Gold Prices May Renew Rally as Yields Decline in Risk-Off Trade

DailyFX.com -

Talking Points:

Crude oil prices break from risk trends, recoil from range resistance

Gold prices may find fuel to renew rally as yields fall in risk-off trade

Eurozone PMI, US ISM data unlikely to command markets’ attention

Crude oil prices broke with broader risk sentiment trends yesterday. The WTI contract edged narrowly lower even as global share prices (as tracked by the MSCI World Stock Index) continued to recover. A discrete catalyst for the move did not readily present itself. Rather, price action may have reflected profit-taking into the end of the quarter following the best three-month performance since 2009.

Meanwhile, gold prices continued to mark time in familiar territory as traders waited for a new catalyst to inspire directional momentum. The yellow metal has mirrored the consolidative tone across the anti-USD space since last week’s volatility surge in the wake of the UK “Brexit” referendum. Uncertainty abounds and investors appear unwilling to commit one way or another for the time being.

Looking ahead, revised Eurozone PMI data and the US ISM Manufacturing survey are unlikely to command significant attention considering these outcomes will not yet reflect the impact of post-Brexit vote uncertainty on growth trends. With that in mind, broader sentiment trends may remain at the forefront. US stock futures are pointing downward, hinting at renewed risk aversion.

Despite yesterday’s split from sentiment trends, a firm correlation between WTI and the S&P 500 (0.74 on rolling 20-day studies) suggests crude prices may face selling pressure in risk-off trade. Bond yields are likely to decline in this scenario amid renewed haven demand for Treasuries, bolstering the relative appeal of non-interest-bearing assets including gold.

Track short-term gold and crude oil trading patters with our proprietary GSI indicator!

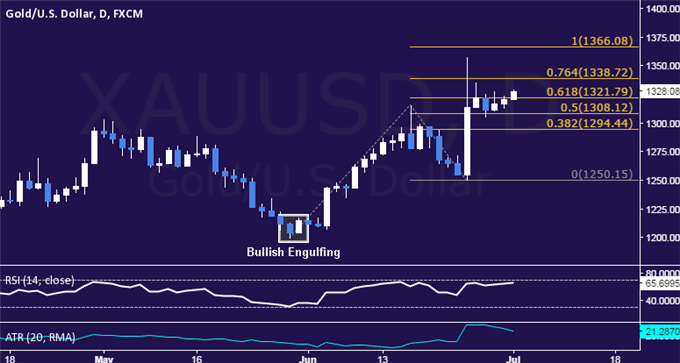

GOLD TECHNICAL ANALYSIS – Gold prices are attempting to build upward momentum yet again after spending four days trapped inside a narrow range. A daily close above the 61.8% Fibonacci expansion at 1321.79 targets the 76.4%levelat 1338.72. Alternatively, a move below support at 1308.12, the 50% Fib, exposes the 38.2% expansionat 1294.44.

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices continue to tread water in a narrowing range below the $52/bbl figure. Near-term support is at 45.60, the 23.6% Fibonacci retracement, with a break below that exposing the 38.2% level at 41.86. Alternatively, a daily close above falling trend line resistance – now at 49.57 – targets the 23.6% Fib expansionat 51.86.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance