Gojek 'strongly considering' food delivery service in Singapore, says GM

SINGAPORE — Singaporeans may soon have another option when it comes to food delivery.

Gojek, the new kid on the block, may give bigger rival Grab a run for its money in the food delivery arena, some nine months after its arrival in the Lion City.

The Jakarta-based company, which started operations in Singapore in November and racked up 10 million completed rides in its first six months, is considering its next move.

“The fact that we are able to hit 10 million rides means that we have been able to contribute to providing choice for consumers in Singapore,” Gojek Singapore general manager Lien Choong Luen told Yahoo Finance Singapore in a recent interview. “There is definitely room for growth.”

Gojek has already launched food delivery services in Vietnam and Thailand, the two other countries where it has operations outside of Indonesia. The GoFood service is available in 74 cities with 400,000 merchants across Indonesia, according to its website. The Vietnam subsidiary claims it is leading the country’s online food delivery market with 70,000 merchants on its platform and offers 1 million menu items, with monthly orders growth of 25 to 33 per cent, according to a KrASIA report on 19 August.

Will Gojek be able to pull a rabbit out of the hat with GoFood in Singapore? Being able to leverage on its experience and know-how in Indonesia, and having China’s e-commerce platform Meituan Dianping as an investor, can’t hurt.

Food delivery “is definitely something we are considering strongly and looking within the market,” Lien said. “We are still evaluating the market conditions.”

Lien explains that Singapore has discerning and sophisticated consumers who expect a high quality of service, and wants to be sure that when it enters the food delivery market that it is able to do it well.

There are some “market dynamic differences” between the food delivery market in Indonesia and Singapore, he said. In Indonesia, Gojek has over 1 million motorcycle riders who can deliver everything from food to laundry, compared with Singapore where the authority doesn’t allow motorcycles to be used for point-to-point transport services, unlike taxis and private hire cars.

In Indonesia, Gojek offers a plethora of services such as motorcycle and car transportation, food delivery, payment of bills, compared to only ride-hailing service in Singapore.

Super App

Gojek has set its sights on being a “super app”. The company on 22 July unveiled a rebranding to mark the growth from a fleet of 20 motorcycle taxis when it was founded nine years ago to Indonesia’s most valuable tech start-up.

The new logo replaced the iconic ‘ojek’, Indonesian for ‘motorcycle taxi’, with a nearly-rounded ring encircling a dot.

The change is to reflect its growth from its humble beginnings to a one-stop platform hosts more than 20 on-demand services from transport to food delivery, e-commerce logistics and digital payments, with a total of more than 130 million total downloads across the region.

Gojek has expanded its regional ecosystem since its its ride-hailing app was launched in 2015 and has a total of more than 130 million downloads across the region.

The company now has over 2 million driver-partners, 400,000 merchant partners and 60,000 service providers across Southeast Asia to date. It doesn’t give the numbers for each market.

Gojek, whose shareholders include Google, Tencent, Temasek and Astra, is valued at close to US$10 billion, according to a TechCrunch report.

Visa Inc. in July became the latest investor in Gojek injecting an undisclosed amount as the two companies push digital payments across Southeast Asia. In the same month, Gojek also secured funding from Thailand’s Siam Commercial Bank Plc, Mitsubishi Motors Corp., Mitsubishi Corp. and Mitsubishi UFJ Lease & Finance Co.

Still, it remains to be seen how quickly Gojek can replicate its rapid growth outside of Indonesia, without losing ground at home. Besides Singapore, in the past year, Gojek has expanded into Vietnam and Thailand as well, and is looking at Malaysia.

The Malaysian Cabinet has, this month, given Gojek the green light to operate, “in-principle”, in Malaysia.

Commitment

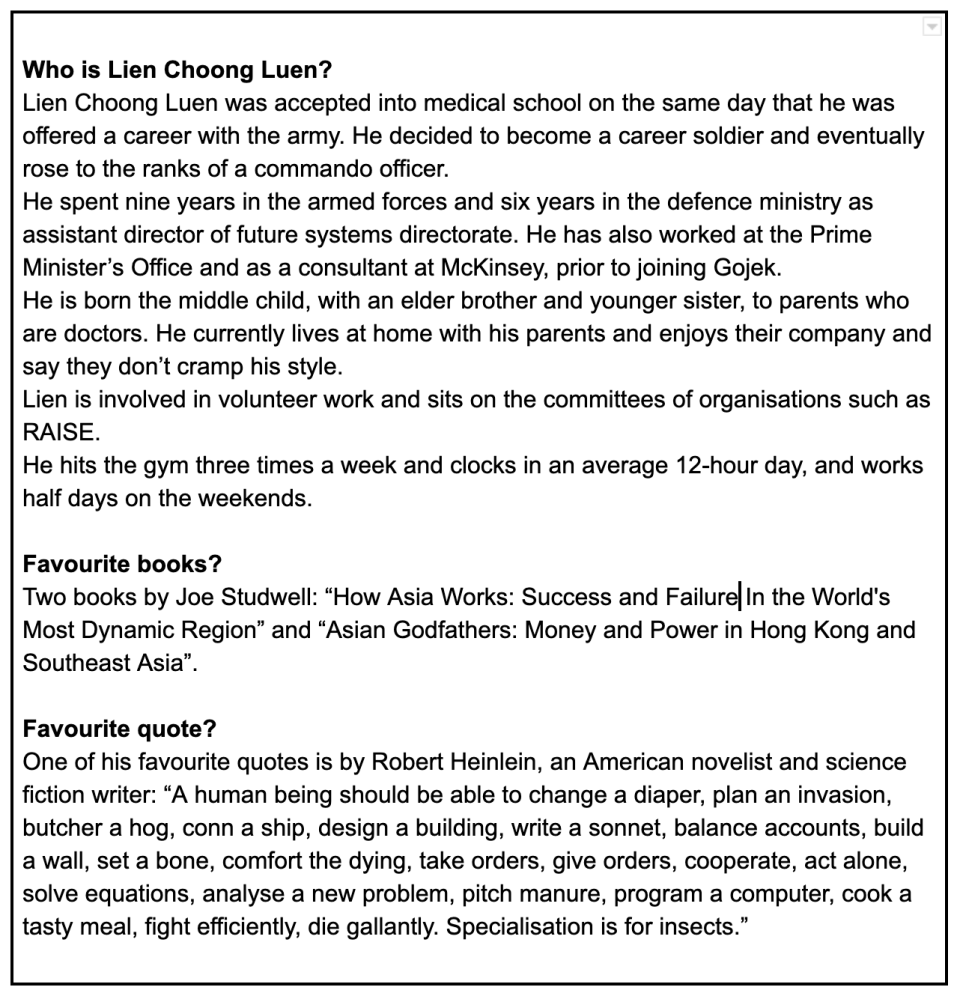

The head of Gojek Singapore is also a licensed private-hire driver, and spoke to this reporter while driving a hire-car.

“If you like the ride, maybe you will give me a good five-star rating?” he said tongue-in-cheek as he grinned at me.

The licence is another trophy under the belt for the 42-year-old, who is also the second Singaporean to have scaled both Mount Everest and K2. He has also skied to the North Pole and participated in ultra-marathons.

Lien, who joined the company in February, is “quietly optimistic” that the company is making inroads into the local market.

A competitive runner who anchored Singapore to a silver medal in the men's relay at the Asia Masters Athletics Championships in 2016, Lien likened Singapore to a marathon, not a sprint, for Gojek.

“We are here for the long haul,” he said. “We are deeply committed to the markets that we are in.”

Gojek is the closest challenger to Grab in Singapore after Uber Technologies sold its Southeast Asian operations to Grab in exchange for a 27.5 percent stake in the company and a seat on its board.

Ride-hailing services are regularly used by more than 35 million users in Southeast Asia in last year, compared with 8 million users in 2015, according to a Google-Temasek report on Southeast Asia internet economy. In 2018, the number of daily rides surged to 8 million from 1.5 million in 2015.

Singapore is the second largest market in the region by value, with an estimated US$1.8 billion in 2018, the report said.

“My immediate priority is to make sure we double down on the initial success,” said Lien. “That we are able to to continue providing better service for riders, whether that translates into specific things such as ride experience or competitive pricing.”

Data from YouGov BrandIndex in February indicated that that Singapore consumers are highly likely to recommend the brand to a friend or colleague as they think it is value for money.

Facing challenges

“For myself, the biggest challenge is still internally growing and strengthening the team because when that works well then they can take care of the drivers and so on,” Lien said. “The cascade of success if what I am constantly trying to strengthen.”

“If we do the internal well, I am very confident that we can respond and react to what is happening externally and be able to dive our own agenda as well,” he added.

The operating environment in Singapore just got tougher. On 6 August, parliament passed a bill requiring that all ride-hail and street-hail service providers with a fleet size of more than 800 vehicles will have to be licensed from June 2020.

Under the new rules, it will be an offence for any person to provide street-hail or ride-hail services without a licence or an exemption, and offenders can be fined and jailed.

“When it comes to regulatory changes, there is usually a reason and logic behind them. Overall, it is still fair for the market,” Lien said, before the bill was announced. “I wouldn’t say we are necessarily aligned on everything, but we understand where it comes from.”

Overall, Lien said, borrowing the famous slogan of an Avis ad campaign, “We are number two, so we try harder.”

Related stories:

Lien Choong Luen appointed as GM of Gojek Singapore

Gojek extends services in beta phase for users to sign up across Singapore

Grab plans to double Singapore headcount to 3,000 by end-2020

Yahoo Finance

Yahoo Finance