General Dynamics (GD) Q1 Earnings Beat, Revenues Rise Y/Y

General Dynamics Corporation GD reported first-quarter 2023 earnings per share (EPS) of $2.64, which beat the Zacks Consensus Estimate of $2.56 by 3.1%. The figure also increased 1.1% from $2.61 per share recorded in the year-ago quarter.

Total Revenues

General Dynamics’ revenues of $9,881 million beat the Zacks Consensus Estimate of $9,322 million by 6%. The top line also improved 5.2% from that reported in the prior-year period.

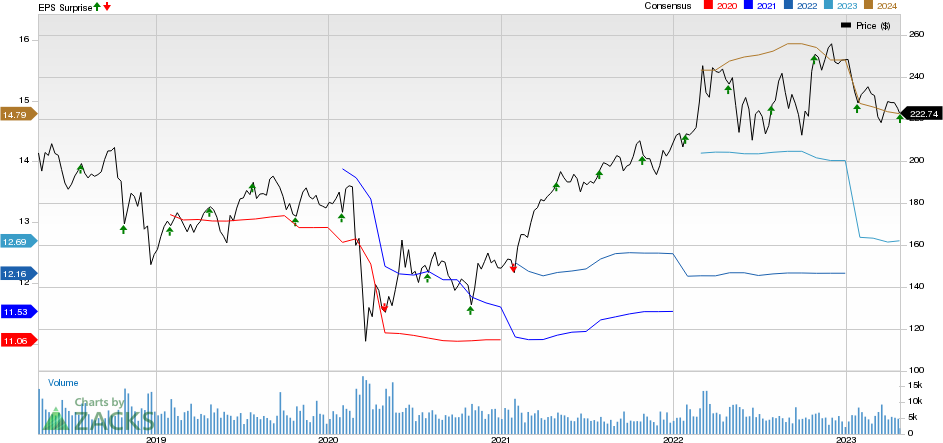

General Dynamics Corporation Price, Consensus and EPS Surprise

General Dynamics Corporation price-consensus-eps-surprise-chart | General Dynamics Corporation Quote

Segmental Performance

Aerospace: The segment reported revenues of $1,892 million, down 0.6% year over year. Operating earnings of $229 million declined 5.8% from the prior-year quarter’s $354 million.

Marine Systems: This segment’s revenues rose 12.9% to $2,992 million from the year-ago quarter. Operating earnings of $211 million came in line with the year-ago quarter’s reported numbers.

Technologies: The segment’s revenues improved 2.5% year over year to $3,241 million. Operating earnings totaled $299 million, up 0.3% from the $298 million recorded in the prior-year quarter.

Combat Systems: The segment’s revenues of $1,756 million were up 4.8% from the year-ago quarter’s $1,675 million. Operating earnings also improved 7.9% year over year to $245 million.

Operational Highlights

GD’s operating earnings were $938 million, up 3.3% from the year-ago quarter’s reported figure of $908 million.

Operating costs and expenses increased 5.4% to $8.9 million from the year-ago period.

Interest expenses declined 7.1% year over year to $91 million.

Backlog

General Dynamics recorded a total backlog of $89.83 billion, down 1.4% from fourth-quarter 2022’s backlog of $91.14 billion. The funded backlog at first-quarter end was $77.12 billion.

Financial Condition

As of Apr 2, 2023, General Dynamics’ cash and cash equivalents were $2,038 million compared with $1,242 million as of Dec 31, 2022.

Long-term debt as of Apr 2, 2023, was $9,245 million, up from the 2022-end level of $9,243 million.

As of Mar 31, 2023, GD generated cash from operating activities of $1,462 million, down from the $1,968 million recorded in the year-ago period.

Zacks Rank

General Dynamics currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

Lockheed Martin Corporation LMT reported first-quarter 2023 adjusted earnings of $6.43 per share, which beat the Zacks Consensus Estimate of $6.07 by 5.9%. However, the bottom line was in line with the year-ago quarter's reported figure.

Net sales amounted to $15.13 billion, which beat the Zacks Consensus Estimate of $14.87 billion by 1.9%. The top line rose 1.1% from $14.96 billion recorded in the year-ago quarter.

Hexcel Corporation HXL reported first-quarter 2023 adjusted earnings of 50 cents per share, which beat the Zacks Consensus Estimate of 39 cents by 28.2%. The bottom line improved massively from the year-ago quarter’s reported figure of 22 cents per share, highlighting solid growth of 127.3%.

Net sales totaled $458 million, which beat the Zacks Consensus Estimate of $428 million by 6.8%. Also, the top line witnessed a 17.2% improvement from the year-ago quarter’s $391 million.

Raytheon Technologies Corporation’s RTX first-quarter 2023 adjusted EPS of $1.22 beat the Zacks Consensus Estimate of $1.11 by 9.9%. The bottom line also improved 6% from the year-ago quarter’s reported adjusted earnings of $1.15 per share.

Raytheon Technologies’ sales of $17,214 million beat the Zacks Consensus Estimate of $16,857 million by 2.1%. The figure also rose 9.5% from $15,716 million recorded in the year-ago quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Hexcel Corporation (HXL) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance