Generac (GNRC) Awarded Contract by Arizona Public Service

Generac Holdings GNRC subsidiary, Generac Grid Services, announced that it has been awarded a multi-year contract by Arizona Public Service (APS).

The contract involves leveraging the company’s Concerto distributed energy resource management system (DERMS) to provide additional grid capacity from residential battery storage and advanced grid services (AGS) like real power orchestration, voltage management, targeted responses and fleet energy control.

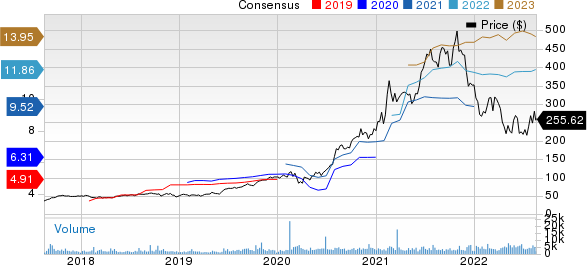

Generac Holdings Inc. Price and Consensus

Generac Holdings Inc. price-consensus-chart | Generac Holdings Inc. Quote

The contract will also increase the company’s reach for PWRcell battery systems, which is a part of APS's Distributed Demand-Side Resources (DDSR) Aggregation Tariff.

GNRC will start to combine home energy from Generac PWRcell batteries from January 2023 over five years. The combined energy will support locational capacity on intended system feeders and system-wide capacity via demand response events.

Apart from the above-mentioned features, GNRC is also selected for customer acquisition, program management and measurement and verification services. It will utilize its vast dealer network to identify and recruit residential customers to participate in the DDSR Aggregation Tariff.

On Jun 2, 2022, Generac Grid announced a partnership with RWE to provide grid-balancing solutions that support a reliable grid. RWE is using Concerto to bid in the German interruptible load market in addition to the aFRR solution. RWE can add value to its fleet of distributed energy resources with this solution.

Prior to that, Generac announced a partnership with PosiGen to provide clean energy for low to medium-income residents. The tie-up will enable the companies to supply residents with cutting-edge battery backup and load-management systems, as well as provide power back to the electrical grid, thereby increasing grid stability and lowering the reliance on fossil fuels.

Generac manufactures power generation equipment, energy storage systems and other power products, including portable, residential, commercial and industrial generators.

The company reported second-quarter 2022 adjusted earnings of $2.99 per share, which beat the Zacks Consensus Estimate by 12.8%. Also, the bottom line increased 25.1% year over year.

Net sales increased 40% year over year and came in at $1.29 billion, beating the consensus mark by 2.4%. Robust demand for Residential and Commercial & Industrial products boosted Generac’s second-quarter performance.

Generac currently carries a Zacks Rank #3 (Hold). Shares of the company have lost 34.4% compared with the industry’s fall of 32.9% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Cadence Design Systems CDNS, Badger Meter BMI and Arista Networks ANET. Cadence Design Systems, Badger Meter and Arista Networks (ANET) each sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CDNS 2022 earnings is pegged at $4.11 per share, rising 5.7% in the past 60 days. The long-term earnings growth rate is anticipated to be 17.7%.

Cadence’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 9.8%. Shares of CDNS have jumped 29% in the past year.

The Zacks Consensus Estimate for BMI’s 2022 earnings is pegged at $2.30 per share, up 6% in the past 60 days.

Badger Meter’s earnings beat the Zacks Consensus Estimate in three of the preceding four quarters, with the average being 12.6%. Shares of BMI have lost 0.8% of their value in the past year.

The Zacks Consensus Estimate for Arista Network’s 2022 earnings is pegged at $3.99 per share, increasing 8.4% in the past 60 days. The long-term earnings growth rate is anticipated to be 18.6%.

Arista Network’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 10.1%. Shares of ANET have increased 43% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Generac Holdings Inc. (GNRC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance