General Motors' (GM) Q2 Sales Down Y-O-Y, Market Share Up

General Motors GM has come out with second-quarter sales figures in the United States. The company witnessed a year-over-year decline of about 15% in its vehicle sales in the quarter as the automaker is battling supply chain issues. However, there was improvement in results from the first quarter.

GM’s sales were up 14% from the first quarter to 582,401 vehicles and the company increased its sales and market share sequentially for the third consecutive quarter. Market share was up 1 point to an estimated 16.3%. However, GM’s second-quarter vehicle wholesale volumes were hit by the ongoing semiconductor supply shortage and other supply chain disruptions, mostly in June. General Motors stated that as of Jun 30 it had about 95,000 vehicles in its inventory that were manufactured without certain components, a majority of which were built in June.

Major automakers such as GM have been trying hard to rebuild dealer inventories that have been badly hit by production cuts amid a global shortage of semiconductor chips and other key automotive components. Automakers have been forced to sporadically shut down plants or slow down production for a few weeks, at least. The dearth in supply, coupled with strong consumer demand, has caused vehicle inventories to plummet to record lows.

General Motors’ reported vehicle inventory was about 248,000 units at the end of the second quarter, down 9.5% from the end of March, when it had about 274,000 vehicles in its U.S. inventory.

However, amid a tight market, GM had a few feathers in its cap this quarter.

The company maintained its top position in full-size pickup truck retail market share with 203,041 combined total sales of the Chevrolet Silverado and GMC Sierra, for the 13th consecutive quarter, in spite of very low inventory. Their estimated retail market share was 44%.

Pent-up demand and significant improvement in availability drove large year-over-year increases in deliveries of the Chevrolet Camaro, which went up 63%; Chevrolet Colorado, up 52%; Chevrolet Malibu, rising 563%; Cadillac XT4, up 116% and Cadillac CT5, increasing 70%.

The company also saw the best-ever retail market share in the first half of the year. Total sales of the GMC Canyon rose 40% and GMC Terrain jumped 37% in the quarter. The GMC Sierra HD, increasing 31% in the quarter, delivered its best second quarter and first half on record.

Electric vehicle sales were more than 7,300 units, including some of the first deliveries of the BrightDrop Zevo 600 and GMC HUMMER EV Pickup, as well as the resumption of Chevrolet Bolt EV and Bolt EUV production.

The company has been expediting the Cadillac LYRIQ production. Orders for the 2023 model year sold out within hours of initiation. GM intends to gradually increase production of the Cadillac LYRIQ and GMC HUMMER EV Pickup in the second half of 2022.

The second-quarter SAAR was an estimated 13.4 million light vehicles compared to 17 million a year ago.

Despite the challenges, the auto giant maintained its previous guidance for 2022. It expects net income during the second quarter to be between $1.6 billion and $1.9 billion and adjusted earnings per share in the $6.50-$7.50 range.

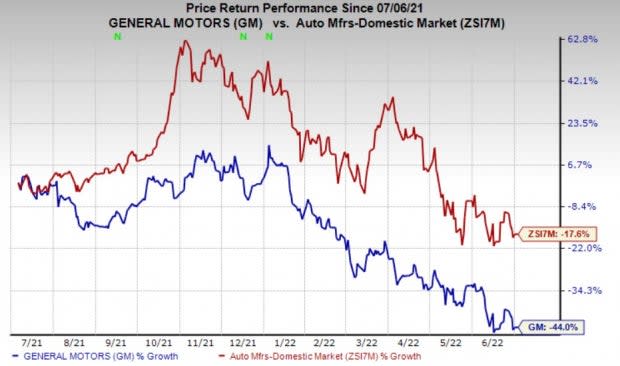

Shares of GM have lost 44% over the past year compared to its industry’s 17.6% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

GM carries a Zacks Rank #3 (Hold), currently.

Some better-ranked players in the auto space are Allison Transmission Holdings ALSN, LKQ Corporation LKQ and Standard Motor Products SMP, each carrying a Zacks Rank #2 (Buy), currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Allison Transmission has an expected earnings growth rate of 24.5% for the current year. The Zacks Consensus Estimate for current-year earnings has been constant in the past 30 days.

Allison Transmission’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. ALSN pulled off a trailing four-quarter earnings surprise of 11.71%, on average. The stock has declined 3.3% over the past year.

LKQ has an expected earnings growth rate of 6.3% for 2023. The Zacks Consensus Estimate for current-year earnings has been revised 0.25% upward in the past 30 days.

LKQ’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. LKQ pulled off a trailing four-quarter earnings surprise of 23.55%, on average. The stock has gained 0.1% in the past year.

Standard Motor has an expected earnings growth rate of 5.2% for the current year. The Zacks Consensus Estimate for current-year earnings has remained constant in the past 30 days.

Standard Motor’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. SMP pulled off a trailing four-quarter earnings surprise of 40.34%, on average. The stock has increased 5.8% over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Motors Company (GM) : Free Stock Analysis Report

Standard Motor Products, Inc. (SMP) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

LKQ Corporation (LKQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance