are known for their convenient access and established amenities, contributing to high demand and livability.

Property prices in these areas have shown significant growth over the past five years, and we expect the starting prices to be above $1,900 PSF, or even $2200 PSF if the site is located close to the Core Central Region (CCR).

Thirdly, nature-adjacent homes. This category comprises sites located near natural attractions, such as Jalan Loyang Besar by the sea or near well-known nature reserves like De Souza Avenue and Dairy Farm Walk. These locations offer future residents a respite from urban life, especially if the developers incorporate biophilic design elements to enhance the connection with nature.

The starting prices for units in these areas, excluding executive condo (EC) sites, are expected to be north of $1,800 PSF.”

Compared to the 2H2023 GLS programme’s Confirmed List, the supply of private housing in the 1H2024 GLS programme’s Confirmed List has increased. Including ECs, the total pipeline supply of private housing is now about 59,100 units. Want to find out more about these sites? Read on!

1. Holland Drive

The Holland Drive site is bounded by North Buona Vista Road, Holland Drive, and Holland Road. It is about a nine-minute bus ride each to Holland Village and Buona Vista MRT station.

An estimated 680 residential units will be able to be built on the Holland Drive site. Future residents of this site will be in proximity to the landed enclave of Holland Village, within a district where hawker food, cafe, and nightlife establishments are aplenty.

The Holland Drive site is set to launch in February 2024.

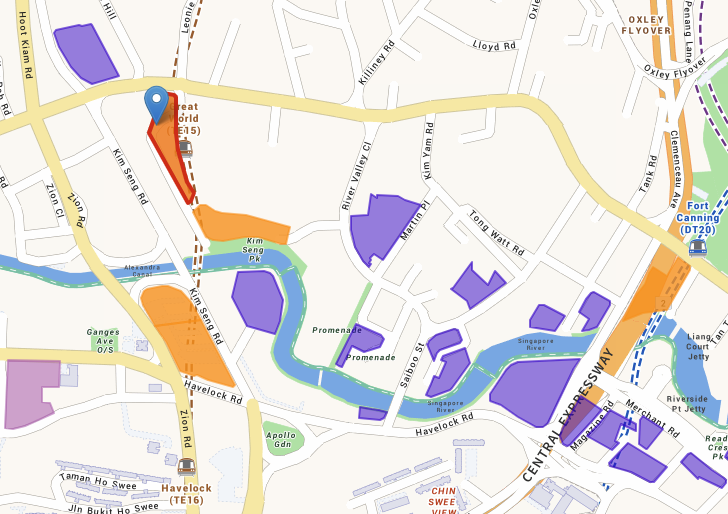

2. River Valley Green (Parcel A)

The River Valley Green (Parcel A) site is along Leonie Hill Road, right beside Great World MRT station along the Thomson-East Coast Line (TEL). It is also a 12-minute and 16-minute bus ride away from Fort Canning MRT station along the Downtown Line (DTL) and Alexandra Canal, respectively.

An estimated 380 residential units will be able to be built on the River Valley Green (Parcel A) site. Future residents of this site will enjoy excellent connectivity to Orchard Road. Parents with school-going children will likely be delighted by their homes’ proximity to River Valley Primary and Secondary Schools.

The River Valley Green (Parcel A) site is set to launch in March 2024.

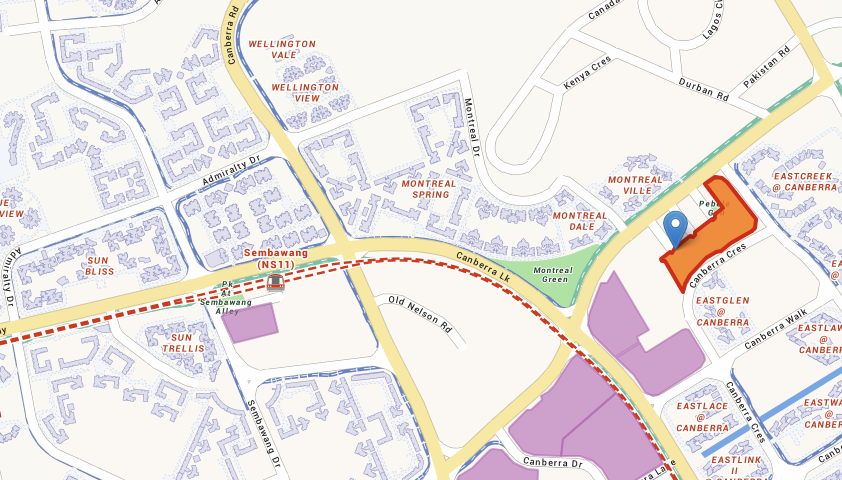

3. Canberra Crescent

The Canberra Crescent site is bounded by Canberra Crescent and Canberra Street. It is a 16-minute bus ride away from Sembawang MRT station. It is also a 16-minute walk (faster if you jog) to Singapore’s largest ActiveSG gym, ActiveSG Sport Centre @ Bukit Canberra, which launched in October 2023.

An estimated 375 residential units will be able to be built on the Canberra Crescent site. The Canberra Crescent site is set to launch in April 2024.

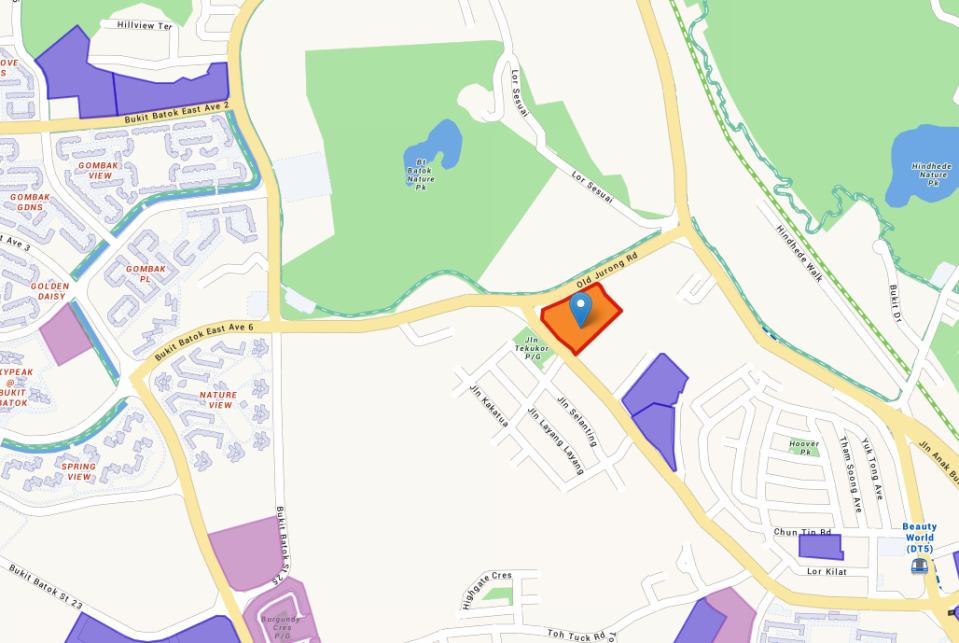

4. De Souza Avenue

The De Souza Avenue site is along Old Jurong Road. It is an eight-minute bus ride to Beauty World MRT station along the DTL. It is also a 10-minute bus ride and a 6-minute drive to Bukit Batok Nature Park and Bukit Timah Nature Reserve, respectively.

Located within the Bukit Batok estate, there will be new cycling paths built near the De Souza Avenue site. This will connect residents to the nearest public transport links more easily and potentially encourage more active living, given the ample supply of nature within proximity.

An estimated 355 residential units will be able to be built on the De Souza Avenue site. The De Souza Avenue site is set to launch in April 2024.

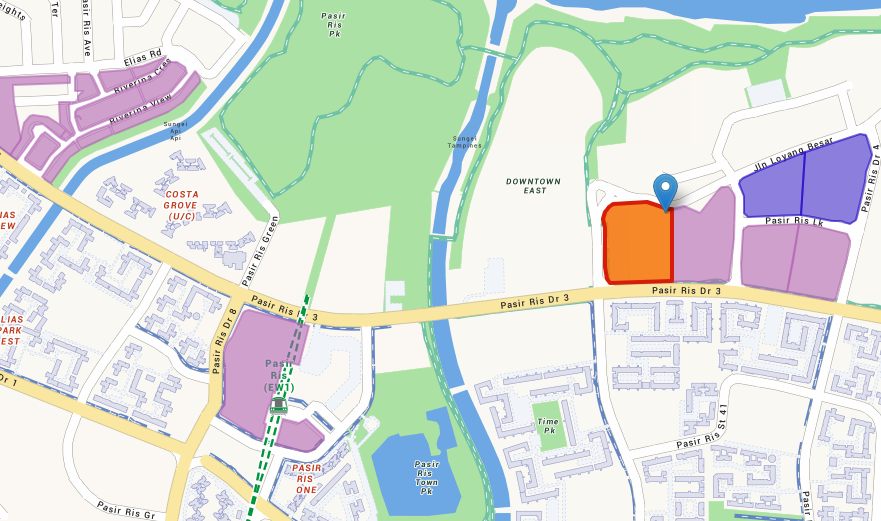

5. Jalan Loyang Besar (EC)

The Jalan Loyang Besar (EC) site is along Pasir Ris Drive 3. Future residents of this site will get to enjoy Downtown East, the central hub of Pasir Ris, located one road away. This entertainment hub comprises Wild Wild Wet, a swimming pool, movie theatre, among other food and lifestyle amenities.

The site is also one bus stop away from Pasir Ris MRT station and within proximity of two MRT stations along the upcoming Cross-Island Line (CRL), Pasir Ris East and Loyang MRT stations.

An estimated 710 residential units will be able to be built on the Jalan Loyang Besar (EC) site. The Jalan Loyang Besar (EC) site is set to launch in May 2024.

6. Margaret Drive

The Margaret Drive site is along Margaret Drive. It is a nine-minute walk to Queenstown MRT station and an 18-minute bus ride to IKEA Alexandra, across the quaint Anchorpoint Mall and Queensway Shopping Centre. Future residents of this site will also be two MRT stations and a short walk away from the Tiong Bahru cafe and restaurant district.

An estimated 460 residential units will be able to be built on the Margaret Drive site. The Margaret Drive site is set to launch in May 2024.

7. Media Circle

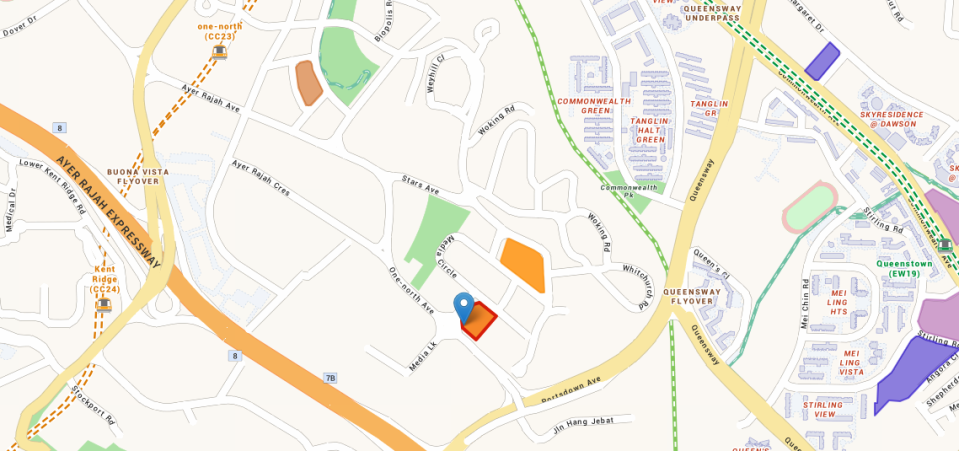

The Media Circle site is bounded by Media Circle, One-North Avenue, and Media Link. It is about a 20-minute bus ride to One-North and Kent Ridge MRT stations, along the Circle Line (CCL). Future residents who drive will also get easy access to the Ayer Rajah Expressway (AYE) and Queensway Flyover.

Dr Tan Tee Khoon, Country Manager – Singapore, PropertyGuru notes that the Media Circle site will be reserved for long-stay apartments.

“Recently, two sites at Upper Thomson Road (Parcel A) and Zion Road (Parcel A) were released with a stipulated proportion for long-stay serviced apartments. This third site at One-North can potentially yield 515 serviced apartments. A fourth site, at River Valley Green (Parcel B) on the Reserve List, may yield 220 serviced apartments from a total of 575 dwelling units.

These two additional sites are likely to be popular among developers in areas with high rental demand given the business catchment. Besides anticipating a future pandemic that could curtail housing supply when completions are delayed and runaway rents make a comeback, the government appears to be providing for foreign demand of rental accommodation into the future now that cross-border employment and talent mobility become active again.

