GDP, Nike earnings — What you need to know for the day ahead

Wednesday was an ugly day for stocks.

After the market opened higher out of the gate, the major indexes gave up gains throughout the day with the market-leading tech sector and the outperforming Russell 2000 both losing more ground than the S&P 500.

From its peak, the Dow fell more than 400 points on Wednesday and closed the session 165 points, or 0.7% below where stocks finished on Tuesday.

The S&P 500 dropped almost 0.9%, or 23 points, while the Nasdaq fell 1.5%, or 116 points, and the Russell 2000 shed 1.7%, or 28 points.

On Thursday, investors will face the week’s busiest schedule with the U.S. economic highlight coming from the third estimate of first quarter GDP growth, which is expected to show the economy expanded at an annualized rate of 2.2% in the first three months of 2018.

The weekly report on initial jobless claims as well as the Kansas City Fed’s June reading on manufacturing activity will also fill out the economic agenda.

And on the earnings side, notable companies expected to report results Thursday include Nike (NKE), McCormick (MKC), Accenture (ACN), and the Dow’s newest member Walgreens Boots Alliance (WBA).

Nike’s earnings, due out after the market close, will likely be the most closely-tracked by markets as investors look for a rebound in the company’s North America business after a 6% sales drop in the prior quarter.

And while the headline indexes continue to show signs of churn and, this week at least, weakness, analysts at Capital Economics on Wednesday pointed to a few signs that there is more worry in equity markets about trade tensions that some headline moves might suggest.

In a note to clients, Capital Economics markets economist Ingvild Borgen Gjerde pointed to weakness in industrial stocks, strength in small caps, as well as weakness in eurozone and Chinese stocks as signs that investors have not had their anxieties eased about the continuation — or even escalation — of trade tensions.

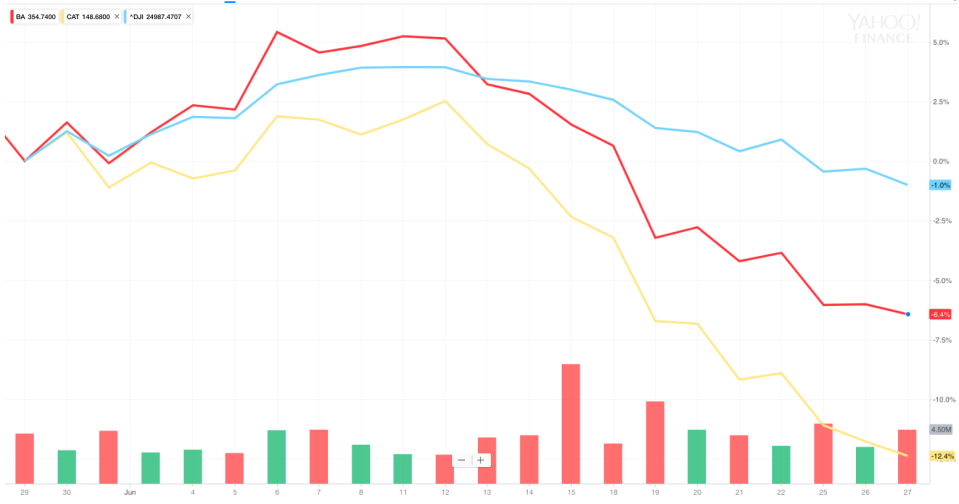

Over the last month, trade-exposed names like Boeing (BA) and Caterpillar (CAT) have both significantly underperformed the Dow. Boeing shares are off 6% and Caterpillar stock is down 12% while the Dow has lost just 1%.

And while these individual stories can perhaps be excused away by the bulls who saw the market-leading FAANG stocks power higher to start June, the late-month stumble in the stock market is starting to make industrial softness look more indicative of the market’s overall mood than another all-time high from Amazon.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Yahoo Finance

Yahoo Finance