Goodland Group –A Niche Developer Under The Radar

Listed on the SGX Mainboard after upgrading its listing status from Catalist in 2013, Goodland Group (Goodland) is a property developer that is flying under the radar as many investors have yet to take notice. The company is currently not being covered by many research houses, and its stock price is trading around $0.22 as at the close of 8 March 2019. After delving further into the company, we find that Goodland has the potential to thrive in a subdued property market in Singapore.

About Goodland Group

Goodland, an investment holding company, develops real estate properties in Singapore and Malaysia. The company was incorporated in Singapore in 1993 and has been listed for the past ten years since October 2009. According to the Company’s website, the group has 25 subsidiaries and six associated companies.

Key Management Team

Goodland is led by two co-founders namely Mr. Ben Tan Chee Beng the Executive Chairman, and Dr. Alvin Tan Chee Tiong the chief executive officer. Mr. Ben Tan oversees that strategic direction and investments of the company, while Dr. Alvin Tan is primarily responsible for the overall management performance, and the formulation of corporate strategies.

Past Projects And Future Pipeline

For Goodland, the company has a diversified portfolio mix of properties with most of their projects centred on the landed housing segment. It currently has two upcoming landed project launches, namely a three-storey terrace dwelling home located in Sirat Road, and another two-storey development located at Cardiff Grove.

One of its prominent developments by Sustained Land – an associate company – was Sturdee Residences, located in the Little India area. According to an article published on PropertyGuru on 26 April 2016, the developer disclosed that of the 305 units in the development, 122 units were sold at an average price of $1,550 per square foot (psf) during the VIP preview alone.

Fast forward just three years later, based on property information aggregator PropertyGuru, the price range of an apartment at Sturdee Residences is currently priced at around $1,612 to $2,130 psf. The pricing factors in some of the locational attributes include its proximity to Farrer Park MRT station, and the proximity to city centre.

Currently, Sustained Land is currently marketing One Meyer (formerly The Albracca), a freehold condominium located at Meyer Road in District 15. The development is a single tower building with 18 to 24 floors and 66 residential units sitting on a land area of 23,400 square feet (sqft). There are two unit types comprising two-bedroom (614 sqft), and three-bedroom (914 – 1,033 sqft). The development is scheduled to be completed in 2023, with similar locational attributes such as accessibility to the upcoming Katong Park MRT station of the Thomson-East Coast Line (TEL).

Previously, Sustained Land had bought the land site through a collective sales bid in July 2017. According to the marketing agent of the enbloc sale JLL, the hotly contested land saw over a dozen bids from both large and boutique developers, contractors and a fund manager. At that time, Sustained Land won the bid with a $69.1 million price tag, translating into a price of $1,409 psf per plot ratio.

Financial Performance

Source: Company’s financials

In the latest quarter 1Q19, Goodland’s revenue fell a shocking 65 percent to $3.6 million. However, intriguingly, net profit attributable to shareholders rose 435 percent to $1.4 million during the same period.

According to its earnings review, management disclosed that the decline in revenue was mainly driven by higher revenue recognised in last year. This is typical for developers as revenue recognition can be lumpy. In 1Q18, Goodland recognised the sales of the mixed residential/commercial development, The Citron and Citron Residences, and the strata terrace landed residential project, The Morris Residence. On the other hand in 1Q19, revenue was mainly generated from the sale of a landed terrace house.

Balance sheet wise, Goodland has cash and cash equivalents on hand of $6.1 million as of the latest quarter. Meanwhile, total borrowings stood at $66.2 million, comprising $50.9 million of short-term borrowings, and $15.3 million of long-term loans.

All the total borrowings are secured debt, with no unsecured portion. Among its total borrowings and debt securities, the amount payable in one year or less rose slightly from $49.5 million in FY18 to $51.6 million in 1Q19. Meanwhile, the amount repayable one year or more fell from $14.9 million in to $14.7 million during the same period.

Cash-flow wise, Goodland’s net cash from operating activities fell into a negative $2.9 million in 1Q19 from a positive $8.9 million last year. This was not out of ordinary given that the company recognised little revenue for the latest quarter.

Source: Company Financials

Key Financial Metric

Source: Company’s financials, SGX StockFacts

Goodland’s financial metrics typically resonate with cyclical swings due to the nature of the real estate business that is impacted by the general economic climate. However, despite the negative to low-single digit return ratios, the company has managed to increase its net income margin to 26.9 percent during the last twelve months (LTM) and its current ratio appeared to look stable at about 3.6 times as of 1Q19.

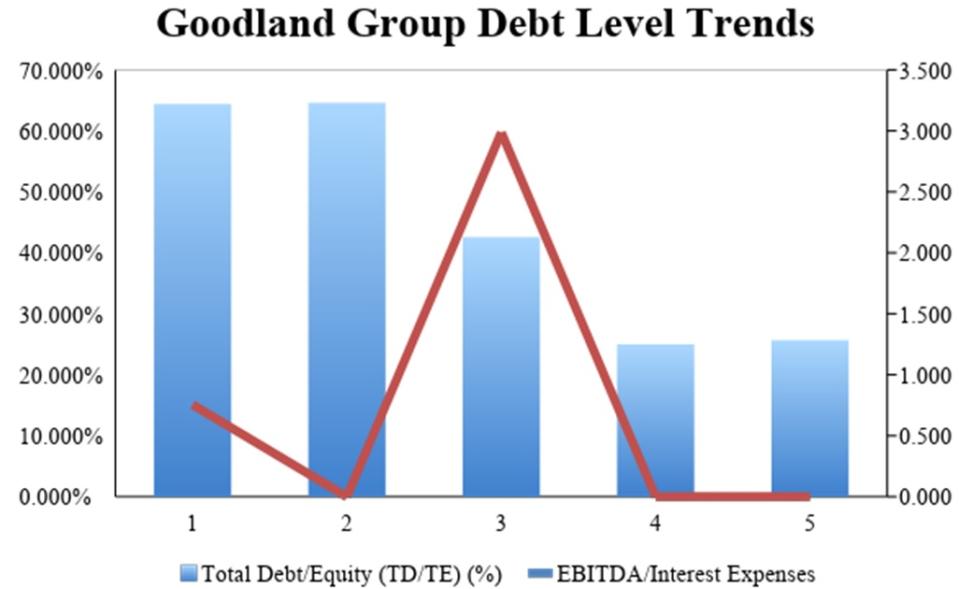

While the Company’s total debt-to-total equity (D/E) rose slightly to 25.6 percent in 1Q19 from 25 percent in FY18, it is still down from the 64 percent seen in FY15 and FY 16.

Source: Company’s financials, SGX StockFacts

Conclusion

At the current trading price of $0.22, stocks of Goodland are changing hands at 0.39 times its book value (P/BV) of $0.581. In addition, the current share price offers a dividend yield of 3.4 percent. The company’s borrowings level is also relatively low at around 25 percent to book value.

That said, the company’s efficiency metrics are quite low. Being cyclically prone, it could also be impacted by further property cooling measures and the peaking of global economic conditions. Like many developers, Goodland also faces risks of any negative economic downturn or slowdown. The lack of projects or failure to sell projects on hand would hit any property developer very hard.

On the other hand, the Goodland has proved itself to be prudent to securitizing its debt obligations to projects. Banks also lend at better rates for secured debts. Moreover, the group also has a strong track record of execution. As such, given its low leverage ratio, Goodland has significant debt headroom to capitalise on especially in a downturn.

Yahoo Finance

Yahoo Finance