The growth of digital nomads in recent times is an example of such emerging leasing trends that blend travelling and working across global cities.

The sites for serviced apartments also allow developers to diversify property development risks and may even benefit from economies of scale when building common facilities.”

An estimated 515 residential units will be able to be built on the Media Circle site. The Media Circle site is set to launch in May 2024.

8. Dairy Farm Walk

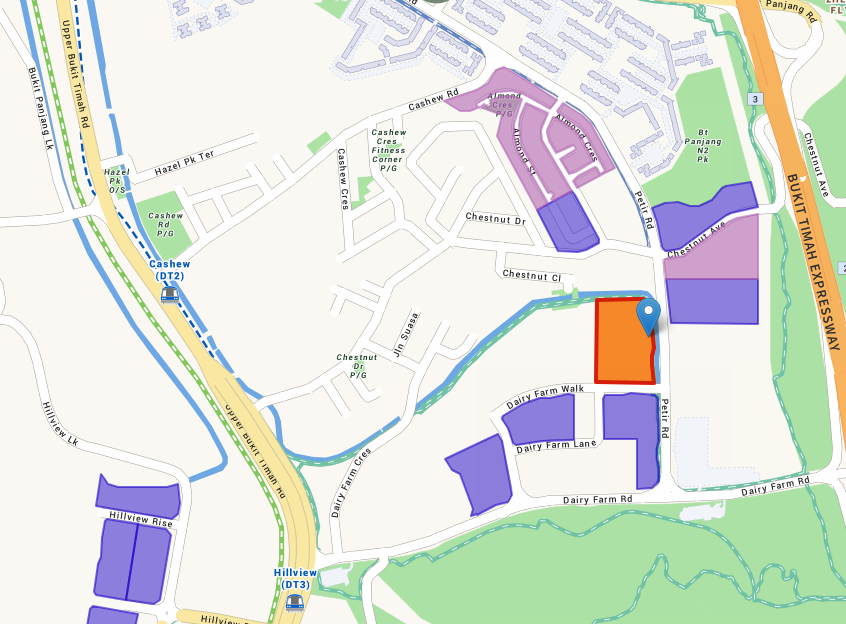

The Dairy Farm Walk site is along Petir Road. It is about a 21-minute bus ride to Cashew MRT station along the DTL and a 30-minute bus ride to Dairy Farm Nature Park. Dairy Farm is a subzone of the Bukit Panjang estate that is in the process of redevelopment.

Current residents of this site enjoy a plethora of nature walks, including Rifle Range Nature Park and Bukit Timah Nature Park. Future residents will be in proximity to Dairy Farm Mall, set to open by the end of this year.

An estimated 530 residential units will be able to be built on the Dairy Farm Walk site. The Dairy Farm Walk site is set to launch in June 2024.

9. Tengah Garden Avenue

The Tengah Garden Avenue site is near Jurong Road and the Pan Island Expressway (PIE). It is also a short distance from numerous Tengah HDB BTO projects at different stages of building.

Residents of this site will get to enjoy all the upcoming developments in the area, including proximity to Jurong Lake District (JLD), Jurong Innovation District, and Jurong Lake Gardens. This upcoming estate will also be carlite and come with live-work-play infrastructure which promotes environmental sustainability and holistic living within reach among residents.

An estimated 860 residential units will be able to be built on the Tengah Garden Avenue site. The Tengah Garden Avenue site is set to launch in June 2024.

