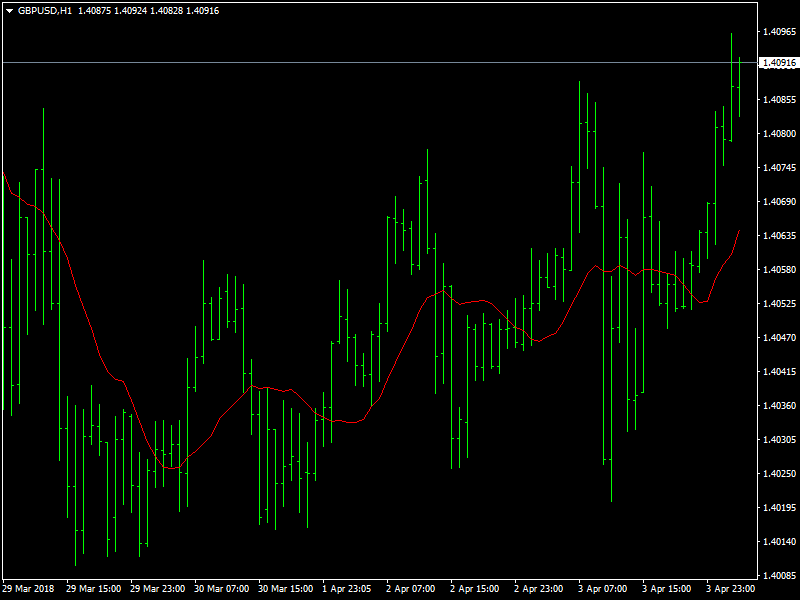

GBPUSD Still Near Support

The pound continues to trade within a tight range and the PMI data from the Uk did not seem to have much of an impact on the GBPUSD pair. It is going to be busy week on the economic calendar and though most of the UK data pertains to the PMI data, which is likely to have a very low impact, there is a lot of data from the US which is going to bring in volatility.

GBPUSD Buoyant

The pair has been trading near the support region of 1.40 for the past few days and we expect the volatility to pick up from today. There was an extended holiday which helped the consolidation and the ranging in this pair but now that the traders are back at their desks and we are also going to see a lot of data, it is likely that the ranging would end and we will be seeing the pair continuing to choose a specific direction. As we have been mentioning over the last few days, the region around 1.40 is key.

The bulls and the bears are likely to fight it out in this region and the result of this battle is likely to determine the short term direction for this pair. The UK economic data has been in line with expectations while the geopolitical issues continue to dominate the market headlines as far as the dollar is concerned. So it remains to be seen how the pair is likely to resolve itself.

Looking ahead to the rest of the day, we have the construction PMI data from the UK while we have the ADP and ISM non-manufacturing PMI data from the US and all these data are likely to bring in a lot of volatility in this pair ahead of the employment data, in the form of NFP, coming in later in the week.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance