Goldman Sachs Analysts’ Slide Suggests Now’s a Good Time to Buy Bitcoin

Market intel from Goldman Sachs suggests investors should capitalize on the current price dip and buy bitcoin.

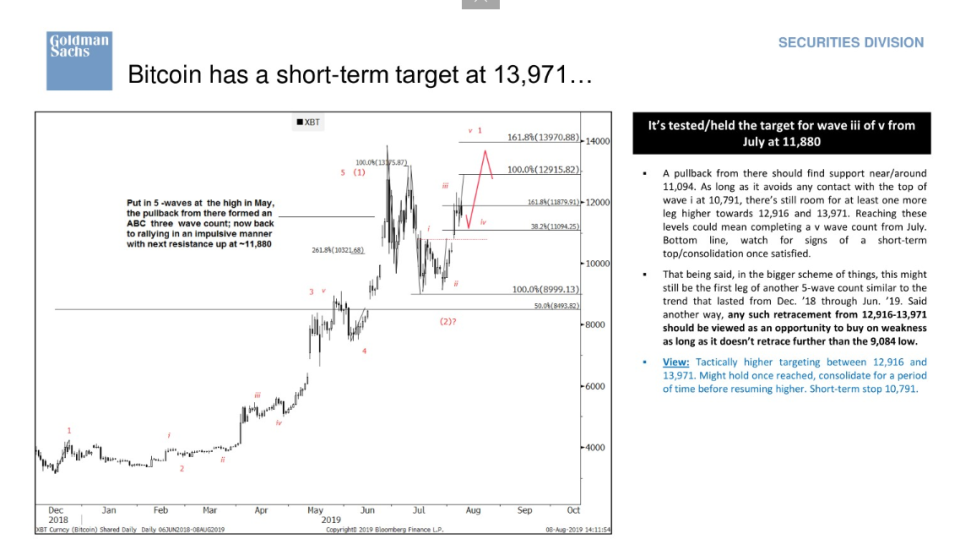

In a series of slides prepared by a technical analysis team and sent out to some institutional clients, Goldman included one that said the short-term target for bitcoin (BTC) is $13,971 and that investors should consider buying on any dips in the current scenario.

The investment bank said that, based on its Elliott Wave analysis, BTC would find support around $11,094, and that there’s scope for a move higher to $12,916, then $13,971.

Related: Bitcoin Price Faces Struggle to Hold Above $11K After Range Breakdown

“Any such retracement from $12,916-$13,971 should be viewed as an opportunity to buy on weakness as long as it doesn’t retrace further than the $9,084 low,” the slide said.

It should be noted that the prices used for the analysis don’t include weekend prices and are likely from futures market data.

While this technical analysis seems bullish on bitcoin, Goldman Sachs’ former CEO and chairman has previously said bitcoin just isn’t his thing. Lloyd Blankfein said in an interview last June that bitcoin is “not for me … I don’t do it. I don’t own bitcoin.” (He retired at the end of last year.)

Related: Bitcoin in Tug of War Between Bulls and Bears as Trading Range Tightens

Rumors that Goldman would launch a crypto trading desk and custody service have been reportedly put on hold over the uncertain regulatory scene in the U.S.

Goldman Sachs slide deck by CoinDesk on Scribd

Edit (21:30 UTC, Aug. 12, 2019): Edited text to clarify that the intel came via a slide deck from a technical analysis team at Goldman, not a research note, and that Lloyd Blankfein is no longer CEO.

Goldman Sachs image via Shutterstock; slide deck image via Goldman

Yahoo Finance

Yahoo Finance