10. Tampines Street 94

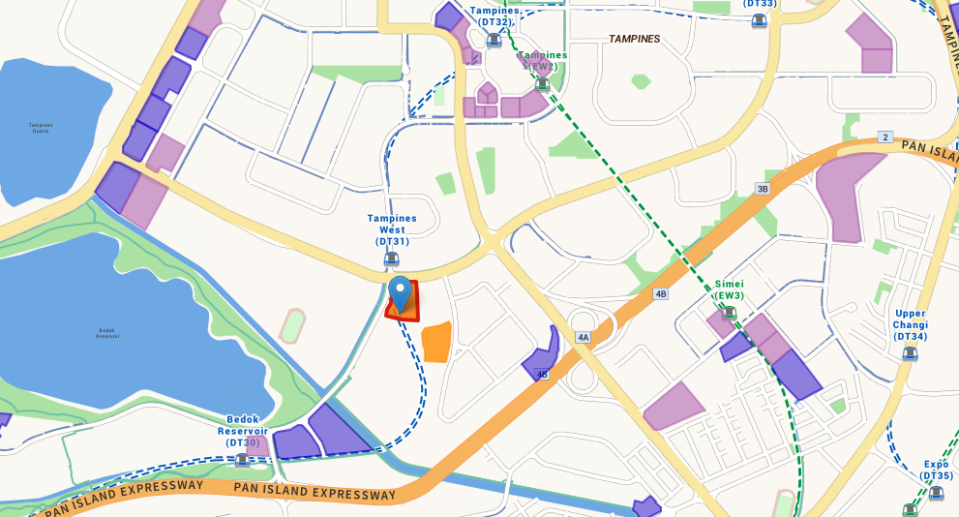

The Tampines Street 94 site is along Tampines Avenue 1, which is a short walk to Tampines West MRT station and 14-minute bus ride to Bedok Reservoir. An estimated 585 residential and commercial units will be able to be built on the Tampines Street 94 site.

The Tampines Street 94 site is set to launch in June 2024.

GLS Programme Reserve List vs Confirmed List: What Is the Difference?

If, at this point, you’re confused about the Confirmed and Reserve GLS sites, let us explain. There are two types of lists on URA’s website: ‘Confirmed List’ and ‘Reserve List’.

They’re pretty much as their names suggest. Confirmed Lists are confirmed in that they will go on sale on a pre-determined date listed on the URA website.

This is not the same for the Reserve List sites, which aren’t released for tender immediately. Instead, they are released only when there is a successful developer application or sufficient market demand for it.

Developers who are interested in the sites on the Reserve List have to put in an application for them. When any of the interested developers have indicated a minimum price that is accepted by the Government, the site will then be put up for tender.

Here’s an overview of the Reserve List sites for 2H2023:

Location | Site area (ha) | Estimated number of units | Proposed gross plot ratio | Status / estimated launch date |

Lentor Gardens | 2.06 | 500 residential | 2.1 | Available |

Senja Close (EC) | 1.01 | 295 residential | 3.0 | Available |

Tampines Street 95 (EC) | 2.24 | 560 residential | 2.5 | Available |

Zion Road (Parcel B) | 0.93 | 610 residential | 5.6 | Available |

River Valley Green (Parcel B) | 1.17 | 575 residential, 500 commercial | 3.5 | March 2024 |

Bayshore Road | 0.98 | 480 residential | 4.2 | June 2024 |

Punggol Walk | 1.00 | 13,350 commercial | 1.4 | Available |

Woodlands Avenue 2 | 2.75 | 440 residential, 78,000 commercial | 4.2 | Available |

River Valley Road | 1.02 | 530 hotel rooms, 2,000 commercial | 2.8 | Available |

How Is the GLS Programme Relevant to Home Buyers?

You might be thinking, “That’s interesting and all, but how is this relevant to me as a home buyer?”

Well, for starters, the GLS sites indicate the upcoming development areas for residential properties. By keeping up with the data from GLS sites (upcoming, current and past), you’ll know where the next new launch condo or ECs projects will be. This is great for those looking to upgrade their property or invest in one.

Before you buy a property, you also want to know if the surrounding land plots are GLS sites that have been sold, are being sold, or will be sold in the future. You don’t want to buy a property for the view only to have said view blocked by another building in a few years.

As they say, knowledge is power. In this case, when it comes to home buying, each decision you make is worth a million bucks. The last thing you want is to make a hasty property purchase, only to find that a more suitable residential project is up for grabs afterwards.

Pro tip: Using the URA Space tool, you can also check out all the GLS sites (upcoming, current and past) on a map.

In conclusion, those who are shopping for a first (or next) home should check out URA’s GLS sites. You can find the recently launched GLS sites here and the past sites here. Alternatively, you can also check out the URA Space to view GLS sites that have been released and sold in the past.

For more property news, content and resources, check out PropertyGuru’s guides section.

Looking for a new home? Head to PropertyGuru to browse the top properties for sale in Singapore.

Need help financing your latest property purchase? Let the mortgage experts at PropertyGuru Finance help you find the best deals.

Yahoo Finance

Yahoo Finance