Gold Falls as US Dollar and S&P 500 Surge

Gold Falls as US Dollar and S&P 500 Surge

Fundamental Forecast for Gold: Bearish

Gold Under Pressure as Investors Appear to Rethink the Appeal of Metals

Commodity Technical Analysis: Gold Has Retraced Entire 1/17 Move

Commodity Technical Analysis: Gold Former Resistance is Estimated Support at 1679

Gold prices fell 1.51% this week as the precious metal closed at $1658.82 in New York on Friday. The US dollar surge contributed the most to gold’s losses, as investors pushed the Greenback higher against the Japanese Yen amidst strong gains in the US S&P 500 and broader risky assets. US equities extended their advance with the S&P breaking above 1500 on Thursday for the first time since 2007. As a consequence, the spot gold price dropped 0.97 percent on the session.

The US Initial Jobless Claims, one important threshold for Fed quantitative easing, came out better than expected this week, dropping by 5,000 to 330,000 and hitting five-year lows. Coupled with an improved US Leading Indicator, the positive reading in hiring adds more signs that the labor market in US is picking up.

Improved labor data boosts expectations that the US Federal Reserve may scale back monetary policy stimulus in the future, and indeed the Greenback quickly rallied against gold on the jobs data. In addition, the Bank of Japan and Bank of England both announced that they would continue monetary easing policy to achieve their inflation targets. Since these countries are indirectly manipulating their currencies for their own economic benefit, investors tend to seek opportunities in the US dollar for safe-haven appeal in lieu of gold.

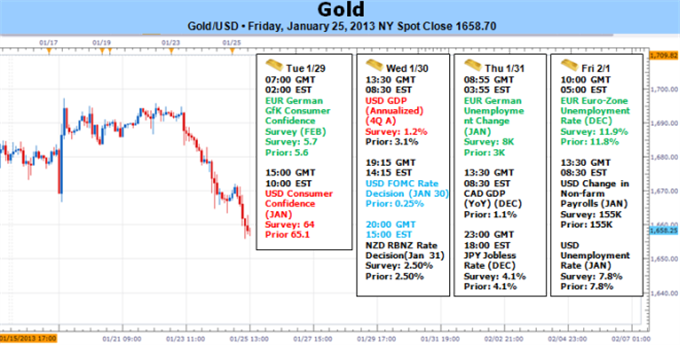

Looking ahead to next week, gold traders will be closely eyeing the US data, as on Wednesday the fourth-quarter GDP will come out, and expectations call for an annualized growth rate of 1.2 percent in Q4, 2012. That same day, the US Federal Open Market Committee will announce interest rates at the conclusion of their January meeting. And finally, Friday’s US Non-farm Payrolls report will be a top headline to guide short-term moves for the US Dollar and gold prices. If the US data comes in better than expected, gold prices are likely to remain on the defensive and thus trade lower. On the global side, fundamental inputs for bullion could be German unemployment change or Japanese jobless rate reports due Thursday. - RM

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance