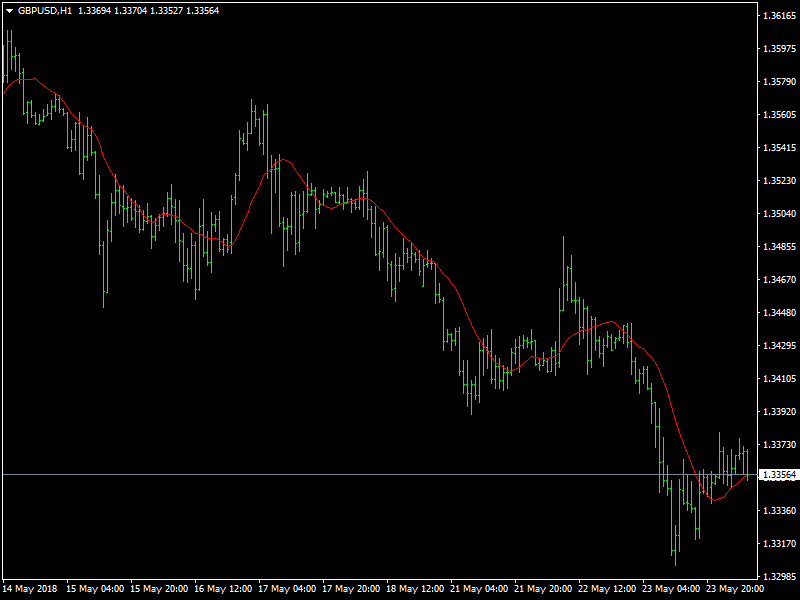

GBPUSD Hits 5 Month Low Post Bearish Inflation Data

The GBPUSD pair posted considerable losses on Wednesday’s trading session. During North American market hours the pair hit 5 month low at 1.3304 it’s lowest since late December 2017. However Sterling managed to make some modest headway against greenback post FOMC minutes and is currently trading at 1.3368 price range. On the release front, British CPI continued to fall, coming in at 2.4% which was just shy of the estimate of 2.5% while the Producer Price Index year-on-year data in April also came below estimates at 5.3% versus a 5.8% forecast. Over in the US, New Home Sales dropped to 662 thousand, well off the estimate of 680 thousand. Both markets saw mixed macroeconomic readings on Wednesday however US markets had produced a better outcome against its counterparts Euro and British Pound. This decline has opened possibility for price movement below 1.3300 handle.

GBPUSD Lower

Investors of British Pound are currently on look out for Core Retail Sales and Second GDP data estimate scheduled to release later today and on Friday respectively. BOE has already skipped one rate hike during last meet owing to dovish inflation data. Many Analysts and investors predicted April’s inflation data to have a hawkish outcome but yesterday’s CPI data update decreased the possibility of rate hike in August 2018 to 33% from a 50% probability which existed at start of the week. Members of BOE have already spoken out that rate hike in future depends mainly on inflation data performance and a dovish outcome in macro data today and tomorrow could mean that there would be no rate hike in August. The current inflation data slowed down to 13 month low approaching the Bank of England’s 2 percent target faster than economists had anticipated.

Meanwhile on US market, the greenback has been growing strong against major global currencies despite US treasury yields which pushed US dollar to new heights in recent times slowing down as FOMC minutes update shows promise of Fed rate hike in near future (Expected at June 2018) and the release also hinted that a continued growth in economy and inflation will likely lead to three rate hikes with 2018 which has caused demand for US dollar to spike among global investors albeit yesterday’s mixed macro data. Expected support and resistance for the pair are at 1.3300 / 1.3220 and 1.3658 / 1.3783 respectively.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance