Generic-Drugs Stock Outlook: No Respite from Pricing Issues

Generic drugmakers mainly focus on developing chemically/biologically identical version of a brand-name drug once it loses exclusivity or patent protection. These drugs can be differentiated into two categories – generic and biosimilar. Generic drugs primarily are small-molecule medications with same active ingredients and chemically identical effects as their branded counterpart.

Biosimilars, on the other hand, consist of larger molecules derived from living cells, which increases the complexity of the development process. These drugs need not have identical but comparatively equivalent effects to original products.

Generic/biosimilar drugs are significantly cheaper than the original drug. However, competition in this segment is higher, which results in thin margins for the manufacturing companies. Meanwhile, some of the large generic drug-makers also market a few branded drugs. We have separate industry outlook articles for some of the largest drug-makers of the world and also on biotech companies.

While the prospects of branded drugmakers are majorly driven by company-specific factors like pipeline developments and drug uptake, generic drugmakers are impacted by industry wide factors. The generic drug industry has been facing drug price erosion due to tough generic pricing environment in the United States since 2017. Moreover, accelerated FDA approvals to generic drugs and ongoing customer consolidation are resulting in increased competitive pressure. The challenges in the U.S. generics market are expected to continue.

Meanwhile, the companies with a few branded products in their marketed portfolio can be severely impacted when a generic version is launched for one of its own products. For example, sales and profits of one of the largest drugmakers, Japan-based Teva Pharmaceutical, were significantly hit by the launch of generic version of its blockbuster multiple sclerosis drug, Copaxone. Moreover, some of the companies are also developing new treatments. A pipeline setback like study failure or disapproval of regulatory application is likely to hamper the prospects of a company.

However, several blockbuster drugs from big pharma companies have lost or are set to lose patent protection. This creates a significant opportunity for generic drugmakers with billions of dollar in sales up for grabs. Several of these companies are undertaking restructuring initiatives to revive growth. Companies with a strong biosimilar portfolio have better prospects as it is a relatively new area.

Industry Lags S&P 500 and Sector

The broader medical sector has picked up in the past three months after struggling initially in the year. So, it makes sense to compare the performance of industries in this sector over this time period.

The Zacks Medical - Generic Drugs, which is a 26-stock group within the broader Zacks Medical Sector, has underperformed both the S&P 500 and its own sector in the past three months.

While the stocks in the Medical – Generic Drugs industry have collectively fallen 0.9% in the past three months, the Zacks S&P 500 Composite and the Zacks Medical Sector have risen 3.5% and 4%, respectively.

Three Month Price Performance

Almost three-fourth of the industry’s market capitalization is concentrated in the top three companies.

Generic Drug Stocks’ Valuation Attractive

Despite the underperformance of the industry, its valuation looks cheap now. One might get a good sense of the industry’s relative valuation by looking at its forward twelve months price-to-earnings ratio (P/E F12M), which is the most appropriate multiple for valuing generic-drug companies.

The industry currently has a P/E F12M of 10.05, which is above its median level of 9.62 in the past year. When compared with the highest level of 10.51 over the past year, there is apparently litlle upside left.

The space is trading at a discount to the Medical market at large, as the median P/E F12M ratio for the Medical market is 19.17.

Price-to-Earnings Forward Twelve Months (F12M)

Some generic drug-makers are debt-laden. Thus, it makes sense to value them based on the EV/EBITDA (Enterprise Value/Earnings before Interest Tax Depreciation and Amortization) ratio. This is because the valuation metric takes into account not just equity but also the level of debt. For capital-intensive companies, the EV/EBITDA is a better valuation metric because it is not influenced by changing capital structures and ignores the effect of non-cash expenses.

Using the EV/EBITDA F12M metric too, the space looks inexpensive compared with the Medical market at large. The current EV/EBITDA ratio for the Medical market is 10.45 while that for Medical - Generic Drugs industry is 9.06.

EV-to-EBITDA Forward Twelve Months (F12M)

Though the industry appears cheap, its low valuation multiples likely reflect the underlying problems. While the industry might look too lucrative to be ignored based on its hefty discount to market at large, one must exercise caution given headwinds like pricing pressure and rising competition.

Underperformance May Continue Due to Bleak Earnings Outlook

With persisting pricing pressure and rising competition due to faster generic approvals, price erosion of the marketed generics are expected to continue. This is likely to unfavorably impact the top line of generic drugmakers. Although restructuring initiatives should save some costs, these will take time to improve operating margins.

But what really matters to investors is whether this group has the potential to perform better than the broader market in the quarters ahead. The earlier valuation discussion shows that market participants have been willing to pay up for these stocks already, potentially limiting further upside from current levels.

One reliable measure that can help investors understand the industry’s prospects for a solid price performance going forward is the industry's earnings outlook. Empirical research shows that earnings outlook for the industry, a reflection of the earnings revisions trend for the constituent companies, has a direct bearing on its stock market performance.

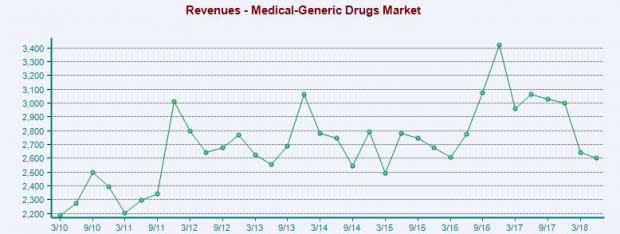

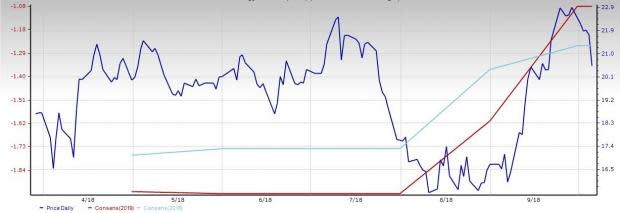

The Price & Consensus chart for the industry shows the market's evolving bottom-up earnings expectations for the industry and the industry's aggregate stock market performance. The red line in the chart represents the Zacks measure of consensus earnings expectations for 2019, while the light blue line represents the same for 2018.

Price and Consensus: Zacks Medical – Generic Drugs industry

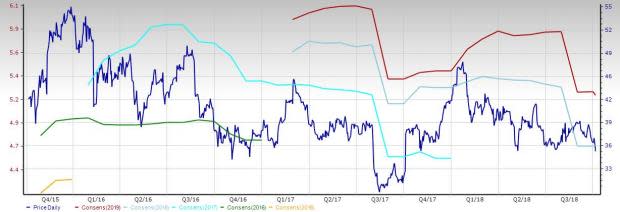

This becomes even clearer by focusing on the aggregate bottom-up EPS revisions trend. The chart below shows the evolution of aggregate consensus expectations for 2018.

Current Fiscal Year EPS Estimate Revisions

Please note that the $3.65 EPS estimate for the industry for 2018 is not the actual bottom-up dollar EPS estimate for every company in the Zacks Medical – Generic Drugs industry, but rather an illustrative aggregate number created by our proprietary analytics model. The key factor to keep in mind is not the earnings of $3.65 per share of the industry for 2018, but how this number has evolved recently.

As you can see here, the $3.65 EPS estimate for 2018 has declined from $3.73 at the end of August and is significantly down from $4.52 at the end of October last year. In other words, the sell-side analysts covering the companies in the Zacks Medical – Generic Drugs industry have been consistently lowering their estimates.

Zacks Industry Rank Indicates Some Prospects for Improvement

The group’s Zacks Industry Rank is basically the average of the Zacks Rank of all the member stocks.

The Zacks Medical - Generic Drugs industry currently carries a Zacks Industry Rank #169, which places it at the bottom 34% of more than 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

However, our proprietary Heat Map shows that the industry’s rank was in the top 50% in four out of the past six weeks but deteriorated in the past two weeks.

Generic Drugmakers Lacks Long-Term Growth Potential

The long-term (3-5 years) EPS growth estimate for the Zacks Medical – Generic Drugs industry appears disappointing. The group’s mean estimate of long-term EPS growth rate has decreased consistently to reach the current level of 8.58%, which compares unfavorably with 9.94% for the Zacks Medical Sector and 9.83% for the Zacks S&P 500 composite.

Mean Estimate of Long-Term EPS Growth Rate

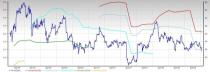

In fact, the basis of this long-term EPS decline could be a steady fall in revenues that generic drug-makers have shown since early 2017.

Bottom Line

The unfavorable factors impacting the generic drug industry are likely to continue. Hence, there is no respite for the companies in the near-to-medium term. However, restructuring initiatives and patent expiration of several blockbuster drugs may give a boost to the companies over the longer term.

The industry might not be able to tide over the broader challenges in the near term. So, it may not be a good idea to bet on this space right now. In the Medical – Generic Drugs universe, no stock currently holds a Zacks Rank #1 (Strong Buy), while four stocks carry a Zacks Rank #2 (Buy). All of these companies have witnessed positive earnings estimate revisions.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Bausch Health Cos Inc. (BHC): The stock of this Canada-based diversified pharmaceutical company has gained 26.7% this year so far. The Zacks Consensus Estimate for current-year earnings per share has increased 0.3% over the past 60 days.

Price and Consensus: BHC

Mallinckrodt public limited company (MNK): The stock of this Dublin, Israel-based specialty biopharmaceutical distributing branded and generic products has risen 14.6% this year. The consensus estimate for current year earnings has increased 1.5% over the past 60 days.

Price and Consensus: MNK

Evoke Pharma, Inc. (EVOK): The consensus estimate for loss has improved 14.3% for the current fiscal year over the past 60 days. The stock has risen 17.3% this year so far.

Price and Consensus: EVOK

Homology Medicines, Inc. (FIXX): The stock of this Bedford, MA-based small drugmaker has risen 10.1% this year so far. The consensus estimate for current year loss has narrowed 27.6% over the past 60 days.

Price and Consensus: FIXX

Stocks to Stay Away From

Investors should avoid the following two stocks to avoid any unfavorable impact on their portfolio due to challenges in the industry. One stock carries a Zacks Rank #5 (Strong Sell) and another carries a Zacks Rank #4 (Sell). Both the stocks have seen negative earnings estimate revisions.

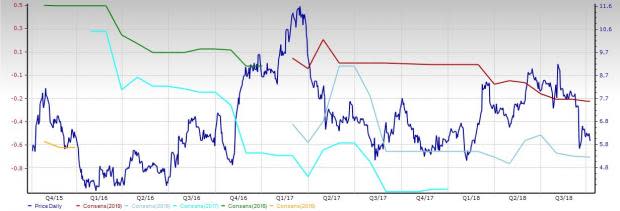

Mylan N.V. (MYL): The consensus EPS estimate for this Canonsburg, PA-based drug and consumer giant has moved 1.7% lower for the current fiscal year in the past 60 days. The stock is down 16.6% so far this year. The stock has Zacks Rank #5.

Price and Consensus: MYL

Progenics Pharmaceuticals Inc. (PGNX): The loss estimate for this Tarrytown, NY-based small drugmaker has widened 4.7% for the current fiscal year over the past 60 days. The stock has a Zacks Rank #4.

Price and Consensus: PGNX

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Progenics Pharmaceuticals Inc. (PGNX) : Free Stock Analysis Report

Mylan N.V. (MYL) : Free Stock Analysis Report

Mallinckrodt public limited company (MNK) : Free Stock Analysis Report

Homology Medicines, Inc. (FIXX) : Free Stock Analysis Report

Evoke Pharma, Inc. (EVOK) : Free Stock Analysis Report

Bausch Health Cos Inc. (BHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance