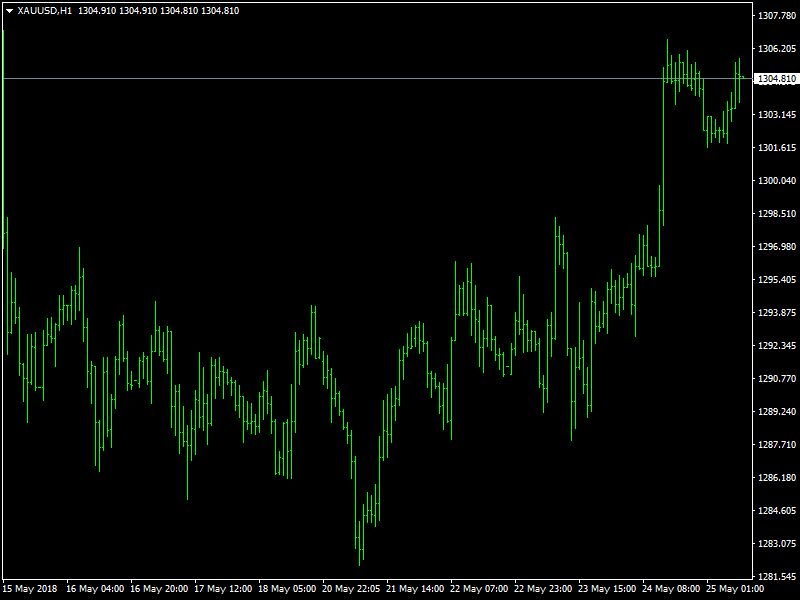

Gold on Bull Run as Trump Calls off North Korean Summit

The XAUUSD pair is currently trading at $1,305.12 having clocked a ten-day high of $1,306.69 in the overnight trade. This uptrend movement was influenced mainly because of US President Trump’s decision to call of North Korean summit. The price saw nearly $10 increase during American session and continues to trade with over 0.70% increase in value when compared to yesterday’s low. However North Korea issued a statement which said that the country is still ready for discussions with US President Trump and this caused risk sentiment in market to go down capping Gold’s uptrend movement.

Gold Through $1300

The pair saw some profit booking activities as risk factor slowed down during early Asian market hours, however the pair has managed to retain its price above the crucial support of $1300 range and is expected to remain above $1300 during last trading session of the week. Silver also saw some activity when investors choose to opt for safe haven instruments but the impact was very little. The XAGUSD pair teased this week’s high and has been moving around $16.60-67 price range. Silver is expected to continue moving in range bound pattern today and close for the week above $16 price range.

Crude Oil price continued to go down amid concerns of increase output. WTIUSD went as low as $70.45 during Thursday’s trading session and reached three week low of $69.66 as trading session headed towards European market hours. The pair is currently trading around $69 price range, this down surge in price started earlier this week over news of OPEC & Non-OPEC members gathering to discuss increase of Oil Output by nearly 1 million barrels to meet the compensate for lack of supply in case of US sanction on Venezuela and Iran limiting the respective country’s oil output. Increase production of Oil in US as visible from latest Crude Oil Inventory data was also another reason for decline in Oil price. Investors are currently observing market to see how Crude Oil performs before trading session closes for the week while some also choose to take funds out of Crude Oil in case the price drops further down during Friday’s trading session.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance